GOLD PRICE FUNDAMENTAL FORECAST: NEUTRAL

Talking Points:

- Gold’s recent bullish breakout may come under pressure despite strong safe-haven demand

- A strong US Dollar notching year-to-date highs to limit further advances in gold

- Prospect of a Federal Reserve rate hike pause could shoot the precious metal higher

GOLD PRICE FUNDAMENTAL FORECAST: NEUTRAL

Over the last 5 days of trading, XAUUSD declined 0.72% as investors anxious over slowing global growth sent the US Dollar higher. Although risk-off sentiment should send the precious metal higher, gains in the Greenback overpowered bullish bids for gold. A higher US Dollar makes purchasing gold denominated in America’s currency relatively more expensive thus limiting upside.

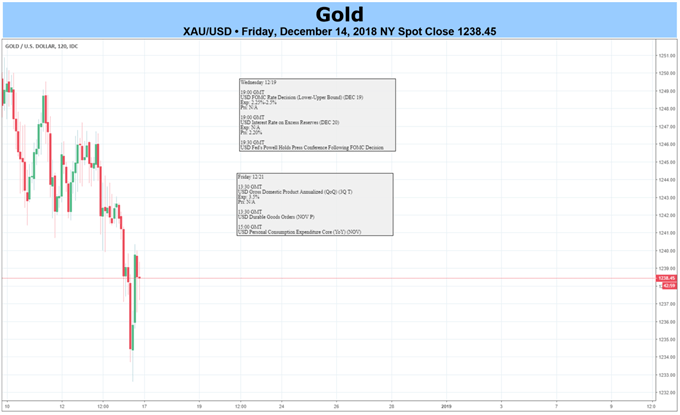

Looking to next week, focus will shift to the Federal Reserve as markets await the highly anticipated decision by the central bank’s Federal Open Markets Committee on monetary policy. Markets are currently pricing a 77 percent chance that the Fed will raise its benchmark policy interest rate for the fourth time this year according to the futures market implied probability.

In general, Gold has an inverse relationship with interest rates due to the precious metal not yielding any cash flows like debt instruments. Higher rates result in weakened demand for the commodity as alternative assets such as US Treasuries provide a higher rate of return. If the Fed surprises markets and pauses next week or makes any material downward change to the Fed’s dot-plot, gold could ascend quickly on back of lower future interest rate expectations.

Eyes will also closely watch for the release of several key economic indicators out of America next week. If actual results miss expectations, risk-off sentiment should continue and further boost demand for gold. However, fears over a slowing global economy will incite further rotation of capital from stocks to bonds with investors flocking to the safety of US Treasuries.

For a list of global economic events and data releases, check out our real-time Economic Calendar.

As international buying of Uncle Sam’s bonds increases, foreigners must convert their currency into US Dollars. This drives up demand for the Greenback which becomes a headwind for gains in gold due to the inverse relationship between the two assets.

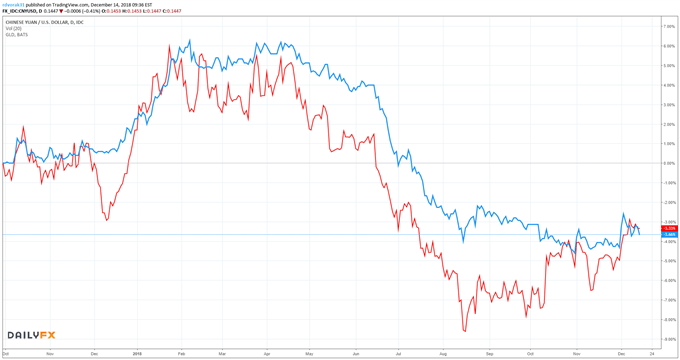

A third key driver to take note of that will determine gold’s next move higher or lower will be the performance of the Chinese Yuan. As the damaged Asian economy continues to experience downward pressure amid worsening economic data due to the ongoing trade war with the United States, the Dollar may appreciate further against its Chinese counterpart.

The importance of USDCNY to gold is seen in their strong negative correlation. Trade talks between the world’s largest economic powerhouses will largely drive returns for the currencies with the CNY benefiting from any progress President Xi can make with President Trump towards de-escalation tension or reaching a deal.

Due to the mixed event risks and waning bullish technical indicators, the forecast for XAU will be neutral over the week of December 17. Take a look at client sentiment for insight on client positioning and trader bearish or bullish biases.

--Written by Rich Dvorak, Junior Analyst for DailyFX

--Follow Rich on Twitter for real time market updates @RichDvorakFX

Other Weekly Fundamental Forecasts:

Japanese Yen Forecast – USD/JPY Rate Fails to Test Monthly-High Ahead of Fed Rate Decision

Oil Forecast – Crude Oil Prices Swamped by OPEC Cuts, Global Growth Fears, Fed

British Pound Forecast – A Complete Lack of a Cohesive Government Blights Sterling

US Dollar Forecast –US Dollar May Rise as the Fed Checks Slide in 2019 Rate Hike Bets