Fundamental Forecast for JPY: Neutral

Japanese Yen Talking Points:

- USD/JPY Rate Analysis: Why the Adjusted Yield Curve Control Matters.

- USD/JPY Initiates Bearish Sequence Amid Failed Run at August High.

- Are you looking for longer-term analysis of the Japanese Yen? Check out our Quarterly Forecasts as part of the DailyFX Trading Guides.

Do you want to see how retail traders are currently trading the Japanese Yen? Check out our IG Client Sentiment Indicator.

Yen Strength Shows as Tariff Talk Moves Towards Japan

The Yen caught a bid in the latter-portion of this week, helping USD/JPY to reverse the entirety of the gains that had posted in the pair from Monday thru Wednesday. This continues the messy price action that’s been showing in USD/JPY since the July breakout faltered. As we came into Q3, all systems appeared set to ‘go’ for bullish continuation, and the pair caught a bid through the first two-and-a-half weeks of Q3. But after resistance showed around the 113.00 area, prices pulled back and haven’t really been able to recover since.

USD/JPY Eight-Hour Price Chart: Diminishing Bullish Case After Earlier-Q3 Breakout Failure

Chart prepared by James Stanley

Yen Drivers

The big item of concern around the Yen from this week is something that cannot be found on the economic calendar, and this is also something that can keep the currency on the move for the foreseeable future. On Thursday, indications began to show that President Trump is beginning to set his sights on Japan for tariff discussions. And while that report was initially somewhat walked back considering that it was published in an op-ed, follow-thru indications appear as though this may be something to contend with in the near-term.

Japan is vulnerable here. The ‘three arrows’ approach towards Abe-nomics hasn’t yet been able to reverse the decades of lagging inflation and slowing growth. Shinzo Abe came to power on the back of this strategy almost six years ago; and last month Japanese inflation came in at .9%. So despite trillions of US Dollars of QE spent towards Asset Purchase Programs over the past half-decade, Japan is still struggling to meet the BoJ’s 2% inflation target.

Up until now, the general belief was the tight trading relationship between the US and Japan may leave the island nation unscathed around the topic of US tariffs; but that appears to be changing in front of our very eyes and, as such, this is something that should not be discounted.

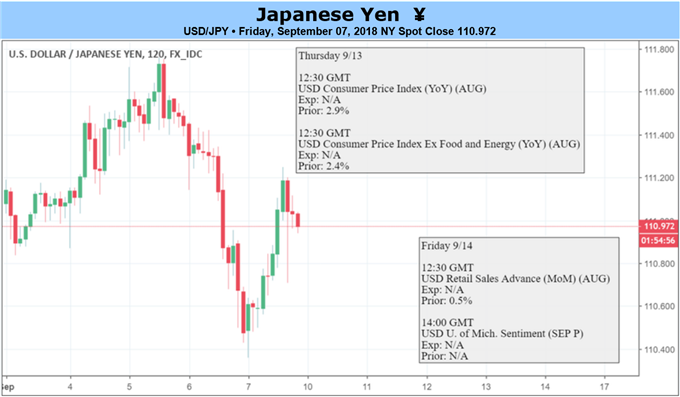

Economic Calendar

This week’s economic calendar out of Japan was relatively light. The one high-impact event that we had was a speech from BoJ Governor Kuroda, and he didn’t really touch the topic of monetary policy. He did have a speech last week, however, in which he said that the Bank of Japan is unlikely to raise interest rates for ‘quite some time.’ He also noted that the recent changes made to the bank’s QE program were designed to afford more flexibility – not to prepare for policy normalization. That was a big statement considering the confusion that showed after the August BoJ rate decision. On the heels of those comments from last week, USD/JPY held support around 110.86 before pushing higher in the early portion of this week, only to watch those gains get wiped away with the Thursday surprise around potential tariffs.

USD/JPY Hourly Price Chart: Support Build (blue) Leads to Early-Week Gain (Green), Quickly Erased on Thursday Drive

Chart prepared by James Stanley

Japanese Yen Moving-Forward

Next week’s economic calendar is also light, but this time we have zero high-impact announcements on the docket. There are a number of high-impact macro events elsewhere, however, and recent themes around risk aversion will likely remain of concern. The big item of importance appears to be external in nature around the development of this theme of tariffs.

Two significant forces appear to be at odds in our current backdrop: On one side we have the Bank of Japan which is continuing to try to push weakness into the Yen by avoiding tighter policy (and openly telegraphing doing so as taken from Mr. Kuroda’s comments last week), while also keeping QE at ‘pedal to the floor’ levels. On the other side, we have exogenous forces that can bring about Yen strength, and this is largely looking at themes around global risk aversion that have begun to grow in prominence this summer. And now with a potential entry of a new driver from potential tariffs, there’s even less reason to be enthusiastic about the return of BoJ-driven Yen-weakness.

But – as of yet, we do not have alignment with near-term price action, which remains messy and congested in USD/JPY. As such, we will hold the forecast at neutral until market prices reflect this potential alteration in the backdrop of JPY and bigger-picture, the Japanese Economy.

To read more:

Are you looking for longer-term analysis on the U.S. Dollar? Our DailyFX Forecasts for Q1 have a section for each major currency, and we also offer a plethora of resources on USD-pairs such as EUR/USD, GBP/USD, USD/JPY, AUD/USD. Traders can also stay up with near-term positioning via our IG Client Sentiment Indicator.

Forex Trading Resources

DailyFX offers a plethora of tools, indicators and resources to help traders. For those looking for trading ideas, our IG Client Sentiment shows the positioning of retail traders with actual live trades and positions. Our trading guides bring our DailyFX Quarterly Forecasts and our Top Trading Opportunities; and our real-time news feed has intra-day interactions from the DailyFX team. And if you’re looking for real-time analysis, our DailyFX Webinars offer numerous sessions each week in which you can see how and why we’re looking at what we’re looking at.

If you’re looking for educational information, our New to FX guide is there to help new(er) traders while our Traits of Successful Traders research is built to help sharpen the skill set by focusing on risk and trade management.

--- Written by James Stanley, Strategist for DailyFX.com

Contact and follow James on Twitter: @JStanleyFX

Other Fundamental Forecast:

New Zealand Dollar Forecast - NZD/USD Prices May Fall on Swedish Election and as ECB Sinks Euro