Talking Points:

- NZD/USD Rebound Vulnerable to Slowing New Zealand Consumer Price Index (CPI).

- USD/CAD Snaps Back from Fresh Monthly Low (1.2086) Even as Canada CPI, Sales Top Forecasts.

- USDOLLAR Continues to Carve Bearish Formation Despite Sticky Core Inflation.

For more updates, sign up for David's e-mail distribution list.

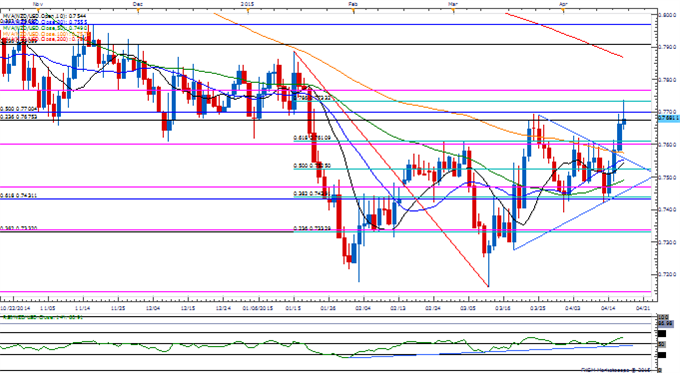

Chart - Created Using FXCM Marketscope 2.0

- Despite marking a fresh monthly high of .0.7739, NZD/USD may remain largely capped around the former support zones from back in December amid the lack of momentum to close above 0.7675 (23.6% retracement) to 0.7700 (50% retracement).

- New Zealand’s 1Q Consumer Price Index (CPI) may undermine the near-term rebound in the exchange rate as the headline reading for inflation is expected to slow to an annualized 0.2% from 0.8% during the last three-months of 2014.

- DailyFX Speculative Sentiment Index (SSI) shows the retail crowd remains net-short NZD/USD after flipping on April 14, with the ratio currently holding at -1.55.

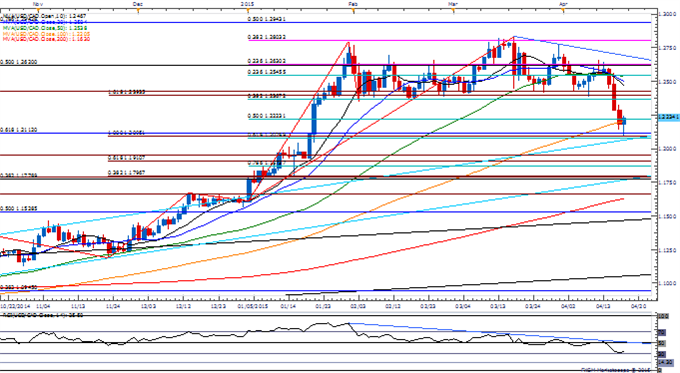

USD/CAD

- Even though USD/CAD struggles to retain the initial reaction to the better-than-expected Canada CPI & Retail Sales report, the pair remains at risk for a further decline as long as the Relative Strength Index (RSI) retains the bearish momentum from earlier this year.

- Looks as though 1.2080 (61.8% retracement) to 1.2110 (61.8% retracement) may act as near-term support as the oscillator holds above oversold territory.

- Will watch former support around 1.2360 (38.2% retracement) to 1.2390 (161.8% expansion) for new resistance.

Join DailyFX on Demand for Real-Time SSI Updates Across the Majors!

Read More:

The Weekly Volume Report: Dollar Trying To Turn?

NZDUSD Breakout Stalls at 7700 Resistance- Short Scalps Pending

USDOLLAR(Ticker: USDollar):

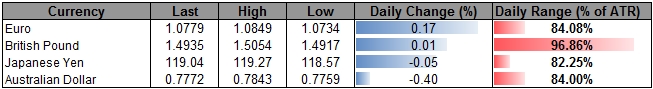

| Index | Last | High | Low | Daily Change (%) | Daily Range (% of ATR) |

|---|---|---|---|---|---|

| DJ-FXCM Dollar Index | 11983.71 | 11989.46 | 11928.32 | 0.04 | 86.41% |

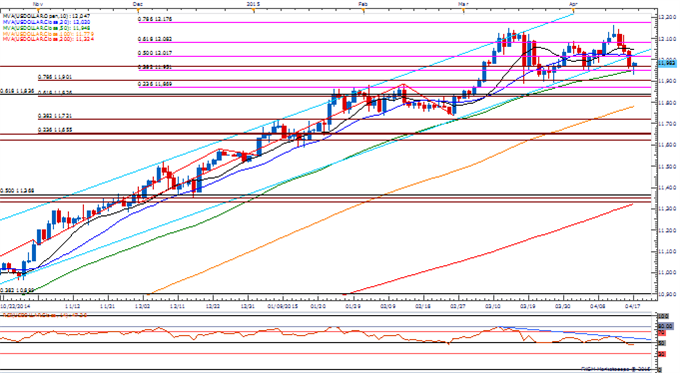

Chart - Created Using FXCM Marketscope 2.0

- Despite the rebound in the Dow Jones-FXCM U.S. Dollar, the greenback remains at risk for a further decline amid the series of lower-highs & lows in price along with the bearish momentum in the RSI.

- The uptick in the core Consumer Price Index (CPI) may show the diminishing threat for disinflation, but may do little to encourage the Fed to raise the benchmark interest rate in mid-2015 amid the ongoing slack in the real economy.

- With the break of the opening monthly range, downside targets remain favored, with 11,869 (23.6% expansion) to 11,901 (78.6% expansion) in focus.Join DailyFX on Demand for Real-Time SSI Updates!

| Release | GMT | Expected | Actual |

|---|---|---|---|

| Consumer Price Index (MoM) (MAR) | 12:30 | 0.3% | 0.2% |

| Consumer Price Index (YoY) (MAR) | 12:30 | 0.0% | -0.1% |

| Consumer Price Index ex Food & Energy (MoM) (MAR) | 12:30 | 0.2% | 0.2% |

| Consumer Price Index ex Food & Energy (YoY) (MAR) | 12:30 | 1.7% | 1.8% |

| Consumer Price Index n.s.a. (MAR) | 12:30 | 236.129 | 236.119 |

| Consumer Price Index Core n.s.a. (MAR) | 12:30 | 240.523 | 240.793 |

| Real Average Weekly Earnings (YoY) (MAR) | 12:30 | -- | 2.2% |

| U. of Michigan Confidence (APR P) | 14:00 | 94.0 | |

| Leading Index (MAR) | 14:00 | 0.3% |

Click Here for the DailyFX Calendar

--- Written by David Song, Currency Analyst

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.

Trade Alongsidethe DailyFX Team on DailyFX on Demand

Looking to use the DailyFX Trade Signals LIVE? Check out Mirror Trader.

New to FX? Watch this Video

Join us to discuss the outlook for the major currencies on the DailyFXForums