Fundamental Euro Forecast: Bearish

- EUR/USD continues to trade in a narrow range but as fears grow of a second wave of coronavirus infections a break to the downside is looking more and more likely.

- For now, those fears are outweighing hopes of an easing of coronavirus restrictions that could allow normal economic activity to resume.

- That in turn means funds will likely flow into haven assets such as the US Dollar at the expense of riskier assets like the Euro, the Australian Dollar, the British Pound and stocks.

EUR/USD downturn possible

EUR/USD continues to trade sideways but a breakout is looking increasingly possible as traders weigh up fears of a second wave of coronavirus infections against an easing of restrictions in many countries that could allow a return of normal economic activity.

For a while now, an increase in Covid-19 concerns has prompted a flow of money into safe havens like the US Dollar from currencies seen as inherently riskier, such as the Euro. Any ramping up of pessimism about an economic revival would therefore likely see EUR/USD break to the downside.

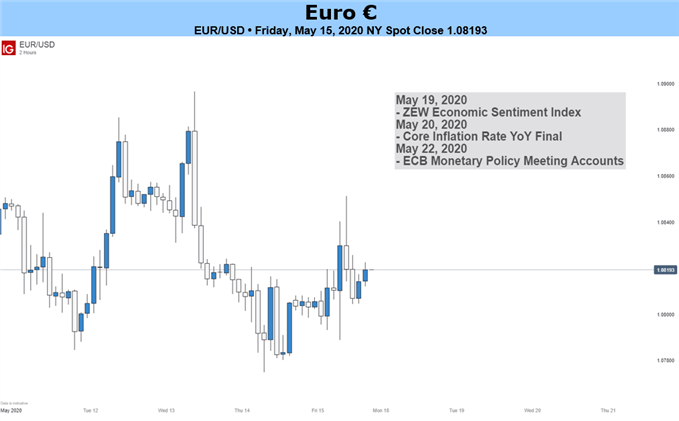

EURUSD Price Chart, Four-Hour Timeframe (March 4 – May 16, 2020)

Chart by IG (You can click on it for a larger image)

The weakness of the Eurozone economy was highlighted Friday by news that the German economy is now in recession, contracting by 2.2% quarter/quarter in the second quarter of the year after a 0.1% decline in the first. Note though that the German figures were better than those for the Eurozone as a whole, which contracted by 3.8% – implying very steep downturns in countries like France, Italy and Spain.

As for the third quarter, that is likely to be even worse given that lockdowns continued in to April and early May.

Moreover, post-Brexit trade talks between the UK and the EU continue to make little progress. That will likely hit the British Pound harder than the Euro but is still another negative factor for EUR/USD.

Want to know why GDP data are deemed highly significant in the FX market? Check out our guide here.

Week ahead:

Turning to the economic data in the week ahead, Tuesday brings the ZEW indicator of German economic sentiment in May and another poor figure is expected. Similarly, purchasing managers’ indexes for France, Germany and the Eurozone in May, due Friday, are expected to continue to show the weakness that was evident in April.

--- Written by Martin Essex, Analyst and Editor

Feel free to contact me via the comments section below

.jpg)