Financial markets endured brief episodes of volatility this past week as the US Dollar gyrated against major FX peers during the Jackson Hole Symposium. A commanding risk-on tone prevailed nonetheless with US stock indices like the S&P 500 and Nasdaq advancing to new all-time highs. This was likely driven in large part by the Fed communicating a shift to average inflation targeting and an openness to ‘running things hot.’

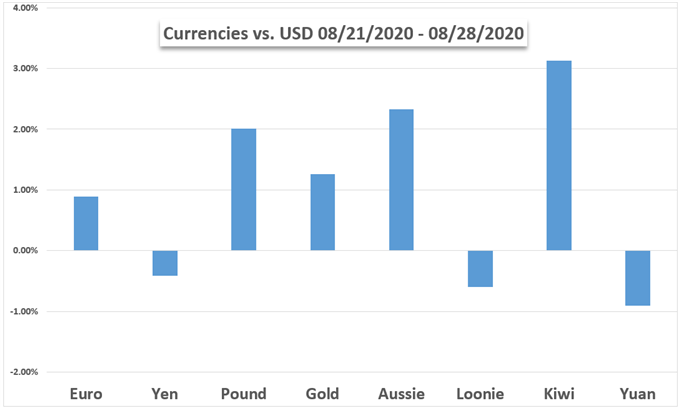

The pullback in gold prices fizzled out last week as inflation expectations climbed, which helped the precious metal form technical support around $1,910/oz. On balance, spot EUR/USD price action gained 0.9% over the last five trading sessions while GBP/USD and AUD/USD jumped 2.0% and 2.9% respectively. The Dollar-Yen spiked notably lower Friday on news that Japan’s Prime Minister Shinzo Abe officially resigned.

In the week ahead, the DailyFX Economic Calendar details the upcoming release of China and US PMIs, Euro area inflation, and nonfarm payrolls. The Australian Dollar and ASX 200 stand to steal focus of traders owing to an RBA decision and Australia GDP report due next week as well. Further, a notable shakeup is scheduled for the Dow Jones Industrial Average, which was largely motivated by the Apple stock split set to take place on August 31. What other themes and markets are traders watching next week?

Fundamental Forecasts:

Australian Dollar May Rise on RBA, Economic Outlook, Strong Risk Appetite

The Australian Dollar may rise following the RBA rate decision amid signs of economic stabilization and resilient risk appetite despite still-precarious fundamentals.

Oil Price Outlook Mired by Rebound in Crude Production

A further rebound in crude production may drag on the price of oil as signs of a protracted recovery dampens the outlook for global demand.

Dow Jones May Climb on Dovish Fed, Improving Macro Data

The Dow Jones Industrial Average may stay on its upward trajectory as the Fed sent a clear dovish message in the Jackson Hole symposium. But doubts remains about its rich valuation.

Gold Prices May Rise as Federal Reserve Adopts Average Inflation Targeting

Gold prices may turn higher as Federal Reserve Chair Jerome Powell announced the adoption of average inflation targeting.

USD/MXN Week Ahead: Quick Rebound Shows Upside is Limited

USD/MXN sees a spike in volatility after Jackson Hole and Banxico meeting minutes

EUR/USD Weekly Forecast: Awaiting Breakout From Monthly Range

EUR/USD holding pattern as markets await September breakout. US Dollar selling the dominant theme.

Technical Forecasts:

Euro Weekly Analysis - EURUSD and EURGBP Prices, Charts and Outlooks

The Euro (EUR) continues to make gains against the US dollar (USD) but is sliding lower against the British Pound (GBP).

US Dollar Outlook: DXY on the Verge of Breaking Big Support

The Dollar could be in for some more trouble in the week ahead as it fails to spring to life and presses on long-term support.

Japanese Yen Outlook: USD/JPY Slams into Support at Monthly Lows

Yen marked a second weekly rally against the Dollar and takes USD/JPY into key support at the monthly range lows. Here are the levels that matter on the technical chart.

Gold Price Forecast: Precious Metals Primed for Next Breakout?

Gold price action has pulled back over 5% from its all-time high recorded earlier this month, but precious metals could be geared up for another advance following a healthy consolidation lower.

British Pound Price Forecast: GBP/USD Breaks Out to Fresh 2020 Highs

Little remains settled in the macro backdrop but the British Pound keeps on pushing higher against the USD.

Canadian Dollar Price Outlook: USD/CAD Downside Breakouts in Focus

The Canadian Dollar cleared key support barriers against the US Dollar on multiple chart time frames. Will USD/CAD extend losses and set course to reverse its trend from 2012?

Nasdaq 100, DAX 30, FTSE 100 Forecasts for the Week Ahead

Equity markets extended higher last week with some establishing new all-time highs and others poking at technical resistance. Here are the levels to watch in the week ahead.

US DOLLAR WEEKLY PERFORMANCE AGAINST CURRENCIES AND GOLD