US Dollar Rate Talking Points

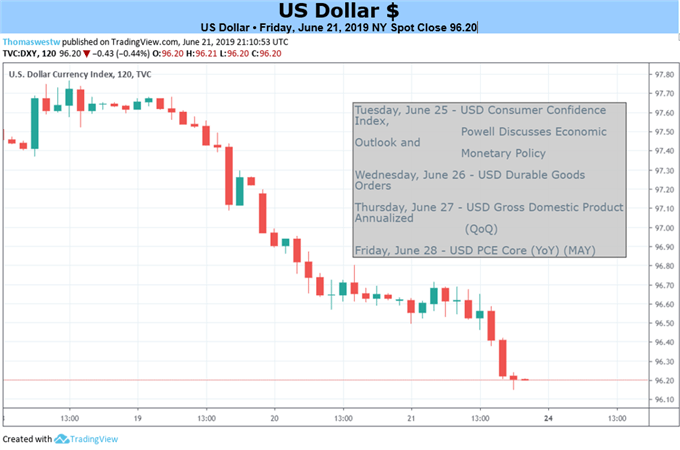

Fresh data prints coming out of the US economy may do little to heighten the appeal of the Dollar as the Federal Open Market Committee (FOMC) alters the forward guidance for monetary policy.

Fundamental Forecast for US Dollar: Bearish

The US Dollar struggles to hold its ground as the Federal Reserve largely abandons the wait-and-see approach for monetary policy, and the central bank may continue to change its tune over the coming months as “many FOMC participants now see that the case for somewhat more accommodative policy has strengthened.”

The US Durable Goods Orders report may reinforce speculation for an imminent Fed rate cut as demand for large-ticket items are expected to hold flat in May, and the final revision to the US Gross Domestic Product (GDP) report may offer the USD little relief as the update is anticipated to show a minor upward revision in the growth rate.

Even though the economy shows little signs of a looming recession, it seems as though FOMC has become less data dependent and more responsive to the shift in US trade policy as the Trump administration relies on tariffs to push its agenda.

As a result, the FOMC appears to be on track to switch gears over the coming months, and a growing number of Fed officials may show a greater willingness to insulate the economy as the “apparent progress on trade turned to greater uncertainty.”

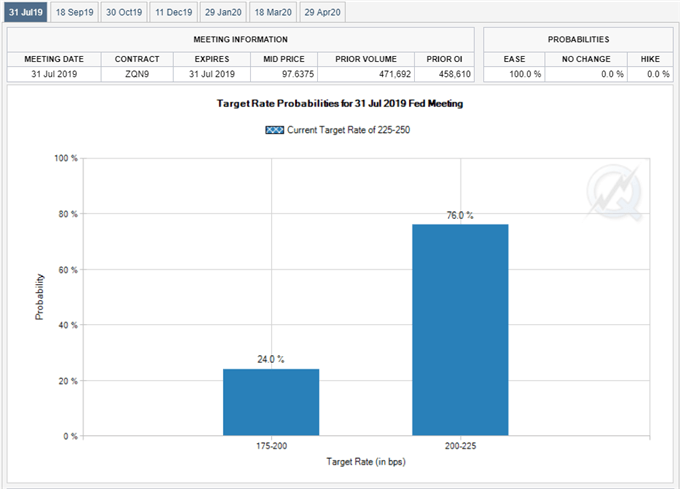

It remains to be seen if the central bank will implement a rate easing cycle as eight Fed officials now project the benchmark interest rate to narrow to 1.75% to 2.00% by the end of 2019, but the current environment is likely to keep the US Dollar under pressure especially as Fed Fund futures now reflects a 100% probability for at least a 25bp rate cut at the next interest rate decision on July 31.

With that said, fresh rhetoric from Fed officials may continue to sway the near-term outlook for the US Dollar, and a batch of dovish comments from Chairman Jerome Powellmay drag on the greenback as the central bank head is to speak in front of the Council on Foreign Relations next week.

Sign up and join DailyFX Currency Strategist David Song LIVE for an opportunity to discuss potential trade setups.

EUR/USD Rate Daily Chart

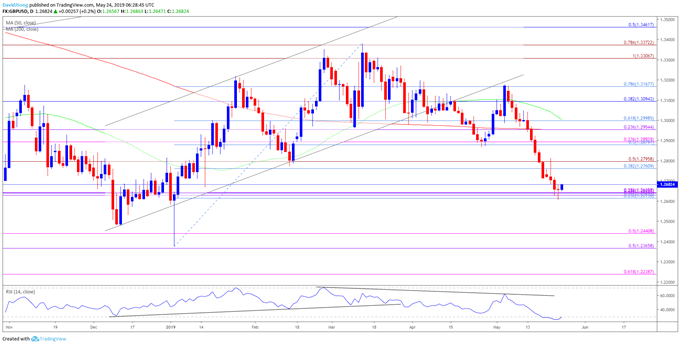

Keep in mind, the broader outlook for EURUSD is no longer tilted to the downside as both price and the Relative Strength Index (RSI) break out of the bearish formations from earlier this year.

With that said, EURUSD stands at risk for a larger correction as the exchange rate clears the April-high (1.1324) following the failed attempt to test the 1.1000 (78.6% expansion) handle.

More recently, the lack of momentum to close below the 1.1190 (38.2% retracement) to 1.1220 (78.6% retracement) region raises the risk for a run at the monthly-high (1.1348), but need a close above the 1.1340 (38.2% expansion) hurdle to bring the 1.1390 (61.8% retracement) to 1.1400 (50% expansion) area on the radar.

Additional Trading Resources

For more in-depth analysis, check out the 2Q 2019 Forecast for EUR/USD

Are you looking to improve your trading approach? Review the ‘Traits of a Successful Trader’ series on how to effectively use leverage along with other best practices that any trader can follow.

Want to know what other currency pairs the DailyFX team is watching? Download and review the Top Trading Opportunities for 2019

--- Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong.