US DOLLAR FORECAST: NEUTRAL

- US Dollar up vs. commodity currencies, down vs. anti-risk FX as stocks drop

- Financial markets may be looking past credit crunch risk, weighing recession

- Tame economic docket likely to keep Covid-19 outbreak macro impact in focus

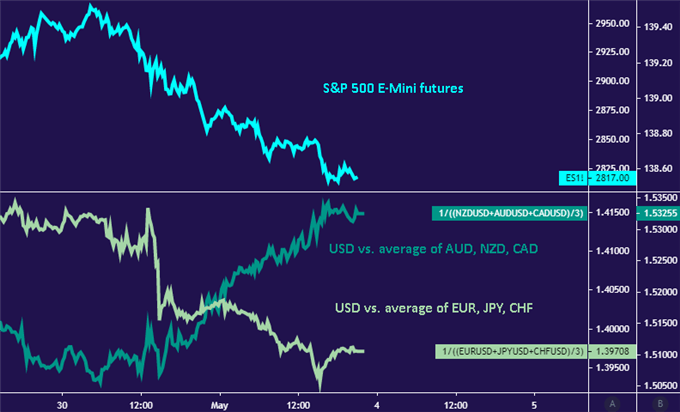

The handoff from April to May proved positive for the US Dollar. It snapped a seven-day losing streak against an average of its major counterparts, in a move that seemed to echo a risk-off turn in broader financial market sentiment. The bellwether S&P 500 stock index suffered its largest daily drawdown in a month, boosting the haven demand for the global reserve currency.

Dissecting the move reveals an interesting dynamic however. The Greenback rose against currencies attached to central banks with comparatively greater room to ease monetary policy – AUD and NZD, for example. It fell against those where borrowing costs are already negative, like the Yen and the Euro. This seems to rank performance along a “scope for rate cuts” spectrum.

Chart of US Dollar vs G10 FX currencies, S&P 500 futures created with TradingView

These moves seem to imply a yields-minded market, despite the dour mood. That is a stark contrast to the all-out liquidation seen in March, when capital fled to the absolute liquidity of the US currency above nearly all else as the availability of cash suddenly looked suspect. This might mean that, with a credit crisis seemingly contained for now, a reckoning with the longer-term scars of Covid-19 is afoot.

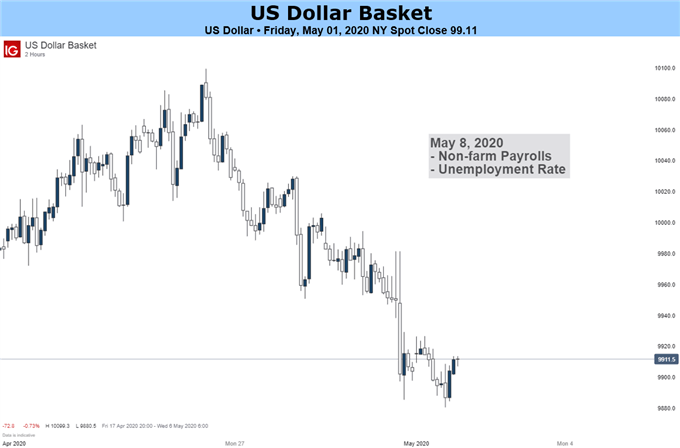

If this is truly the case, a relatively tame economic calendar seems unlikely to interfere in the week ahead. Monetary policy announcements from the RBA and the Bank of England are likely to be most interesting for their assessments of the macro backdrop rather than any immediate changes in current policy. It ought to surprise nearly no one that April’s US jobs report will likely register as utterly abysmal.

--- Written by Ilya Spivak, Sr. Currency Strategist for DailyFX.com

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter

US DOLLAR TRADING RESOURCES

- Just getting started? See our beginners’ guide for FX traders

- What is your trading personality? Take our quiz to find out

- Join a free webinar and have your trading questions answered