US Dollar Talking Points

The US Dollar Index (DXY) bounces back from a three-day losing streak ahead of the Federal Reserve interest rate decision on March 17, and fresh forecasts coming out of the central bank are likely to influence theGreenback as Fed officials are slated to update the Summary of Economic Projections (SEP).

Fundamental Forecast for US Dollar: Neutral

The US Dollar Index (DXY) attempts to retrace the decline from the monthly high (92.50) amid the recent rebound in longer-dated US Treasury yields, and it remains to be seen if the Federal Open Market Committee (FOMC) will adjust the forward guidance for monetary policy as Congress passes the $1.9 trillion coronavirus recovery package.

At the same time, the 379K rise in US Non-Farm Payrolls (NFP) may encourage the FOMC to adopt an improve outlook as the central bank lays out an outcome-based approach for monetary policy, and the Fed rate decision may spur a bullish reaction in the US Dollar if the central bank utilizes the SEP to signal a looming change in policy.

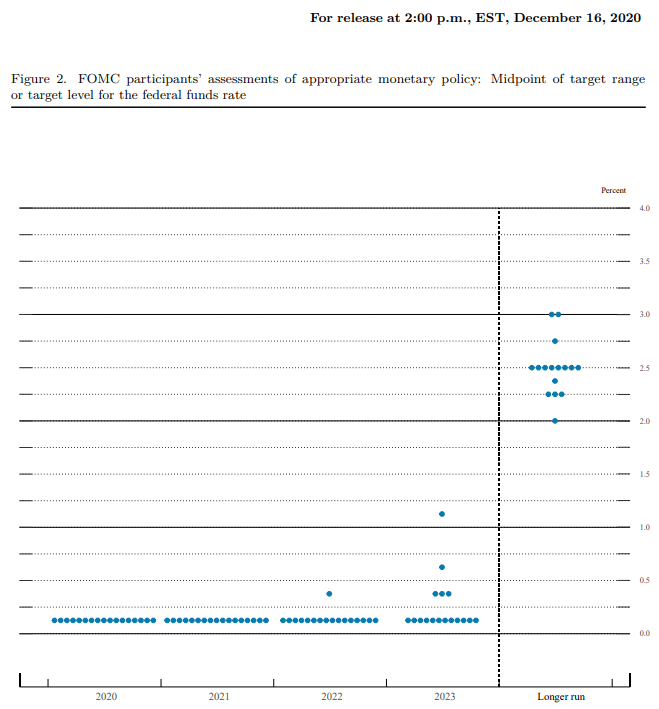

Source: FOMC

It remains the FOMC will adjust the monetary policy outlook as the minutes from the January meeting insist that “the Committee's current guidance was well suited to the current environment because it describes how policy would respond based on the path of the economy,” but an upward revision in the Fed’s interest rate dot may generate a bullish reaction in the US Dollar as it reflects a greater willingness to scale back the emergency measures.

However, recent remarks from Chairman Jerome Powell suggest the Fed is in no rush to alter the course for monetary policy as the central bank head warns that “it’s not at all likely that we’d reach maximum employment this year.” It seems as though the FOMC is on a preset course as the central bank extends the Paycheck Protection Program Liquidity Facilityby three months to June 30, and the committee may endorse a wait-and-see approach throughout the first half of 2021 as the central bank remains “committed to using its full range of tools to support the U.S. economy in this challenging time.”

With that said, the FOMC may stay on track to “increase our holdings of Treasury securities by at least $80 billion per month and of agency mortgage-backed securities by at least $40 billion per month,” and more of the same from Fed officials may produce headwinds for the US Dollar as the central bank relies on its non-standard tools to achieve its policy targets.

--- Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong