GBP/USD FUNDAMENTAL HIGHLIGHTS:

China Risks, Fed & BoE Decisions

Aside from the rising uncertainty in China over Evergrande default risks, two central bank decisions will dominate the market theme next week. The Federal Reserve will provide their latest policy update regarding tapering of asset purchases, while attention will also centre around the dot plot projections, which could lean to the hawkish side. The other central bank in focus will be the Bank of England who will have two new members on the committee.

Since the prior BoE meeting, the most interesting comment had been made by Governor Bailey, who stated that members in August were split 4-4 as to whether the minimum necessary criteria for raising rates had been reached. Following this comment, headline inflation has risen to 3.2%, hitting the highest level since 2012, while the all important jobs market has gone from strength to strength with all regions besides London, Scotland and the South East now above pre-pandemic levels. Of course, the BoE have been cautious, given that the furlough scheme will expire at the end of the month, however, with a record amount of vacancies, having hit over 1mln, the impact of the furlough scheme’s expiration is likely to be muted. Therefore, the BoE have reasons to be optimistic about the economic recovery and while I believe risks are tilted for a hawkish outcome for the BoE meeting, there is a concern that markets may be overly optimistic amid the recent increase in rate hike calls by analysts as well as tightening priced in by money markets, in which a rate rise to 0.25% is seen by May 22.

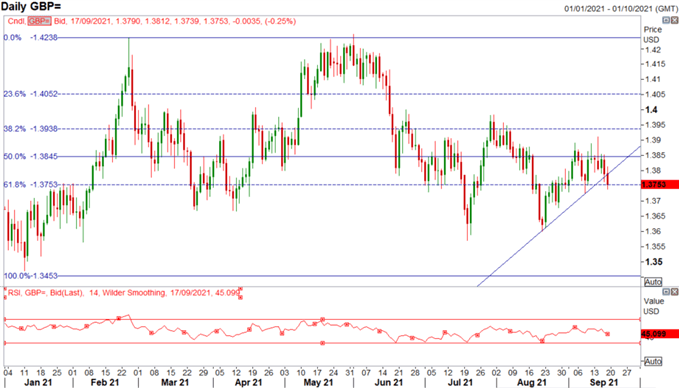

GBP/USD: Markets have been in sell the rally mode for Cable the past week as the pair struggled to make a firm breach through 1.3880-1.3900. That being said, with GBP/USD back down to 1.3750 the pair is back at near term support in the form of the 61.8% Fib of this year’s range.

EUR/GBP: My favoured cross for trading the BoE would either be EUR/GBP or GBP/CHF given that GBP/USD could quite easily be caught up with the Fed. On the broader time frame, EUR/GBP still remains in a range and there are little signs of that changing. That said, key support resides at 0.8515-20 and 0.8500, therefore a close below the latter following a hawkish BoE could see a return to 0.8400.

GBP/USD Chart: Daily Time Frame

Source: Refinitiv

“The Need to Know Complete Guide on Trading the Pound (GBP)”

| Change in | Longs | Shorts | OI |

| Daily | -2% | -2% | -2% |

| Weekly | 5% | 3% | 4% |