Euro Price (EUR) Fundamental Forecast: Neutral

- Back end of next week may provide fresh signals.

- US President Trump likely to delay decision on EU auto tariffs.

Brand New Q4 Euro Forecast and Top Trading Opportunity

Traders Likely to Eye Any Euro Rally as a Fresh Selling Opportunity

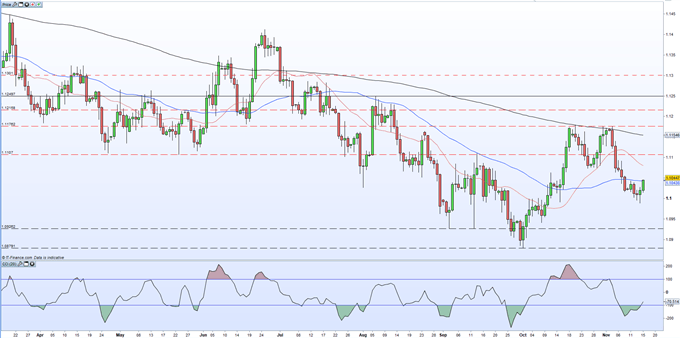

The single currency remains under pressure with limited upside moves unable to follow through as buyers keep their hands in their pockets. The daily chart shows a pattern of sell-off, mild pull-back followed by another sell-off and until there is a fiscal boost plan agreed by member states, then inflation and growth – and the Euro - will remain lowly.

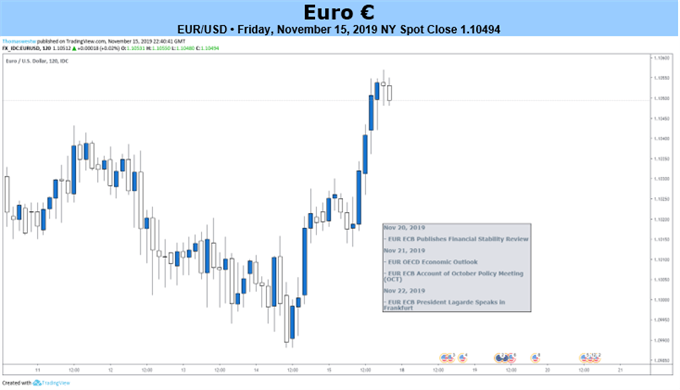

Next week there are little market moving economic releases and events until Thursday when there is a notable double. The latest OECD Economic Outlook is released at 10:00 GMT and is likely to highlight weaker growth and further uncertainty in the Euro-Zone. The September OECD interim report reduced Euro area growth expectations down to 1.1% in 2020 and 1.0% in 2021, with global downside risks continuing to mount. Later Thursday the latest minutes of the ECB MPC meeting will be released, and again these will highlight ongoing weakness. On early Friday, a raft of preliminary Euro area PMIs will be released, just minutes after new ECB President Christine Lagarde has spoken in Frankfurt. Friday morning has the potential for increased volatility.

For a full rundown of all market moving economic data and events see the DailyFX Calendar

The deadline for the United States to impose EU auto tariffs passed on November 14 and is set to be delayed further, according to various news sources. However, at a speech earlier this week, US President Trump said that the EU imposed terrible trade barriers that in many ways were ‘worse than China’, keeping tensions high between the two sides. Further trade disruption and/or additional tariffs will weigh heavy on the single-bloc’s currency.

The recent German provisional Q3 GDP figures showed that the Euro-Zone’s largest member just missed entering a technical recession with a meagre 0.1% growth recorded between July and September. The Q2 GDP figure of -0.1% was downgraded however to -0.2%, leaving growth in the last two quarters in Germany at -0.1%.

EURUSD is currently trading either side of the 50-day moving average and for prices to push back to the 1.1100 area, a break and close above the dma will be required. See this weekend’s Euro Technical Analysis report for more in-depth chart analysis of EUR/USD.

EUR/GBP Outlook – Price Action Continues to Break Down

EUR/USD Daily Price Chart (March – November 15, 2019)

IG Client Sentiment shows that how traders are positioned in a wide range of assets and markets.

Traders may be interested in two of our trading guides – Traits of Successful Traders and Top Trading Lessons – while technical analysts are likely to be interested in our latest Elliott Wave Guide.

What is your view on the Euro – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author at nicholas.cawley@ig.com or via Twitter @nickcawley1.