Dow Jones, DAX 30, FTSE 100 Outlooks:

- The Dow Jones enjoyed a substantial recovery last week as China reduced tariffs in an attempt to boost US imports

- The DAX 30 climbed despite abysmal German manufacturing figures

- The FTSE 100 followed other global equity markets last week as it awaits UK GDP data in the week ahead

Dow Jones Forecast

Outlook: Neutral

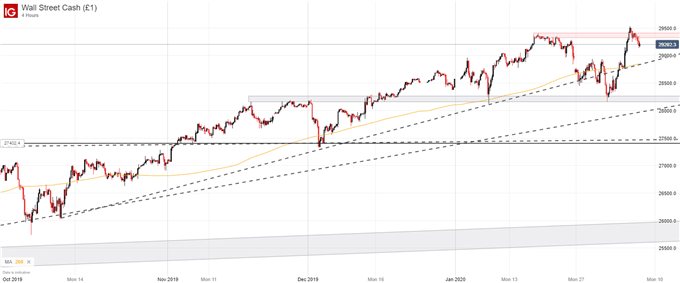

The Dow Jones enjoyed a considerable bounce last week after coronavirus fears worked to erode risk appetite in the week prior. Alongside ebbing concerns, China announced it would reduce tariffs on US goods in an attempt to boost US imports and conform to the specifications outlined in the phase one trade agreement.

Dow Jones, Nasdaq 100, S&P 500 Technical Forecasts

Consequently, US equities climbed to new heights on Thursday before surrendering some gains on Friday despite a strong non-farm payrolls report. Still, the stage has been set for the Dow Jones, Nasdaq and S&P 500 to drive higher in the week ahead should risk trends allow.

Dow Jones Price Chart: 4 - Hour Time Frame (October 2019 – February 2020)

Day Trading the Dow Jones: Strategies, Tips & Trading Signals

While coronavirus fears have taken a back seat for the time being, companies have continued to warn the viral outbreak will weigh on first quarter growth. Furthermore, tepid economic activity will likely offset the impact of lower tariffs which could spark trouble in the future as the US looks to hold China to its import totals. Either way, it seems as though the coronavirus could work to erode equity valuations down the line.

A potential opportunity for insight on the epidemic’s impact will occur on Tuesday when Alibaba delivers its quarterly earnings results and outlook. As China’s largest e-commerce provider, Alibaba should have considerable insight into the economic impact of the coronavirus which could see BABA earnings have a macroeconomic influence. Until then, the Dow Jones may track larger risk trends with an underwhelming economic calendar. In the meantime, follow @PeterHanksFX for updates and insights

DAX 30 Forecast

Outlook: Neutral

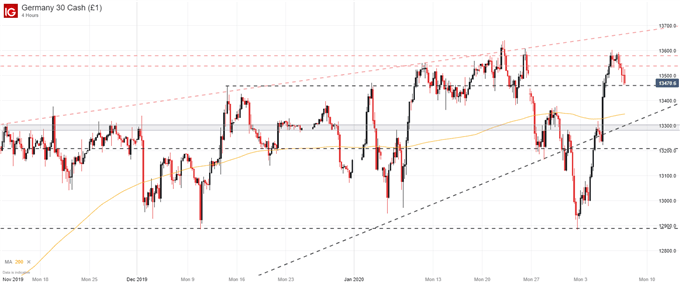

The DAX 30 was dealt a damaging blow on Thursday when German manufacturing data revealed another month of contraction. Interestingly, the DAX pressed to technical resistance regardless, suggesting investors are expecting a dovish response from the ECB to revive growth – a prospect that can be further evidenced by EUR/USD weakness. With that in mind, the market will now look for dovish confirmation from the central bank before it can continue higher in earnest.

DAX 30 Price Chart: 4 - Hour Time Frame (November 2019 – February 2020)

How to Trade Dax 30: Trading Strategies and Tips

FTSE 100 Forecast

Outlook: Neutral

Venturing across the channel, the FTSE 100 will look to upcoming GDP data in the week ahead. Sharing a similar performance with the DAX, the FTSE may require a fundamental spark to break through some of the price barriers it has encountered in recent months. Until such a catalyst arrives, the equity index will likely track other major equity markets.

FTSE 100 Price Chart: 4 – Hour Time Frame (October 2019 – February 2020)

Evidently, the week ahead lacks significant scheduled event risk for most major markets which may allow fluid themes like coronavirus, economic growth expectations and monetary policy to take center stage and influence equity performance. Further still, volatility remains in the backdrop and could threaten to unravel last week’s recovery if risk aversion picks up again.

--Written by Peter Hanks, Junior Analyst for DailyFX.com

Read more: 3 Things to Know When Trading Earnings Announcements