Market sentiment ended on a somewhat cautious note Friday as the tech-heavy Nasdaq 100 fell about 0.9%. The Dow Jones and S&P 500 erased losses however. The sentiment-linked Australian and New Zealand Dollars came under selling pressure as the haven-linked US Dollar and Japanese Yen managed to rise. Even gold prices succumbed to selling pressure after pronounced gains.

All eyes have lately been on technology companies for driving some of the most aggressive gains in global equities since late March. Last week, US-China tensions may have played a key role. The former moved to ban transactions with key Chinese tech companies WeChat and TikTok. Tencent, the owner of WeChat, saw its share price at one point decline as much as 10.5% on Friday.

Retaliation from China, the world’s second-largest economy, should be kept an eye out for as that could depress market mood further. Another key risk to watch for is developments around US fiscal stimulus. Last week, Democrats and Republicans failed to find an agreement on the size of the package, pushing the White House to consider executive action on certain stimulus provisions.

Markets are forward looking, hence the optimistic non-farm payrolls report being brushed aside last week. A lack or delay in US stimulus as well as escalating US-China tensions could derail prospects of a swift global economic recovery from the damage coronavirus has done. That could mute the impact of EU and UK GDP data ahead. More focus could be given to University of Michigan Sentiment on Friday as a relatively timely indicator of economic health.

Discover your trading personality to help find optimal forms of analyzing financial markets

Fundamental Forecasts:

British Pound May Fall on Virus-Hit GDP Data, Brexit Stalemate

The British Pound may come under fire as uncertainty about Brexit continues to curb GBP’s enthusiasm ahead of the release of preliminary, Q2 UK GDP data.

Oil Price Outlook Hinges on OPEC Meeting as US Output Remains Stagnant

The price of oil clears the July high ($42.51) ahead of the OPEC meeting as US crude output sits at its lowest level since 2018.

S&P 500 and FTSE 100 Forecasts for the Week Ahead

Tech leading the S&P 500 towards record highs, however, China risks rise. FTSE 100 hovers in a lower range.

US Dollar Weekly Outlook - Short-Term Relief Rally or a Change of Heart?

The US dollar is trying to form a supportive base to rally-off but the fundamental backdrop remains gloomy for the greenback.

Yen May Rise as Nasdaq 100 Falls on US-China Tensions, Fiscal Woes

The anti-risk Japanese Yen may rise versus currencies like the AUD and NZDon US-China tensions and fiscal stimulus woes which sank the Nasdaq 100 at the end of last week.

Technical Forecasts:

US Dollar Outlook: USD Sell-off Halted at Trend Support– DXY Levels

The Dollar is down than 3% year-to-date with the index responding to trend support at multi-year lows. Here are the levels that matter on the DXY weekly technical chart.

S&P 500, DAX 30, FTSE 100 Forecasts for Week Ahead (Charts)

US stocks looking for new highs while the DAX and FTSE continue to demonstrate relative weakness.

USD/MXN Week Ahead: Sentiment Will Focus on Sino-US Tensions Ahead of Banxico Meeting

USD/MXN recovers some buyer support as escalating geopolitical tensions cause a shift towards havens

EUR/USD Price Forecast: Eyes a Test of the Neckline Support Level

Last week, EUR/USD rallied to an over two – year high then declined after. Will the price hit a new high in the coming days?

Australian Dollar Outlook: AUD/USD Rates Eyeing 2019 High

The Australian Dollar could be on the verge of a major breakout against the US Dollar as AUD/USD rates eye a close above pivotal chart resistance.

Gold Price Technical Forecast: Gold Rally Rolls, How Far Can it Go?

Gold prices put in a massive breakout in the first four days of this week, with a sizable pullback showing up on Friday. But will that deter Gold bulls?

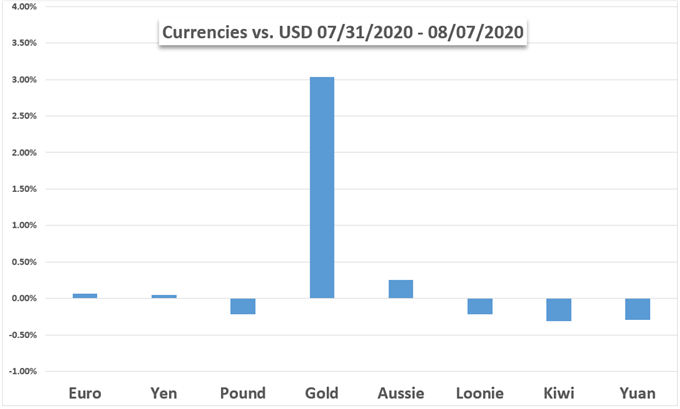

US DOLLAR WEEKLY PERFORMANCE AGAINST CURRENCIES AND GOLD