Fundamental Forecast for JPY: Bullish

- EUR/JPY Technical Analysis: Down-Trend Back with Vengeance

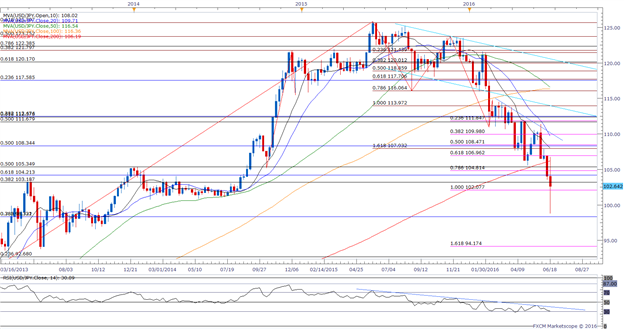

- USD/JPY Technical Analysis: The Proverbial Falling Knife

- Avoid the pitfalls of trading by steering clear of classic mistakes. Review these principles in the "Traits of Successful Traders" series.

For more updates, sign up for David's e-mail distribution list.

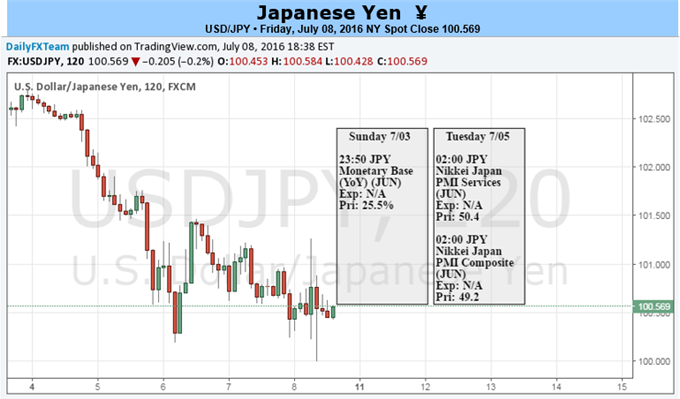

Key developments coming out of the U.S. economy may largely influence the USD/JPY exchange rate over the week ahead as the economic docket remains fairly light for Japan.

Despite the stronger-than-expected Non-Farm Payrolls (NFP) report, a slowdown in U.S. Retail Sales accompanied by another 2.2% print for the core Consumer Price Index (CPI) may encourage the Federal Open Market Committee (FOMC) to endorse a wait-and-see approach at the next interest-rate decision on July 27 as the central bank argues market-based measures of inflation compensation remain weak, while ‘most survey-based measures of longer-term inflation expectations are little changed.’ As a result, fresh comments from Kansas City Fed President Esther George, Cleveland Fed President Loretta Mester, Fed Governor Daniel Tarullo, St. Louis Fed President James Bullard, Minneapolis Fed President Neel Kashkari, Dallas Fed President Robert Kaplan, Philadelphia Fed President Patrick Harker and Atlanta Fed President Dennis Lockhart may fail to prop up interest-rate expectations as central bank officials remain in no rush to further normalize monetary policy, and the dollar stands at risk of facing near-term headwinds as Fed Funds Futures show narrowing speculation for a 2016 rate-hike.

At the same time, the Bank of Japan (BoJ) may also stick to the sidelines and retain its current stance at the next rate decision on July 29 as the central bank continues to assess the impact of the negative-interest rate policy (NIRP). Even though the BoJ largely preserves a dovish outlook for monetary policy, Governor Haruhiko Kuroda and Co. may attempt to buy more time especially as Prime Minister Shinzo Abe delays the sales-tax hike and pledges to take ‘bold’ steps to foster a stronger recovery.

In turn, USD/JPY stands at risk for a further decline as market participants push out bets for the next Fed rate-hike, and the weakening outlook for global growth may generate increased interest in the Yen as Japan returns to its historical role as a net-lender to the world economy.