Gold Price Analysis and Talking Points:

See our quarterly gold forecast to learn what will drive prices through mid-year!

Federal Reserve Could Take Gold to $1400

Fundamental Forecast for Gold: Neutral

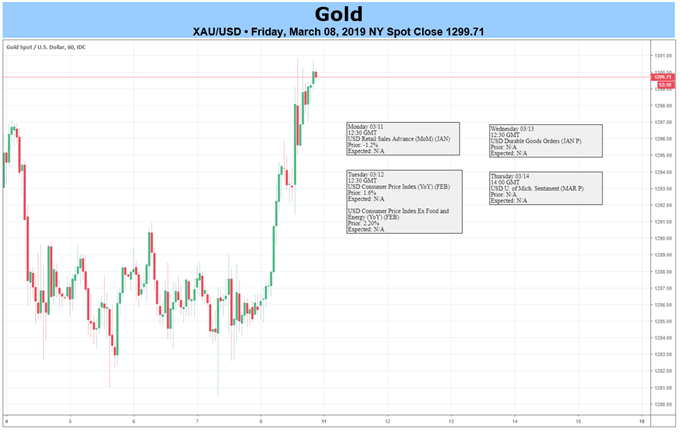

Gold prices posted marginal gains of 0.4% over the week following the technical correction from the prior week. Having bounced off support at $1280, the precious metal trades just south of the psychological $1300 handle. Among the supporting factors for gold has been the dovish stance held across global central banks with this week seeing the RBA, BoC and ECB point out that normalisation is not on the horizon in the near-term, with the latter in fact adding fresh stimulus.

Looking for a technical perspective on gold? Check out the Weekly Gold Technical Forecast.

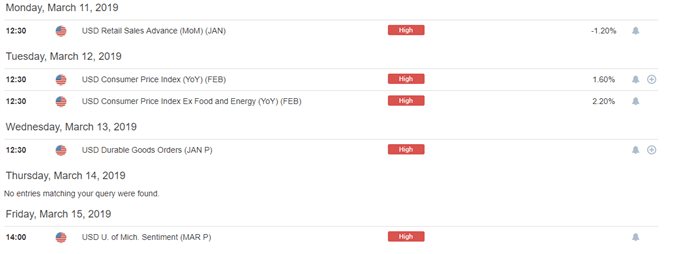

Fed to Stick to Script, Focus on US CPI

While Fed Chair Powell is set to speak over the weekend, it is likely that the Fed Chair will continue to stick with the patience mantra and as such, it is unlikely that his views will deviate from the current script. Consequently, among the key factor that will dictate gold prices over the course of the week, will be the plethora of tier 1 data from the US, most notably the latest inflation figures. The latest NFP served as a reminder that wage pressures are building, which in turn raises the prospect that this may begin to filter into inflation.

GOLD PRICE CHART: Daily Time-Frame (Aug 2018-Dec 2018)

GOLD TRADING RESOURCA ES:

- See our quarterly gold forecast to learn what will drive prices through mid-year!

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

--- Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX

Other Weekly Fundamental Forecast:

Australian Dollar Forecast –Limps Into New Week, May Well Stay Down

Oil Forecast – Crude Oil Forecast: 2019 Recovery at Risk as Near-Term Range Buckles