Fundamental Forecast for NZD: Neutral

- The Reserve Bank of New Zealand will keep its official cash rate at 1.75% Thursday and maintain its neutral bias.

- The New Zealand Dollar needs a new catalyst after its recent rally ran out of steam.

- Check out the DailyFX Economic Calendar and see what live coverage of key event risk impacting FX markets is scheduled for the week on the DailyFX Webinar Calendar.

The New Zealand Dollar is in a rut and is unlikely to break out either upwards or downwards as the central bank’s official cash rate looks set to remain at 1.75% for months and perhaps years to come. The Reserve Bank of New Zealand meets on Thursday morning local time and a rate move would be a huge surprise.

Instead, RBNZ Governor Graeme Wheeler will likely emphasise not just that rates will not be changed for a long time yet but also that the bank’s bias is strictly neutral, with an equal chance of the next move being an increase or a decrease. That could be as far away as late next year.

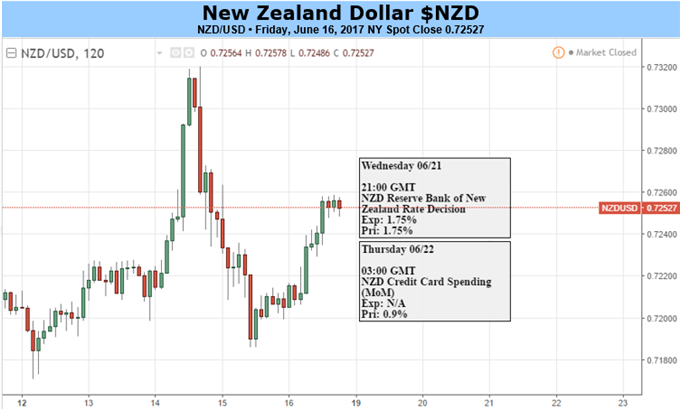

Chart: NZD/USD Daily Timeframe (2017 to Date)

As the chart above shows, NZDUSD has been climbing since mid-May. However, that rally has run out of steam and for the past few sessions the pair has traded sideways. That’s despite news last week of lower-than-expected GDP growth of 0.5% quarter/quarter in Q1.

The data imply that GDP growth this year could be nearer 3.0% than 3.5%. However, core inflation in New Zealand remains subdued and headline inflation is only just above the midpoint of the RBNZ’s 1%-3% target range.

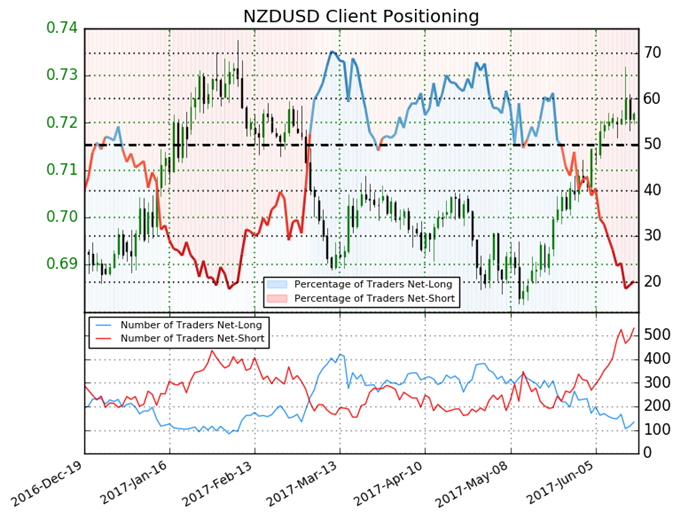

This all suggests a neutral bias for NZD, although IG Client Sentiment data suggest that NZDUSD could resume its uptrend once the current consolidation period ends.

Retail trader data show 20.2% of traders are net-long with the ratio of traders short to long at 3.96 to 1. In fact, traders have remained net-short since May 24, when NZDUSD traded near 0.69967; the price has moved 3.5% higher since then. The number of traders net-long was 1.5% higher on Friday than on Thursday and 14.1% lower from last week, while the number of traders net-short was 15.4% higher than Thursday and 34.1% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests NZDUSD prices may continue to rise. Traders were further net-short than Thursday and last week, and the combination of current sentiment and recent changes gives us a stronger NZDUSD-bullish contrarian trading bias.

--- Written by Martin Essex, Analyst and Editor

To contact Martin, email him at martin.essex@ig.com

Follow Martin on Twitter @MartinSEssex

What will drive the currency majors in 2017’s second half? Check out the free DailyFX Quarterly Forecasts