Fundamental Forecast for USD: Bearish

Talking Points:

- Dollar Drops on Downbeat NFP: EUR/USD, GBP/USD Bounce From Key Supports.

- US Dollar Taking Few Cues From Fed Rate Pricing.

- Trading USD Pairs? Our IG Client Sentiment follows traders’ positioning on key Dollar-pairs like EUR/USD, GBP/USD and USD/JPY.

If you’re looking for longer-term analysis on the US Dollar, click here for our Trading Forecasts.

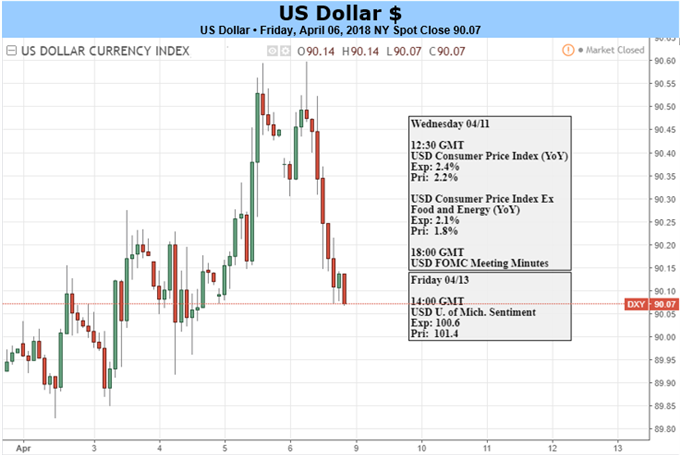

Inflation, Fed Minutes Highlight Next Week’s US Data

The big items on the macro-economic calendar for next week both take place on Wednesday, with March inflation numbers released early in the US morning and meeting minutes from the Fed’s March rate hike being released later in the day. We have one additional high impact USD print on the calendar for next Friday, with the April release of University of Michigan Consumer Sentiment Numbers. Next week also ushers in earning season out of the US as many US corporates release first quarter performance numbers.

DailyFX Economic Calendar: High-Impact Items for Week of April 9, 2018

Chart prepared by James Stanley

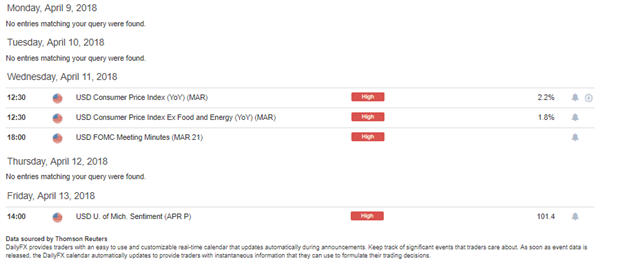

Six Consecutive Months of Inflation Above 2%

In February, US CPI came in at an annualized 2.2%, making for the sixth consecutive month of inflation at 2% or higher. That 2% number is the Fed’s target, and this inflationary strength helped to bring the March rate hike, which we’ll get more context around when meeting minutes from the March rate decision are released next week. The big question around inflation is whether we get a seventh straight month of a read at the Fed’s target or higher and, perhaps more to the point, will it help to bring some element of a bullish response into the currency?

US CPI Since January, 2017: Six Consecutive Months at 2% or Higher

Chart prepared by James Stanley

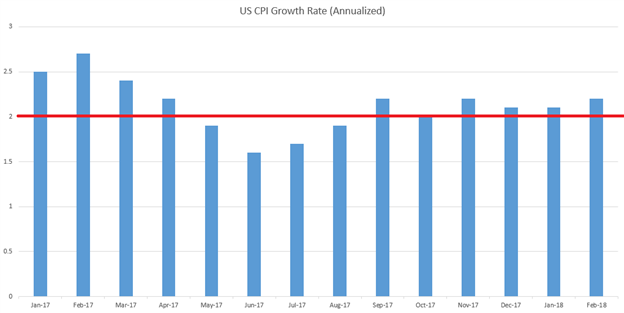

USD Gives Back Gains After Disappointing Non-Farm Payrolls Report

The US Dollar spent most of this week moving higher, continuing the gains that had started in the week prior as we closed-out Q1. After jostling around the 90.00 level for the first three days of this week, the Greenback caught a bid on Thursday after a really strong ADP payrolls report. But, jobs numbers on Friday via Non-Farm Payrolls could not replicate that strength, and the headline number printing at +103k versus the +188k expectation was enough to push DXY right back-down towards the 90.00 level.

US Dollar via ‘DXY’ Hourly Chart: Reversal of Gains After Friday’s NFP

Chart prepared by James Stanley

Going into next week the US Dollar remains in a vulnerable position. The first quarter of the year saw a continuation of the downtrend that defined the Dollar’s trading in 2017. This weakness showed even as the Federal Reserve was one of the only major Central Banks raising rates, alluding to the fact that this bearish drive was likely more-related to fiscal policy rather than expectations around near-term interest rates. We discussed this premise a few weeks ago, tying the themes of fiscal policy and USD price action together by the medium of US Treasuries; and this very much remains a relevant driver in the US currency. This theme may become a bit more obscured in the near-term as the topic of tariffs dominate the headlines, keeping the focus on shorter-term stimuli rather than longer-term scenarios.

Tariffs

Much has been written about tariffs and their possible impact, and we’ve even seen some USD volatility around the timing of certain tweets or comments relating to the matter. But, to date, nothing is certain; and at this stage, it would appear that we’re hearing a bit of saber-rattling on both sides. Nonetheless and regardless of what the long-term impact might be if this actually does comes to fruition, price action has displayed a USD-negative overtone as tensions around the topic have flared, and this could be enough to nullify a longer-term bullish USD view until some order of resolution is found.

Next Week’s Forecast

The forecast for next week on the US Dollar will be set to bearish, looking for a continuation of the longer-term down-trend to remain in order.

US Dollar via ‘DXY’ Daily Chart: Short-Term Range Resistance, Longer-Term Down-Trend

Chart prepared by James Stanley

To read more:

Are you looking for longer-term analysis on the U.S. Dollar? Our DailyFX Forecasts for Q1 have a section for each major currency, and we also offer a plethora of resources on USD-pairs such as EUR/USD, GBP/USD, USD/JPY, AUD/USD. Traders can also stay up with near-term positioning via our IG Client Sentiment Indicator.

--- Written by James Stanley, Strategist for DailyFX.com

To receive James Stanley’s analysis directly via email, please SIGN UP HERE

Contact and follow James on Twitter: @JStanleyFX