GOLD PRICE WEEKLY FUNDAMENTAL FORECAST: NEUTRAL

- Gold outlook still hinges on stimulus deal expectations and corresponding swings in real yields

- XAU/USD price volatility could persist as uncertainty surrounding fiscal aid and COVID-19 linger

- Precious metals might stay supported more broadly as the Fed balance sheet hits all-time highs

Gold price action fluctuated within a 2% range over the last five trading sessions only to finish flat on the week. The precious metal continues to seek a bullish catalyst to fuel a breakout from its consolidation pattern, and in light of murkiness surrounding fiscal stimulus negations, gold prices could keep drifting broadly sideways.

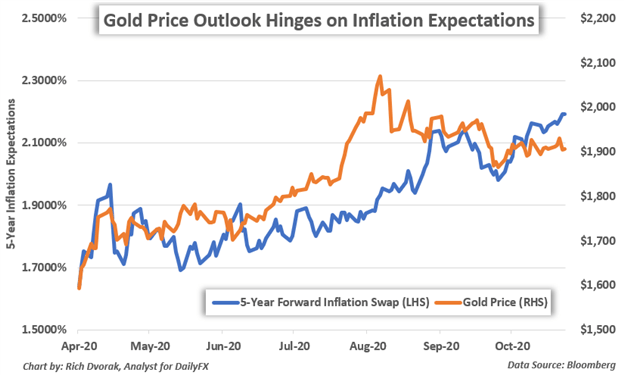

GOLD PRICE OUTLOOK HINGES ON INFLATION EXPECTATIONS (CHART 1)

Despite the notable rise in US Treasury rates over the last several weeks, the price of gold has largely kept afloat thanks to climbing inflation expectations. In fact, the 5-year forward inflation swap rate has jumped to 2.19%, which marks a fresh post-crisis high, and helps keep pressure on real yields. Inflation expectations rising faster than interest rates causes real yields to move lower, which is a bullish fundamental driver for gold prices.

Inflation expectations have potential to gain further ground with the prospect of another comprehensive fiscal aid package before the November 2020 election in focus. If US politicians can strike a stimulus deal, gold prices could stage an explosive move higher with inflation expectations.

| Change in | Longs | Shorts | OI |

| Daily | -7% | -5% | -6% |

| Weekly | 7% | -15% | -4% |

Even if an agreement on stimulus cannot be reached prior to the election, inflation expectations could still stay relatively elevated if odds of a democratic sweep remain intact, as this would likely correspond with an even bigger stimulus deal early next year. That said, potential for a gridlocked congress could undermine inflation expectations and weigh negatively on gold price action.

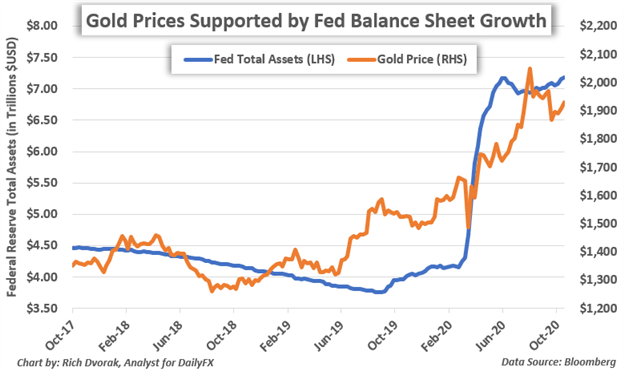

GOLD PRICES SUPPORTED BY FED BALANCE SHEET GROWTH (CHART 2)

Resurfacing coronavirus concerns as new cases spike and governments reimpose restrictions on business activity presents another bearish threat to gold outlook. Yet, gold prices and inflation expectations could remain bolstered by Fed balance sheet growth. FOMC asset purchases have mounted and just pushed total assets held by the Federal Reserve to a new record high of $7.18-trillion.

Learn More - How to Trade Gold: Top Gold Trading Strategies & Tips

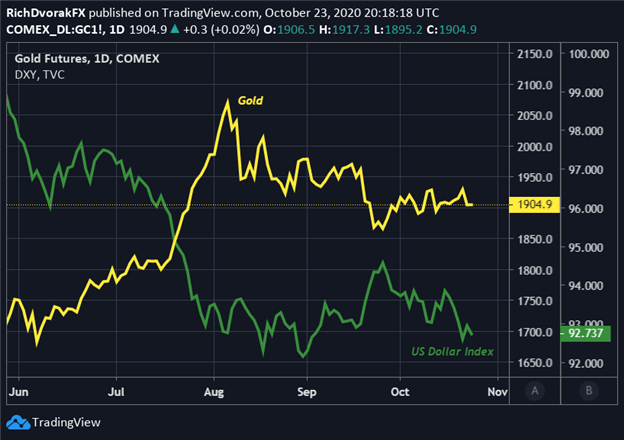

GOLD FUTURES PRICE WITH US DOLLAR INDEX OVERLAID (CHART 3)

Chart by @RichDvorakFX created using TradingView

Explosive Fed balance sheet growth, which is expected to continue at the current pace according to recent commentary from Fed officials, underpins the anti-fiat narrative and investor demand for gold. Correspondingly, the direction of gold might mirror the US Dollar Index due to the strong inverse relationship generally maintained by the two safe-haven assets.

Gold prices could spike higher with potential for the US Dollar to weaken further if fiscal stimulus optimism can outshine skepticism. XAU/USD could decline, however, if the US Dollar strengthens as coronavirus concerns take hold and inflation expectations gravitate lower.

Learn More - US Presidential Election Timeline & Implications for Gold Prices

-- Written by Rich Dvorak, Analyst for DailyFX.com

Connect with @RichDvorakFX on Twitter for real-time market insight