Talking Points:

- GBP/USD Rebound to Fizzle as Bullish RSI Momentum Comes Under Pressure.

- NZD/USD Bullish Break to Benefit From Widening New Zealand Trade Surplus.

- USDOLLAR Holds Post-FOMC Low; RSI Threatens Bearish Trend Following Sticky CPI.

For more updates, sign up for David's e-mail distribution list.

Chart - Created Using FXCM Marketscope 2.0

- Lack of momentum to close above 1.4980-90 (38.2% retracement) may highlight a near-term topping process in GBP/USD; break of the bullish RSI momentum to favor downside targets, but need a close below 1.4700-10 (78.6% expansion) to favor a resumption of the downward trend.

- Despite the weakness in the U.K. Consumer Price Index (CPI), a rebound in Retail Sales may mitigate the bearish sentiment surrounding the sterling heading into the end of March.

- DailyFX Speculative Sentiment Index (SSI) ratio has narrowed to +1.52 as short-interest gains traction amongst the retail crowd.

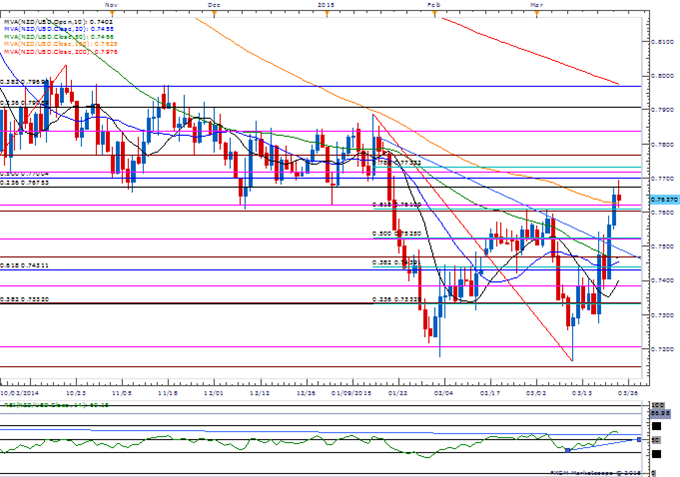

NZD/USD

- Despite the pullback from a fresh monthly high (7696), NZD/USD may continue to track higher over the next 24-hours of trade as New Zealand’s Trade Balance is expected to widen to 350M from 56M in January.

- A further improvement in growth prospects may highlight a more bullish outlook for the kiwi especially as the bar remains high for the Reserve Bank of New Zealand (RBNZ) to revert back to its easing cycle.

- Need a close above 0.7675(23.6% retracement) to 0.7700 (50% retracement) to favor a larger advance in NZD/USD.

Join DailyFX on Demand for Real-Time SSI Updates Across the Majors!

Read More:

Price & Time: Key Zone Coming Up For the Buck

Webinar: Scalps Favor Dollar Correction- EUR/USD Eyes FOMC Highs

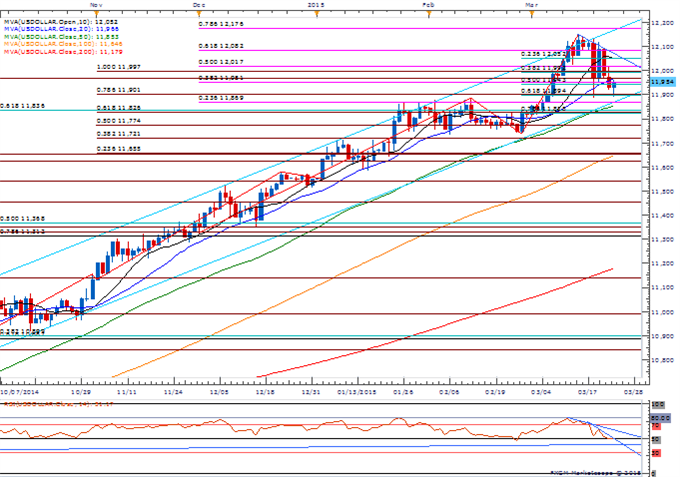

USDOLLAR(Ticker: USDollar):

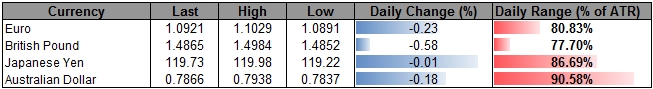

| Index | Last | High | Low | Daily Change (%) | Daily Range (% of ATR) |

|---|---|---|---|---|---|

| DJ-FXCM Dollar Index | 11954.86 | 11965.05 | 11892.26 | 0.18 | 87.40% |

Chart - Created Using FXCM Marketscope 2.0

- With the Dow Jones-FXCM U.S. Dollar index holding above the low (11,886) set following the Federal Open Market Committee (FOMC) meeting, the greenback may face a larger rebound especially as the RSI threatens the bearish structures.

- Despite the choppy reaction to the better-than-expected U.S. Consumer Price Index (CPI) paired with dovish rhetoric from Fed Vice-Chair Stanley Fischer, another expansion in demand for U.S. Durable Goods may support the greenback going into April.

- As 11,894 (61.8% retracement) offers near-term support, next topside region of interest comes in around 11,992 (38.2% retracement).

Join DailyFX on Demand for Real-Time SSI Updates!

| Release | GMT | Expected | Actual |

|---|---|---|---|

| Consumer Price Index (MoM) (FEB) | 12:30 | 0.2% | 0.2% |

| Consumer Price Index (YoY) (FEB) | 12:30 | -0.1% | 0.0% |

| Consumer Price Index ex Food and Energy (MoM) (FEB) | 12:30 | 0.1% | 0.2% |

| Consumer Price Index ex Food and Energy (YoY) (FEB) | 12:30 | 1.7% | 1.7% |

| Consumer Price Index n.s.a. (FEB) | 12:30 | 234.728 | 234.722 |

| Consumer Price Index Core s.a. (FEB) | 12:30 | 240.122 | 240.247 |

| FHFA House Price Index (MoM) (JAN) | 13:00 | 0.5% | 0.3% |

| Markit Purchasing Manager Index Manufacturing (MAR P) | 13:45 | 54.6 | 55.3 |

| New Home Sales (FEB) | 14:00 | 464K | 539K |

| New Home Sales (MoM) (FEB) | 14:00 | -3.5% | 7.8% |

| Richmond Fed Manufacturing Index (MAR) | 14:00 | 3 | -8 |

Click Here for the DailyFX Calendar

--- Written by David Song, Currency Analyst

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.

Trade Alongsidethe DailyFX Team on DailyFX on Demand

Looking to use the DailyFX Trade Signals LIVE? Check out Mirror Trader.

New to FX? Watch this Video

Join us to discuss the outlook for the major currencies on the DailyFXForums