Japanese Yen Fundamental Forecast: Bearish

- The Japanese Yen is close to the weakest levels traded since 1998

- Bank of Japan policy decision due out, will Kuroda take action?

- Fiscal spending plans likely to complicate any BOJ tightening

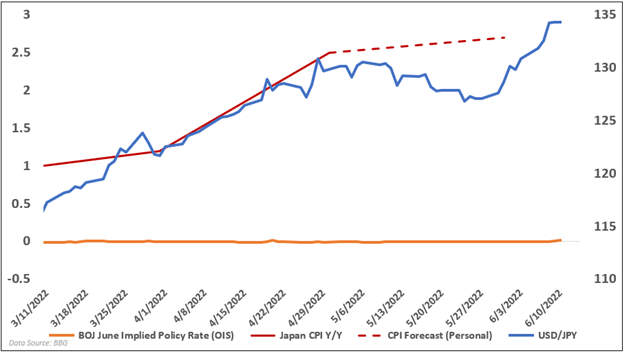

The Japanese Yen fell to its weakest level since February 2002 versus the US Dollar and came within 1% of falling to levels not traded at since 1998. The Yen’s rapid decline started back in March when the Federal Reserve got serious in its fight against inflation. Since then, Mr. Powell has coordinated a series of aggressive rate hikes to tame sky-high inflation. That has stiffened the US Dollar’s fundamental position.

Japan’s monetary policy remains ultra-loose. However, signs are arising, both economically and through the banks messaging, that a period of tightening may be on the horizon. Governor Haruhiko Kuroda walked back his previous comments, stating that consumers have become tolerant of higher prices. The weak Yen has also exacerbated already high-costing energy imports.

Still, the BOJ finds itself far behind the curve of normalization compared to its major peers, and analysts expect the bank to hold steady at its policy meeting on Friday. No change is expected to the bank’s yield curve control program. Despite inflation rising above the 2% target, overnight index swaps (OIS) show almost no chance for a rate change through the next several meetings.

Meanwhile, fiscal spending is expected to increase per the country’s latest annual fiscal policy plan. Prime Minister Fumio Kishida would likely prefer the BOJ to remain in its dovish stance as it reduces borrowing costs to the government. There is also more appetite for defense spending in the coming years, a byproduct of Russia’s invasion of Ukraine. This spending will make it harder for the BOJ to tighten policy when the time comes, if ever. That said, altogether, the Yen may continue to slide.

Trade Smarter - Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

--- Written by Thomas Westwater, Analyst for DailyFX.com

To contact Thomas, use the comments section below or @FxWestwater on Twitter