Gold Fundamental Forecast - Bearish

- Gold prices saw worst weekly performance since June 2021, falling 3.5%

- Absent escalating Ukraine risks, a rising rate environment may hurt XAU

- Fed Chair Jerome Powell and company to be speaking in the week ahead

Gold prices weakened about 3.5% in the worst weekly performance since June 2021 despite a surge in the yellow metal that initially occurred amidst the outbreak of Russia’s attack on Ukraine. Ongoing price action in XAU/USD continues to underscore the challenging road ahead for it to be able to gain meaningful upside price action, absent further escalation around Ukraine.

With such high inflation permeating across the world, recently increased by geopolitical tensions in Europe, central banks have been stepping up. This past week, the Federal Reserve began its rate hike cycle as the Bank of England continued its own. Gold prices are typically viewed as an anti-fiat instrument, given that the yellow metal has no inherent yield for traders holding on to it.

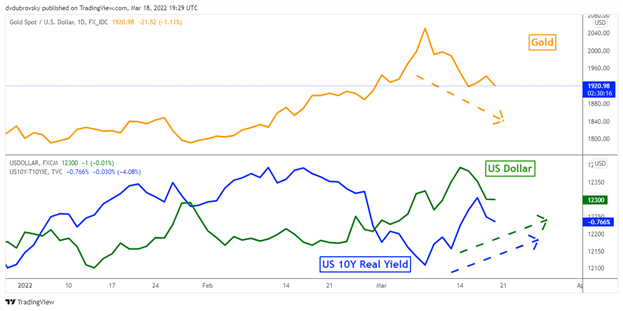

In a rising interest rate environment, especially globally, that makes holding XAU/USD relatively less appealing. On the chart below, gold can be seen aiming lower in recent days as the US Dollar and 10-year real yields climbed. The latter is generated by subtracting the difference between nominal and breakeven rates, yielding the inflation-adjusted return.

The week ahead is relatively light in terms of economic event risk, placing the focus for gold on broader fundamental themes. This is primarily a combination of where Ukraine and bond yields are heading. A slew of Fedspeak will cross the wires, ranging from Chair Jerome Powell, to San Francisco branch president Mary Daly, to St. Louis branch president James Bullard.

Markets will be closely gauging their thoughts on inflation and Ukraine. Towards the end of last week, bets of a 50-basis point rate hike at the May meeting increased to about 50%. Meanwhile, China’s President Xi Jinping spoke with his US counterpart, Joe Biden, saying that the invasion “is not something we want to see”. Absent rising Ukraine tensions, gold may struggle to find upside momentum ahead.

Check out the DailyFX Economic Calendar to see when Fed policymakers will be speaking this coming week!

Trade Smarter - Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Gold Versus US 10-Year Real Yield and US Dollar – Daily Chart

--- Written by Daniel Dubrovsky, Strategist for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter