Gold Prices Fundamental Forecast: Mixed

- The potential adjustment of the Federal Reserve’s bond-purchasing program may underpin gold prices.

- Declining real yields and rising inflation expectations also suggest a rebound higher could be in the offing.

- Non-farm payrolls and a flurry of PMI releases may dictate the near-term outlook for bullion.

Dovish FOMC to Underpin Gold Prices

Gold prices have taken a beating in recent weeks, falling over 8% from the monthly high, after a slew of positive vaccine results triggered a rotation away from the anti-fiat metal and into growth-related assets.

However, this correction lower could prove short-lived given recent comments from the Federal Reserve suggesting the provision of additional monetary stimulus is on the table.

The minutes from the FOMC’s November meeting showed that “many participants judged that the Committee might want to enhance its guidance for asset purchases fairly soon”.

The central bank also noted that “while participants judged that immediate adjustment to the pace and composition of asset purchases were not necessary, they recognized that circumstances could shift to warrant such adjustments”.

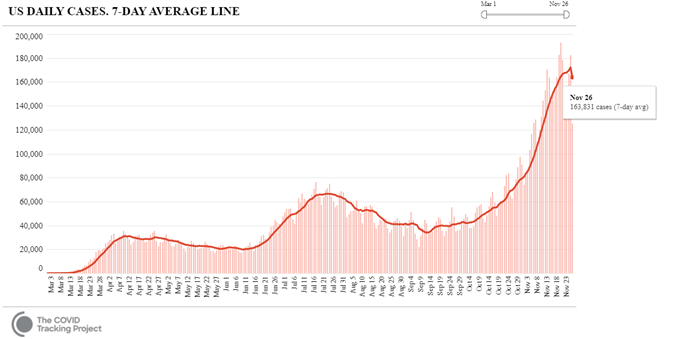

Source – COVID Tracking Project

Considering Treasury Secretary Steven Mnuchin refused to extend several of the Fed’s lending facilities past their December 31 deadline, and with the nation averaging over 160,000 new cases of Covid-19 a day, the central bank may look to act sooner rather than later.

Indeed, several officials “emphasized the important roles” these lending facilities have played “in restoring financial market confidence and supporting financial stability”, adding that “these facilities were still serving as an important backstop in financial markets”.

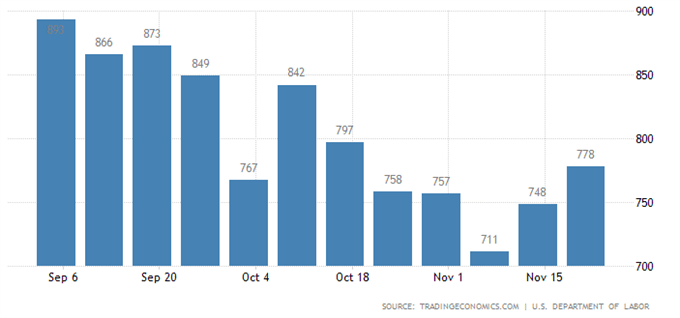

Moreover, the absence of a much-needed fiscal stimulus package, in tandem with initial jobless claims figures spiking to five-week highs, could put further pressure on the Fed to act in the near term.

US Initial Jobless Claims

Source – Trading Economics

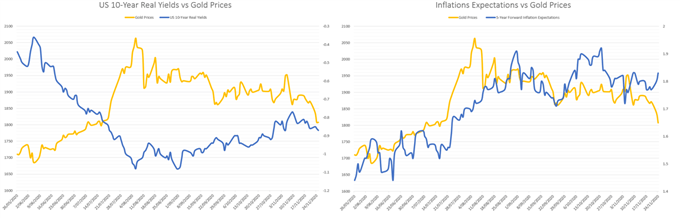

Falling Real Yields, Rising Inflation Expectations to Nurture Bullion’s Rebound

The recent breakdown in gold’s relationship with real yields and inflation expectations could also imply that bullion’s turn lower was driven more by portfolio repositioning, than a true shift in overall market sentiment.

After all, as a non-yielding asset, gold prices tend to move higher on the back of falling real rates of return.

Gold is also widely considered a hedge against inflation and may continue to benefit from rising inflation expectations in the medium-term.

Therefore, prices may recover in the coming weeks on the back of falling real yields and rising consumer price growth expectations.

Data Source – Bloomberg

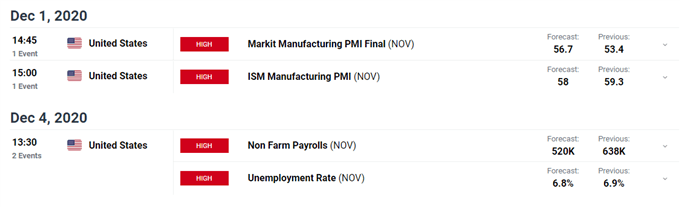

Non-Farm Payrolls, November PMI Figures

Looking ahead, a flurry of PMI figures out of the US for November will be intently scrutinized by market participants to assess how the world’s largest economy is coping with a third-wave of infections, ahead of the volatility-inducing non-farm payrolls report.

Better-than-expected data may diminish the need for additional monetary support and in turn cap the yellow metal’s upside potential.

Conversely, disappointing economic data prints could put a premium on gold if investors begin to price in further easing from the Federal Reserve.

-- Written by Daniel Moss, Analyst for DailyFX

Follow me on Twitter @DanielGMoss