Forecast: Bearish

Gold Talking Points:

- Trade wars and Fed speak will likely dictate gold’s price in the week ahead

- A continuation of the recent rally may stall as global growth risk is reduced

- Want to try your hand at trading Gold? Check out our Trading Guides.

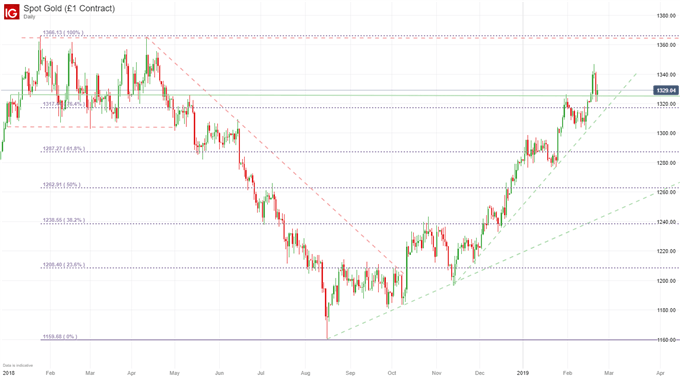

Looking for a technical perspective on the Gold? Check out the Weekly Gold Technical Forecast.

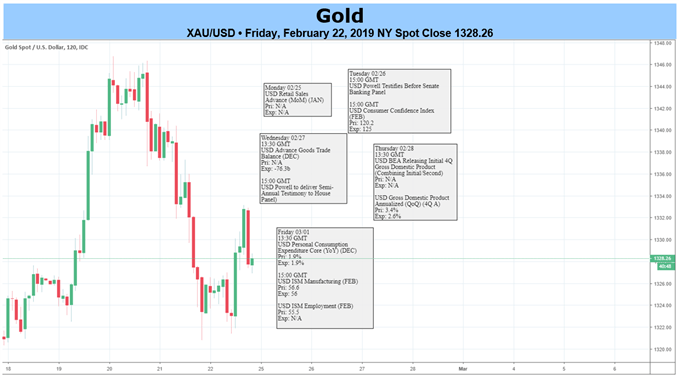

Gold recorded a solid week last week as it traded near $1350 and notched a 10-month high on Wednesday before retracing later in the session. In the week ahead, the precious metal will have plenty of event risk and economic data to guide price action.

Gold Price Chart: Daily Time Frame (January 2018 – February 2019) (Chart 1)

The forefront of risk next week lies in trade wars. On Friday, President Trump announced the US and China had made considerable progress on trade and would likely reach a deal. The statements were echoed by Chinese President Xi Jinping and equities rallied while gold traded slightly lower as the optimism worked to reduce market fears.

In the week ahead, gold may be due for a brief stall in the recent rally barring a new trade war front. That said, the resolution of the US-China trade war is an undeniable reduction in global economic risk which clouds the picture for gold. Further, it may cause inflation expectations to shift. With a major headwind for growth lifted, GDP forecasts may be revised upward, and a recently dovish Fed could in turn strike a more hawkish tone.

Wednesday will offer market watchers an opportunity to hear the Fed’s tone when Fed Chairman Jerome Powell offers his semi-annual testimony before a House panel. After last Wednesday’s Fed minutes revealed a unanimous vote to pause rate hikes, the reduction of global growth risk may prove a catalyst for change. Follow me on Twitter @PeterHanksFX for updates and analysis on trade wars, equities and currencies.

Read more: Consumer Confidence Ticks Higher, Inflation Expectations Plummet

--Written by Peter Hanks, Junior Analyst for DailyFX.com

Contact Peter on Twitter at @PeterHanksFX

DailyFX forecasts on a variety of currencies such as the US Dollar or the Yen are available from the DailyFX Trading Guides page. If you’re looking to improve your trading approach, check out Traits of Successful Traders. And if you’re looking for an introduction to the Forex market, check out our New to FX Guide.

.

Other Weekly Fundamental Forecasts:

Australian Dollar Forecast – Australian Dollar Market May be Calmer, But Watch Trade Headlines

Oil Forecast – Crude Oil Prices Risk Overbought RSI Signal Despite Record U.S Output

British Pound Forecast – Sterling Refuses to Believe in No Deal Brexit

US Dollar Forecast – US Dollar Eyes Powell Speech, US- China Trade Talks, Data Deluge