Talking Points:

- Euro Rebound at Risk on Dovish European Central Bank (ECB) Rhetoric.

- GBP/USD Continues to Carve Bearish Pattern Ahead of BoE Meeting.

- USDOLLAR Resilience Continues as Fed Officials Highlight 2015 Liftoff.

For more updates, sign up for David's e-mail distribution list.

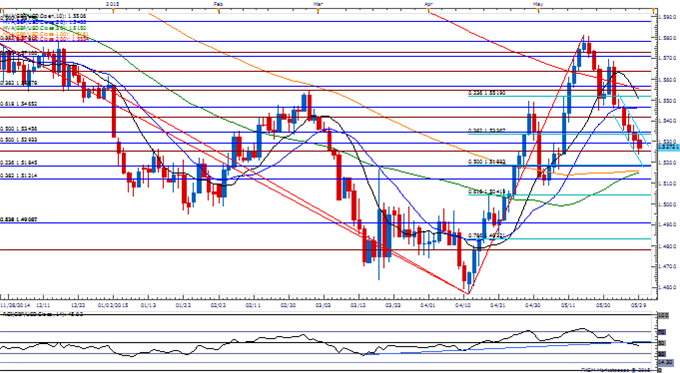

Chart - Created Using FXCM Marketscope 2.0

- Failure to preserve the downward trending channel from the May high (1.1465) may highlight a near-term consolidation in EUR/USD; with the ongoing closes above 1.0850 (78.6% expansion) to 1.0870 (38.2% retracement), may see a move back towards former support around 1.1120 (61.8% retracement).

- Will keep a very close eye on the fresh batch of rhetoric coming out of the European Central Bank (ECB) as the Governing Council is widely expected to retain its current policy; may see President Mario Draghi pledge to carry out the quantitative easing (QE) program until at least September 2016.

- DailyFX Speculative Sentiment Index (SSI) shows retail crowd remains net-short EUR/USD since March 9, with the ratio currently sitting at -1.77 going into June.

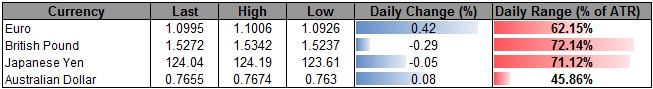

GBP/USD

- GBP/USD remains at risk for a further decline as it fails to retain the bullish formation carried over from April & continues to carve a series of lower highs & lows going into the end of the month.

- With the Bank of England (BoE) anticipated to retain a wait-and-see approach in June, may see a limited market reaction should the central bank refrain from releasing a policy statement.

- In turn, the descending channel in the exchange rate favors the downside target for GBP/USD, with the next level of interest coming in around 1.5180 (23.6% retracement) to 1.5190 (50% retracement).

Join DailyFX on Demand for Real-Time SSI Updates Across the Majors!

Read More:

Price & Time: GBP/USD Bucking the Trend?

USDJPY Breakout Testing Initial Resistance Ahead of U.S. GDP

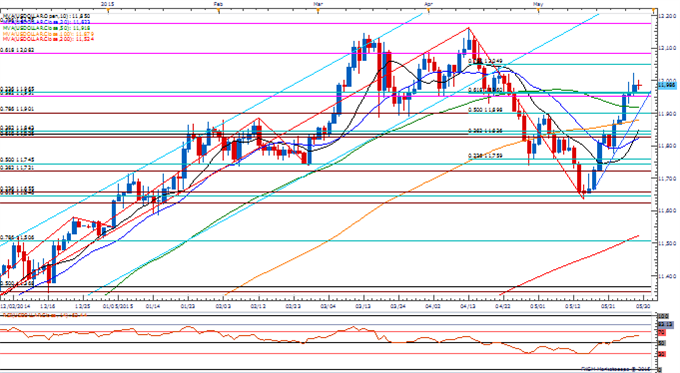

USDOLLAR(Ticker: USDollar):

| Index | Last | High | Low | Daily Change (%) | Daily Range (% of ATR) |

|---|---|---|---|---|---|

| DJ-FXCM Dollar Index | 11986.61 | 12003.46 | 11971.09 | -0.02 | 49.14% |

Chart - Created Using FXCM Marketscope 2.0

- Ongoing closes above 11,960 (61.8% retracement) will continue to favor the topside targets for the Dow Jones-FXCM U.S. Dollar as the bullish formation continue to take shape.

- Despite mixed results of the 1Q Gross Domestic Product (GDP) report, the slew of key data prints going into the highly anticipated Non-Farm Payrolls (NFP) report may play a greater role in dictation the dollar as well as the Fed outlook as the central bank pledges to look past the weakness during the first three-months of 2015.

- String of higher-lows in USDOLLAR continues to put 12,049 (78.6% retracement) on the radar.

Join DailyFX on Demand for Real-Time SSI Updates!

Click Here for the DailyFX Calendar

--- Written by David Song, Currency Analyst

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.

Trade Alongsidethe DailyFX Team on DailyFX on Demand

Looking to use the DailyFX Trade Signals LIVE? Check out Mirror Trader.

New to FX? Watch this Video

Join us to discuss the outlook for the major currencies on the DailyFXForums