Crude Oil Fundamental Forecast Q4 Intro

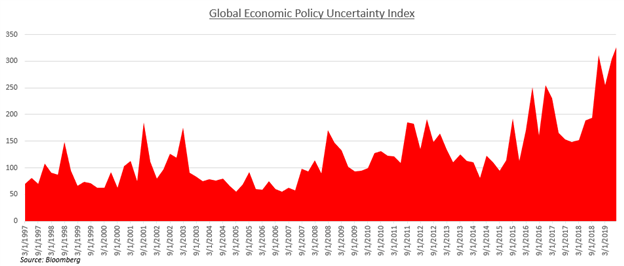

Crude oil prices continue to face pressure from formidable headwinds ranging from the US-China trade war to strained geopolitical tensions across the world. Inter-emerging market trade conflicts are also threatening to disrupt critical nodes in the commodity and technology supply chain networks and further undermine global growth prospects.

As a result of the greater uncertainty permeating market sentiment, producers have scaled back expanding their enterprises from the concern that supply will outweigh demand. As it so happens, crude oil prices face a similar threat. Waning demand and slower cross-border investment has pressured crude oil prices, a notoriously fickle commodity.

OPEC supply cuts have so far shown to be an inadequate upside force for crude oil prices as output continues to be reduced but the commodity still descends. Having said that, increased political tension in Iran and the now the broader Middle East have helped buoy crude oil prices. The most notable politically-induced supply disruption fear was the recent Saudi Arabia Aramco attack.

Looking ahead, traders may have to assess the fundamental outlook and determine whether geopolitical oscillations will be enough to stave off the decline in crude oil prices, or whether the commodity is doomed to follow the overall trajectory of global growth. To learn more, see the report.