The aggressive pace in bullish momentum since global equities bottomed last month notably cooled this past week. In the United States, as virus case growth continued slowing, the Dow Jones and S&P 500 ended the previous 5 sessions cautiously lower. Yet losses were notably trimmed as Friday wrapped up and the US government passed a $484 billion interim stimulus package.

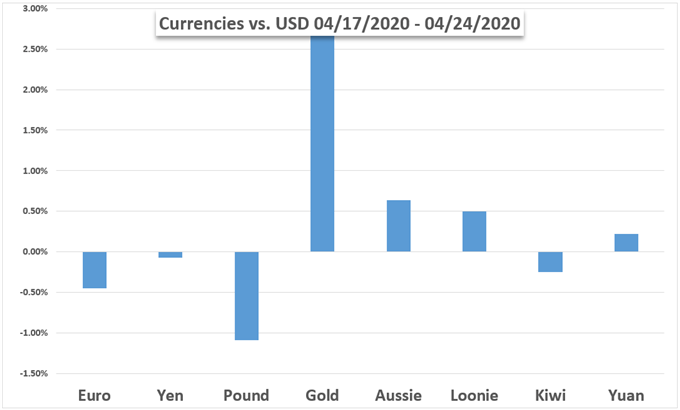

All things considered, it was a relatively quiet week for FX despite crude oil prices at one point turning negative for the first time on record. As the commodity stabilized, so too did the Canadian Dollar. The sentiment-linked Australian Dollar was a notable outperformer while the haven-oriented US Dollar ended only marginally higher on average.

Earnings may continue being the focus for financial markets in the week ahead as central banks and key economic data accompany. Financial businesses have been a notable underperformer while information technology and consumer discretionary ones have been showing some levels of resilience. Earnings from Amazon, Apple, Alphabet, Visa, Caterpillar and more are due.

With most major central banks sitting at zero rates as quantitative easing runs in the background, traders will likely focus on their economic assessments. Those up ahead are the Bank of Japan, European Central Bank and the Federal Reserve. First-quarter US GDP is anticipated to shrink, but by how much? Markets seem to be looking forward to a reopening with each passing week.

Fundamental Forecasts:

Euro Forecast: Outlook for EUR/USD Still Bearish

The prospect of a severe contraction in the Eurozone economy, combined with the region’s slow and complex decision-making process, will likely lead to further losses for EUR/USD in the week ahead.

Australian Dollar Faces Key CPI Data, Coronavirus Will Blunt Its Impact

The Australian Dollar market normally focuses laser-like on inflation data which comes only once a quarter. The coming set, however, will likely see its impact severely blunted.

S&P 500, DAX 30 and FTSE 100 Forecasts for the Week Ahead

Economies are now beginning to re-open, however, the question remains as to what a post-lockdown world will look like.

US Dollar Outlook Bullish on FOMC as Virus-Induced Recession Risks Swell

The US Dollar may rise if demand for liquidity surges and pushes the haven-linked Greenback higher as the global growth outlook deteriorates. The FOMC rate decision may fan these flames

Oil Price Fundamental Outlook Mired by Great Lockdown

The economic shock from COVID-19 may continue to drag on the price of oil as the Great Lockdown disrupts global demand, with the crude surplus raising the cost of storage.

Technical Forecasts:

Gold Price Outlook: XAU/USD Drawn Like a Moth to a Flame

The price of gold has rallied $280/oz. in the last five weeks and if the current trajectory continues, the precious metal may make a fresh attempt at a new multi-year high.

Euro Forecast: April ECB Meeting Comes as EUR/JPY, EUR/USD Rates Pressured

Both EUR/JPY and EUR/USD rates are under immense pressure, having made a number of key technical breaks to the downside in recent sessions.

Crude Oil Price Faces a Critical Resistance Level - Brent Oil Forecast

This week, Crude oil price printed its lowest price in two-decade. Here are the key chart points to keep track of in the next week.

British Pound Forecast: GBP/USD, Watch Monthly Low & High

GBP/USD volatility has declined in recent weeks, with back and forth price action not yet providing a clean look; levels to watch for signs of a momentum if broken.

Dow Jones & DAX 30 Technical Forecast for the Week Ahead

After rebounding in late March and early April, the Dow Jones and DAX 30 have slowed their ascent and run the risk of reversing lower in the week ahead.

US Dollar Bullish Push on Edge? EUR/USD, GBP/USD, USD/CAD, AUD/USD

The US Dollar cautiously gained this past week but commitment to a broader bullish push seemed lacking. What is the technical road ahead for EUR/USD, GBP/USD, USD/CAD and AUD/USD?

Japanese Yen Price Outlook: USD/JPY Range Breakout Imminent

Japanese Yen is contracting into the weekly / monthly opening-ranges- we’re on breakout alert. Here are the levels that matter on the USD/JPY weekly technical chart.

US DOLLAR WEEKLY PERFORMANCE AGAINST CURRENCIES AND GOLD