Sterling (GBP) Talking Points:

- BoE cuts growth forecasts but Sterling re-traces the sell-off.

- Incendiary comments aside, Brexit remains no closer to resolution.

The DailyFX Q1 GBP Forecast s are available to download including our short- and medium-term look at Sterling.

Fundamental Forecast for GBP: Neutral

A tough week for trying to value Sterling looking forward with a mildly dovish Bank of England Report having only a short-term negative effect on GBP, while the Irish backstop problem becomes seemingly even more entrenched. We do not like changing forecasts on a regular basis but after being Sterling positive for only a couple of weeks, we now downgrade to neutral until the Brexit fog clears.

Brexit and the British Pound: Why the EU Might Spurn a Last-Minute Deal with the UK.

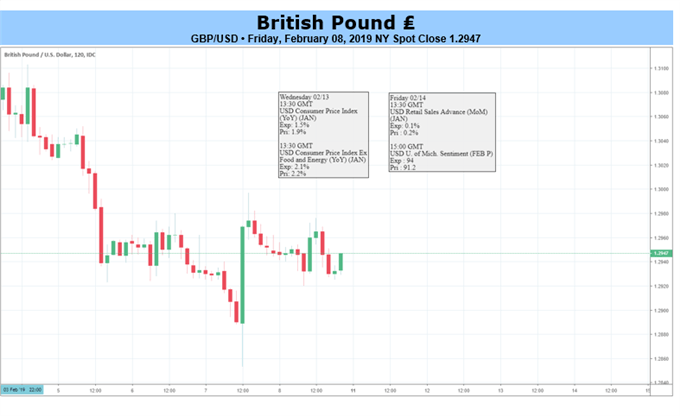

The Bank of England ‘Super Thursday’ saw the central bank downgrade growth expectations for 2019 again, this time to 1.2% from 1.7% and trimming interest rate expectations to just one 0.25% hike by the end of 2020.The BoE based their lower growth forecast on weaker overseas economic activity and ‘the greater effects from Brexit uncertainties at home’. These comments sent GBPUSD spinning around one cent lower, but this fall was quickly erased when comments came out from Brussels that further Brexit discussions will take place between PM May and European Commission President Juncker before the end of February. Later, comments from Donald Tusk saying that there will be a ‘special place in hell’ for politicians who pushed for Brexit without a delivery plan, were brushed off , despite gathering reams of headlines. GBPUSD was also under pressure all week from a resurgent US dollar which touched a fresh five-week high. EURGBP, perhaps a better Brexit barometer, is ending the week fractionally lower.

Looking for a technical perspective on the GBP? Check out the Weekly GBP Technical Forecast.

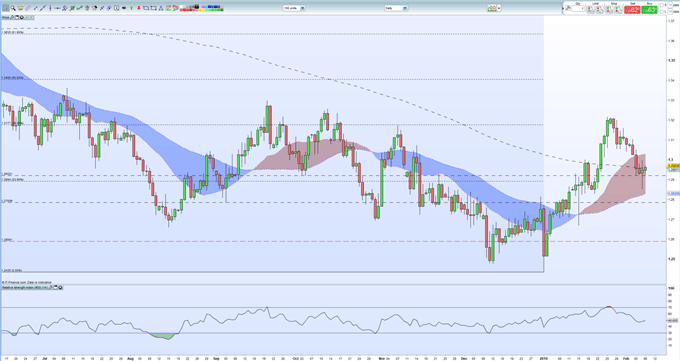

GBPUSD Daily Price Chart (June 2018 – February 8, 2019)

Looking ahead there is a raft of heavyweight economic releases next week, including the latest GDP readings on Monday, consumer and producer inflation data on Wednesday and increasingly important UK retail sales numbers at the end of the week.

IG Client Sentiment data show 58.8% of traders are net-long GBPUSD. We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggest that GBPUSD prices may continue to fall. However, the combination of recent daily and weekly positional changes gives us a mixed trading bias.

Traders may be interested in two of our trading guides, especially in times of volatility – Traits of Successful Traders and Top Trading Lessons – while technical analysts are likely to be interested in our latest Elliott Wave Guide.

--- Written by Nick Cawley, Analyst

To contact Nick, email him at nicholas.cawley@ig.com

Follow Nick on Twitter @nickcawley1

Other Weekly Fundamental Forecast:

Australian Dollar Forecast – Australian Dollar Could Take Some Rest On The Road Lower

New Zealand Dollar Forecast – NZD/USD Looks Vulnerable. How Dovish Will the RBNZ Turn Next Week?

Oil Forecast – Fears of Slowing Global Growth to Limit Further Gains