FUNDAMENTAL FORECAST: BULLISH

- Gold prices may gain if US GDP and consumption data misses estimates

- Underperformance in the reports could boost Fed rate cut expectations

- Dovish expectations may buoy appeal of non-interest-bearing assets e.g. gold

See our free guide to learn how to use economic news in your trading strategy !

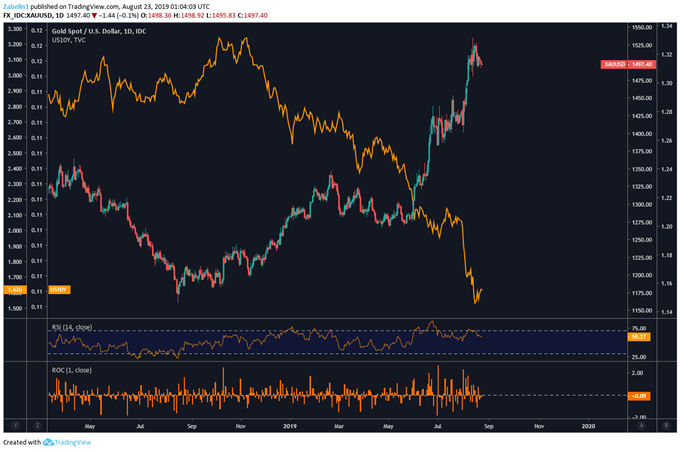

Gold prices may get buoyed by a spike in Fed rate cut bets if US GDP data reinforces the notion that the world’s largest economy is slowing down and requires accommodative monetary policy. Market participants may then further pile on aggressive rate cut bets and push bond yields lower, making the appeal of holding a non-interest-bearing asset – like gold – comparatively more appealing.

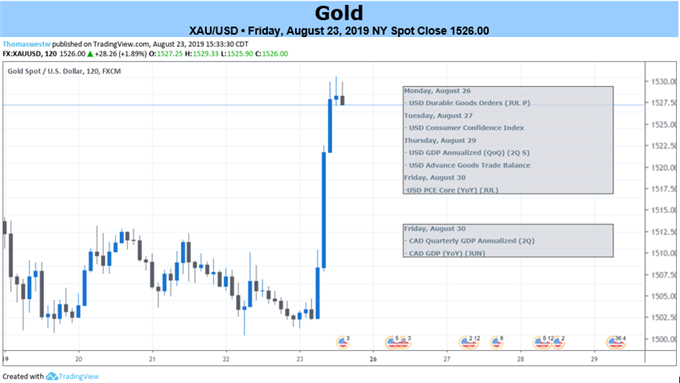

Gold Prices, US 10-Year Bond Yields

Gold chart created using TradingView

Since February, US economic data has been tending to underperform relative to economists’ expectations. Ongoing US-China trade war negotiations have severely hampered cross-border investment. That has put a sour taste in the mouths of businesses skeptical to expand their enterprises if demand is lacking. Worries about a global slowdown have also proven to be contagious and have undermined inflationary pressure.

What are the five fundamental factors undermining global growth?

Traders will also be closely watching the release of personal consumption data. This is not surprising considering consumption accounts for well over 70 percent of US economic growth. Rising recession fears could spill over and negatively impact consumers that are hesitant to spend more freely in anticipation of hard times ahead. In turn, this could undermine inflation prospects further and boost the case for easing, lifting gold prices.

Overnight index swaps are currently pricing in a 97 percent chance of a 25 basis-point cut at the next FOMC meeting in September, while the probability for a 50 basis-point cut is at 57 percent. However, there appears to be a discrepancy between market expectations and the far more reserved view that the Fed has actually conveyed. If traders are forced to reprice bets closer to the scenario that the central bank envisions, gold prices may suffer.

GOLD TRADING RESOURCES

- Join a free webinar and have your trading questions answered

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

--- Written by Dimitri Zabelin, Jr Currency Analyst for DailyFX.com

To contact Dimitri, use the comments section below or @ZabelinDimitri on Twitter