Main USD/MXN Talking Points:

- Risk-on sentiment is causing assets to venture far into oversold territory

- FOMC is expected to resume forward guidance on Wednesday

- USD/MXN takes a small breather but seems to continue to point lower

There is no denying that this week has been dominated by continued unprecedented amounts of stimulus that have geared up optimism in the markets. Risk-on sentiment is on a three-week rally as central banks around the world do what is needed to cushion the economic blow of Covid-19, as Q2 figures are expected to be much worse than the ones just gone by.

The is not much to say specific about Mexican Peso fundamentals other than it has now become the country the 7th highest number of deaths by the virus, as the government announced at a press conference late Thursday that there were 105,680 cases and at least 12,545 deaths, not something to really cheer about. But nonetheless the Peso has continued to gain ground against the Dollar as the reopening of worldwide economies and better than expected economic data have caused broad-based USD weakness. Since my report last Sunday, USD/MXN has lost another 3% to date.

We can expect price action to continue to be dominated by market sentiment in the coming week, with special focus on economic data that measure periods if time where the economy has started to function again, to see if we are heading in the right direction. This will be things like CPI and consumer confidence for the month of May as well as weekly trade data. Special focus will also be on the FOMC meeting on Wednesday, especially on topics regarding negative rates, further stimulus and the return of forecasting as it was previously dropped to focus on bringing order and liquidity to financial markets.

But if bond markets are anything to go with, the rally in risky assets is expected to continue, as investors move capital away from low-yielding safe investments to equities, with the US 10-year yield gaining 30 bps since Monday.

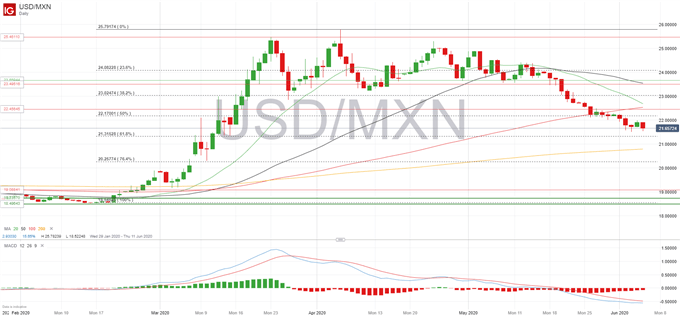

USD/MXN daily chart (29 January – 05 June 2020)

We can expect to see some profit-taking at theses levels so short-term corrections are expected, similarly to what we saw on Thursday’s session across risk-on assets. That said, it is unlikely to see a move above the 50 % Fibonacci at 22.17 from the Feb-Mar uptrend. If bids do gain enough support, another resistance follows closely at 22.45, in confluence with the 100 day moving average.

Further downside pressure might emerge but immediate support can be found around the 61.8% Fibonacci at 21.31. No significant support can be found after that until de 200 day moving average at 20.78. At this point, a continuation of the downtrend is not clear as USD/MXN enters oversold territory

--- Written by Daniela Sabin Hathorn, Market Analyst

Follow Daniela on Twitter @HathornSabin