GOLD OUTLOOK: BULLISH

- Gold prices may rise on FOMC rate decision and upbeat outlook

- Republican relief bill proposal could boost inflation expectations

- Economic stabilization amplifying gold’s anti-fiat hedge appeal

FOMC Rate Decision: Optimism May Push XAU/USD Higher

Gold prices may rise following the FOMC rate decision and subsequent press briefing by Fed Chairman Jerome Powell. While market participants are largely expecting for the Fed to keep rates unchanged, positive commentary on the outlook could boost expectations for future price growth. Gold’s attribute as an anti-fiat hedge may outshine other assets in this environment and push the precious metal higher.

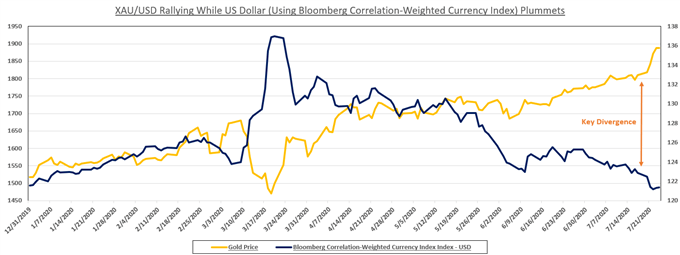

XAU/USD, US Dollar Index Chart

Source: Bloomberg

Furthermore, reinforcing the narrative of economic stabilization could put a discount on haven-linked assets like the Greenback. Consequently, a weaker US Dollar could amplify XAU/USD’s rally. The Fed’s swelling balance sheet – which now sits just shy of $7 trillion – and use of the Main Street Lending Program may also increase gold’s allure as an anti-fiat hedge under the assumption that these measures will boost inflation.

Follow me on Twitter @ZabelinDimitri for more market updates!

US Fiscal Talks May Boost Inflation Prospects

Last Thursday, Treasury Secretary Steven Mnuchin said that he and White House Chief of Staff Mark Meadows were looking over the “final details” for another stimulus bill. He also added that a payroll tax holiday – vocally advocated for by US President Donald Trump – will not be included in the upcoming aid package. Having said that, Mr. Mnuchin said that such a measure may appear in future legislation.

Senate Majority Leader Mitch McConnell said Republicans will unveil a virus-relief bill early this week. Lawmakers are feeling the heat as the $600/week unemployment benefit – signed into law in March – is set to expire. While friction in cross-aisle talks may rattle gold, the details of the release and response by Democrats – if positive – could be a tailwind for XAU/USD.

Economic Stabilization May Inspire Bright Outlook on Inflation

Signs of economic stabilization across both developed and frontier economies – and a number of statements from officials suggesting that the economy “bottomed out” in April – is helping to bolster sentiment. Anticipation of improved economic activity has also increased inflation expectations and polished gold’s appeal as an anti-fiat hedge.

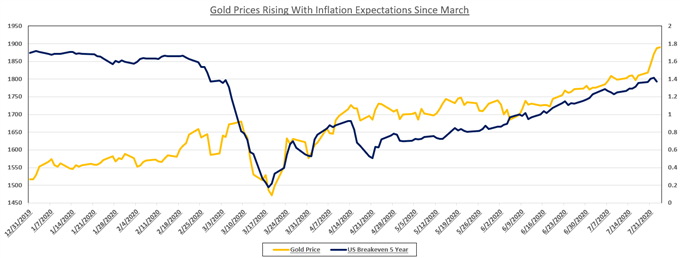

On the chart below is gold prices against the US 5-Year breakeven rate. The latter is the difference between yields of nominal and inflation-linked Treasuries. The spread helps to derive inflation expectations.

Gold Prices, US 5 Year Breakeven Inflation Rate

Source: Bloomberg

The combined, unprecedented monetary and fiscal stimulus measures of both the Federal Reserve and federal government within such a short period of time could result in price growth spiking. While many geopolitical and economic complications could derail the recovery, the narrative of continual improvement and future expectations may continue to support gold’s rally – at least in the week ahead.

--- Written by Dimitri Zabelin, Currency Analyst for DailyFX.com

To contact Dimitri, use the comments section below or @ZabelinDimitri Twitter