Fundamental Forecast for the Euro: Bullish

- The Euro has benefited as concerns around a no deal, “hard Brexit” and the US-China trade war have swirled, providing plenty of fuel for gains by EURGBP and EURUSD, respectively.

- Overnight index swaps are currently pricing in a 100% chance of a 10-bps rate cut at the September ECB meeting, while there is an 82% chance of 20-bps of rate cuts by the end of 2019.

- The IG Client Sentiment Index suggests that the current EURUSD price trend may soon reverse higher despite the fact traders remain net-long.

See our long-term forecasts for the Euro and other major currencies with the DailyFX Trading Guides.

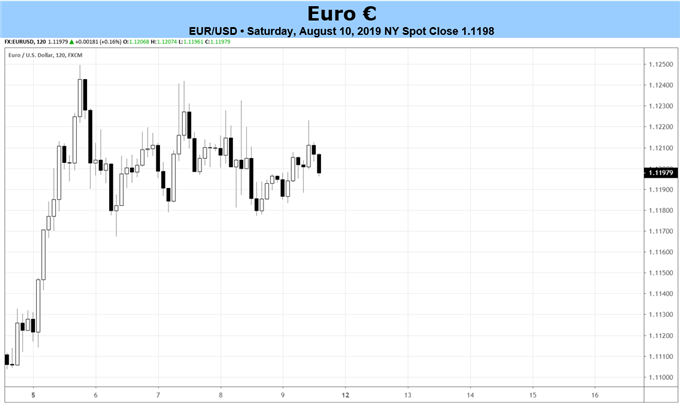

Euro Rates Week in Review

The Euro finished the week broadly higher, gaining ground against all but two currencies as the Euro’s lack of recent drama has made it a sort of ‘safe haven du jour.’ And the fact of the matter is, the Euro’s appeal may simply boil down to the current market environment being a situation analogous to the notion that it is one of the ‘cleaner shirts in the dirty laundry.’

Indeed, the Euro has benefited as concerns around a no deal, “hard Brexit” and the US-China trade war have swirled, providing plenty of fuel for gains by EURGBP and EURUSD, which added 1.87% and 0.82% over the past week, respectively. The Euro gained against all but two majors, EURCHF and EURJPY, which fell by -0.17% and -0.02%, respectively, as the low yielding currencies attracted capital flows amid further drop in global sovereign bond yields thanks to a wave of easing coming from all corners of the globe.

Q2’19 Eurozone GDP Report Due on Wednesday

According to a Bloomberg News survey, the first revision to the Q2’19 Eurozone GDP report is due but no change is expected. The quarterly rate is due in on hold at 0.2% while the yearly rate is set to hold at 1.1%. Consistently weak growth figures should serve to reinforce the European Central Bank’s Governing Council’s view that risks have moved “to the downside,” and to this end, that more easing will arrive in September when the ECB releases the next iteration of its Staff Economic Projections.

Read more: FX Week Ahead - Top 5 Events: Q2’19 Eurozone GDP & EUR/JPY Rate Forecast

Eurozone Economic Data Otherwise Disappointing

The past several weeks have produced disappointment on the Eurozone economic data front, at least when trying to take a look at economic data from an objective point of view. The Citi Economic Surprise Index for the Eurozone, a gauge of economic data momentum, dropped to -54.1 by the end of last week; one month ago, it was at -7.7. The disappointing streak of Eurozone data has come alongside rising growth concerns elsewhere, which have underpinned the decline in energy prices around the world.

Eurozone Inflation Expectations versus Brent Oil Prices: Daily Timeframe (August 2018 to August 2019) (Chart 1)

Outgoing ECB President Mario Draghi’s preferred measure of inflation, the 5y5y inflation swap forwards, closed last week at 1.260%, slightly lower than where they were one month earlier at 1.289%, but still significantly above the yearly low set on June 17 at 1.141%.

September ECB Meeting Should Start Rate Cut Cycle

According to separate Bloomberg News and Reuters surveys of economists, the ECB will not move on any of its key interest rates this week – the main rate, the marginal lending facility, or the deposit facility rate. Yet a look at market pricing as derived from Eurozone overnight index swaps suggests otherwise:

European Central Bank Interest Rate Expectations (August 9, 2019) (Table 1)

Overnight index swaps are currently pricing in a 100% chance of a 10-bps rate cut at the September ECB meeting. There is a 68% chance of a second 10-bps rate cut coming in October, while there is an 82% chance of the second 10-bps of rate cut at the December ECB meeting. Rates markets are pricing a third rate cut over the next 12-months coming in March 2020. It’s important to note that marketing pricing generally dictates that the ECB will only act on rates at meetings when it has a new SEP.

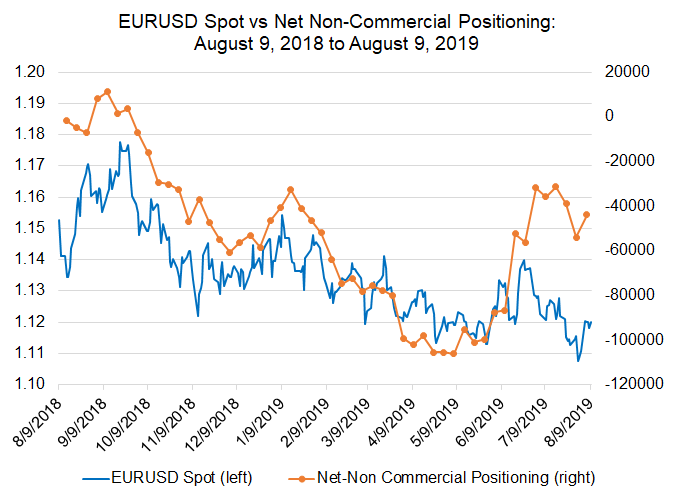

EURUSD versus COT Net Non-Commercial Positioning: Daily Timeframe (August 2018 to August 2019) (Chart 2)

Finally, looking at positioning, according to the CFTC’s COT report for the week ended August 6, speculators decreased their net-short Euro positions from 54K to 44K contracts. Prior to Q3’19, net-short Euro positioning was in a similar state back in December 2018, January 2019, and February 2019; EURUSD was trading closer to 1.1400 during those times. A short covering rally by EURUSD could quickly see prices readjust to the topside.

FX TRADING RESOURCES

Whether you are a new or experienced trader, DailyFX has multiple resources available to help you: an indicator for monitoring trader sentiment; quarterly trading forecasts; analytical and educational webinars held daily; trading guides to help you improve trading performance, and even one for those who are new to FX trading.

--- Written by Christopher Vecchio, CFA, Senior Currency Strategist

To contact Christopher, email him at cvecchio@dailyfx.com

Follow him in the DailyFX Real Time News feed and Twitter at @CVecchioFX