The Dow Jones, S&P 500 and Nasdaq Composite roared to life this past week as a blowout jobs report defied even the least-dismal projection from economists. Over 2.5 million non-farm payroll positions were added versus -7.5m anticipated. The US unemployment rate even declined to 13.3% from 14.7% prior. Analysts were looking for an increase to 19.0%.

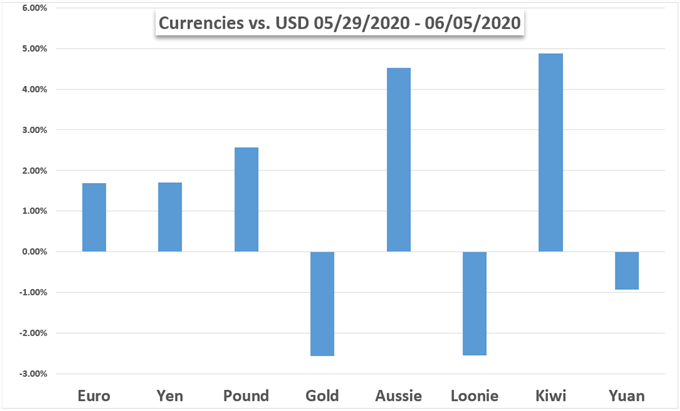

This meant a dreadful week for the haven-linked US Dollar as it plunged to its average cheapest price since early March. The sentiment-linked Australian and New Zealand Dollars exploded higher, testing peaks set at the beginning of this year. Longer-term Treasury yields rose, reflecting rising confidence which weighed against anti-fiat gold prices.

For now fears of a second wave of the coronavirus and escalating US-China tensions have taken a back seat. All eyes next week turn to the Federal Reserve monetary policy announcement as nations around the world continue slowly lifting lockdown measures. The central bank’s main policy settings are anticipated to be left unchanged with traders eyeing economic assessments.

Crude oil prices have the weekend OPEC+ meeting to catch support from as the commodity-producing cartel could extend record output curbs. Brexit talks also continue for the fate of the transition period. Traders may also look for signs of rising confidence at the end of the week when the world’s largest economy releases preliminary sentiment data for June.

Discover your trading personality to help find optimal forms of analyzing financial markets

Fundamental Forecasts:

Euro Forecast: Outlook for EUR/USD Still Bullish, More Stimulus Planned

The European Commission’s proposed €750 billion recovery package for the EU economy will be on the agenda this coming week, likely keeping EUR/USD on an upward path.

Crude Oil Prices Eye OPEC+ Meeting as US and China Demand Rises

Crude oil prices await the OPEC+ meeting where record output cuts could be prolonged as demand for energy from the US and China continues recovering. What could be the downside risks?

USD/MXN Outlook: Profit-Taking, FOMC and More Real-Time Economic Data

The Mexican Peso performs another stellar week against the Dollar but profit-taking may curb further losses

Gold Price Outlook: Gold Slammed Lower on Record US Jobs Creation

Gold has fallen sharply after the latest US Non-Farm Payroll report showed 2.5 million jobs created in May , smashing expectations of an 8 million loss.

AUD/USD Rallies to Yearly Open Ahead of FOMC Rate Decision

The Australian Dollar has soared back to the yearly open highs, seemingly dismissing the imminent onset of Australia’s first recession in 29 years

Nasdaq 100, DAX 30 & FTSE 100 Forecasts: Will the Recovery Continue?

The Nasdaq reached fresh heights on Friday despite an ever more complicated fundamental landscape as President Trump floated the idea of auto tariffs on the EU. How might this impact the week ahead?

Technical Forecasts:

US Dollar Recovery Could Undermine Gains in AUD/USD & EUR/USD

The Greenback may reclaim some lost ground versus the Australian Dollar and Euro in the week ahead after an aggressive selling bout sent the USD index to an 11-week low.

Gold Forecast: 2012 High Still on Radar as Price Holds May Range

The price of gold may continue to exhibit a bullish behavior in June as the pullback from the yearly high ($1765) reverses ahead of the May low ($1670).

Yen Price Outlook: USD/JPY Explodes, AUD/JPY Extends V-Recovery

JPY price action weakens further as the Japanese Yen continues to crumble against its US Dollar and Australian Dollar peers. Can spot USD/JPY and AUD/JPY keep climbing or is the rally overdone?

Crude Oil Outlook: Big Gap & Resistance Levels in View

Oil continues to recovery, and may have some more room to go, but traders will want to keep an eye on a couple of important technical thresholds.

S&P 500, Nasdaq 100, FTSE 100 Technical Outlook For Next Week

S&P 500 bulls in command, Nasdaq 100 produces “V” shaped recovery, while FTSE 100 extends recovery

Sterling Price Outlook: Pound Surges into Critical Fibonacci Resistance

Sterling rallied more than 11% vs US Dollar since the March low with price now testing key confluent resistance. Here are the levels that matter on the technical charts.

Euro Technical Forecast: EUR/USD, EUR/JPY, EUR/GBP, EUR/CHF

The risk rally continued in a big way this week and Euro bulls have remained in-charge against the US Dollar and Japanese Yen.

US DOLLAR WEEKLY PERFORMANCE AGAINST CURRENCIES AND GOLD