Talking Points:

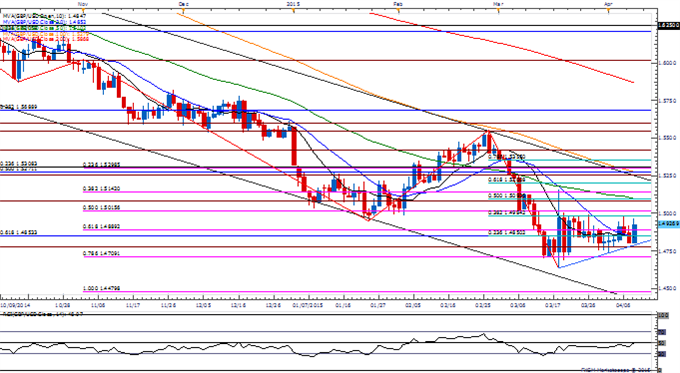

- GBP/USD Holds Range Resistance Ahead of Bank of England (BoE) Policy Meeting.

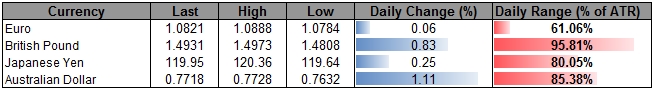

- AUD/USD Rebound to Face Slowing China Inflation; Former Support in Focus.

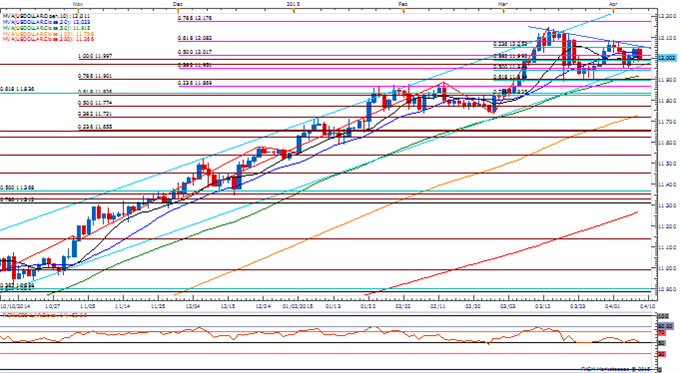

- USDOLLAR Threatens Bearish RSI Momentum; FOMC Minutes in Focus.

For more updates, sign up for David's e-mail distribution list.

Chart - Created Using FXCM Marketscope 2.0

- GBP/USD may continue to face range-bound prices going into the Bank of England (BoE) interest rate decision amid the string of failed attempts to close above 1.4980 (38.2% retracement) to 1.5015 (38.2% expansion).

- May see more of the same from the BoE ahead of the May election; will retail a flat bias on GBP/USD as long as the pair continues to close above the 1.4700-10 (78.6% expansion) region.

- DailyFX Speculative Sentiment Index (SSI) shows the retail FX crowd has flipped back net-long GBP/USD just ahead of the European close, with the ratio now sitting at +1.05.

AUD/USD

- AUD/USD may continue to hold below former-support around 0.7720 (161.8% expansion) to 0.7740 (78.6% expansion) as China – Australia’s largest trading partner – is expected to face a further slowdown in consumer price inflation.

- Lack of momentum to push & close above former-support may limit the rebound in AUD/USD and generate range-bound price action throughout April.

- Will continue to keep a close eye on the 0.7570 (50% expansion) to 0.7590 (100% expansion) range amid the failed attempts to close below the key zone.

Join DailyFX on Demand for Real-Time SSI Updates Across the Majors!

Read More:

Price & Time: USD Searching For Trend

AUDJPY Snaps 9 Day Losing Streak- Long Scalps Favored Above 91.20

USDOLLAR(Ticker: USDollar):

| Index | Last | High | Low | Daily Change (%) | Daily Range (% of ATR) |

|---|---|---|---|---|---|

| DJ-FXCM Dollar Index | 12002.71 | 12047.24 | 11981.32 | -0.38 | 76.94% |

Chart - Created Using FXCM Marketscope 2.0

- Dow Jones-FXCM U.S. Dollar remains at risk of facing a larger correction as Fed Governor Jerome Powell and New York Fed President William Dudley highlight the ongoing slack in the real economy along with concerns surrounding the appreciation in the greenback.

- May see a more dovish Federal Open Market Committee (FOMC) Minutes as central bank officials push back their interest rate forecast, while weak energy prices have shown little evidence of boosting private-sector consumption, one of the leading drivers of growth and inflation.

- Will keep a close eye on the retracement from the late-February advance, with the 50% retracement (11,943) and the 23.6% retracement (12,052) in focus.Join DailyFX on Demand for Real-Time SSI Updates!

| Release | GMT | Expected | Actual |

|---|---|---|---|

| Fed’s Narayana Kocherlakota Speaks on U.S. Economy | 12:50 | -- | -- |

| IBD/TIPP Economic Optimism (APR) | 14:00 | 49.0 | |

| JOLTS Job Openings (FEB) | 14:00 | 5003 | |

| Consumer Credit (FEB) | 19:00 | $12.250B |

Click Here for the DailyFX Calendar

--- Written by David Song, Currency Analyst

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.

Trade Alongsidethe DailyFX Team on DailyFX on Demand

Looking to use the DailyFX Trade Signals LIVE? Check out Mirror Trader.

New to FX? Watch this Video

Join us to discuss the outlook for the major currencies on the DailyFXForums