S&P 500, DAX 30, ASX 200 Price Outlooks:

- The S&P 500 will look to level off after central banks and governments injected significant stimulus

- The DAX 30 will await commentary from Christine Lagarde, Governor of the ECB

- Meanwhile, the ASX 200 may offer insight of equity performance in post-outbreak economies

S&P 500 Forecast

Outlook: Neutral

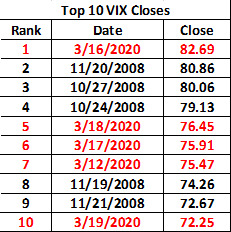

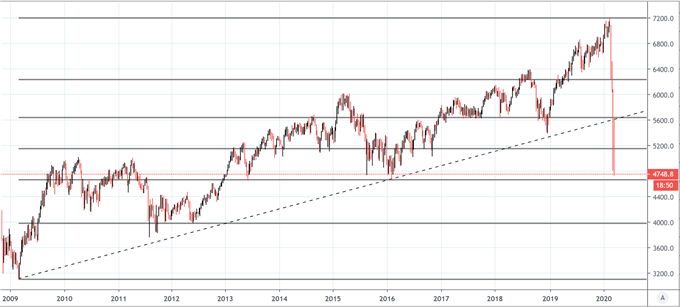

The S&P 500 witnessed another historic week of price activity as circuit breakers were triggered and higher limits were tagged. Amidst the volatility, the market’s “fear gauge,” or VIX index recorded record-setting readings despite significant intervention from governments and central banks. With stimulus offered and declines slowing, have markets finally come to grips with the economic impacts of the coronavirus?

S&P 500 Weekly Price Chart (2009 – 2020)

To be sure, the emerging drawdown in volatility is an encouraging sign, but not one that rules out further losses. The pullback in volatility would be more suggestive that gains or declines the market does experience are more normal, which might hint the market is no longer in a state of panic, but perhaps a state of acceptance.

Source: Bloomberg

Therefore, further declines may occur as cases in the United States continue to balloon, but if the VIX continues to drop, record-setting declines should become less likely. In the meantime, follow @PeterHanksFX on Twitter for updates and insights.

DAX 30 Forecast

Outlook: Neutral

Much of the same can be said for the DAX 30. With the ECB following in the footsteps of the BOJ and Fed and the subsequent reaction of the indices last week, it would appear sentiment has improved somewhat, and investors may look to wade back into the market should risk trends improve further.

DAX 30 Weekly Price Chart (2009 - 2020)

How to Trade Dax 30: Trading Strategies and Tips

That being said, forthcoming commentary from ECB’s Governor, Christine Lagarde, may be crucial in continuing the positive trend. She is slated to speak on Tuesday and will likely offer further insight on the central bank’s response to the crisis.

Apart from commentary, forecasting the impact on upcoming data is near impossible as many of the readings are pre-outbreak so they do not encapsulate the debilitating effects of the coronavirus. Further still, many central banks and governments have become increasingly proactive in their policy decisions – opting to make announcements outside of the scheduled meetings. As a result, the outlook for the week ahead is neutral.

ASX 200 Forecast

Outlook: Neutral

While the United States and Europe remain in the earlier stages of the coronavirus outbreak, Australia was one of the first economies impacted. Therefore, with neighboring China on the road to recovery and relatively few domestic cases, the ASX 200 may become a useful barometer in measuring the post-crisis performance of a major equity market.

ASX 200 Price Chart: Weekly Time Frame (2009 – 2020)

Created in TradingView

To that end, tracking the recovery of the Australian economy via economic data in the weeks ahead may prove useful. Unfortunately, data is lagging so insight will likely be confined to anecdotal evidence for the time being. Still, if equity markets begin to diverge with the ASX at the helm, interesting trading opportunities should follow suit.

--Written by Peter Hanks, Junior Analyst for DailyFX.com