Fundamental Forecast for Gold:Bullish

Gold Talking Points:

- Gold rebound from multi-year support gathers pace post-Powell; supportive above 1180

- What’s driving gold prices? Review DailyFX’s 2018 Gold Projections

- Join Michael for Live Weekly Strategy Webinars on Monday’s at 12:30GMT to discuss this setup and more!

Gold prices were fractionally softer this week with the precious metal shedding 0.1% to trade at 1203 ahead of the New York close on Friday. The loss comes on the heels of a strong rebound in bullion with prices trading just below resistance into the close of the month. Heading into the start of September trade our outlook remains unchanged as we look for further confirmation that a more significant low was registered in August.

New to Trading? Get started with this Free Beginners Guide

Trade War / Geo-Political (EM) Concerns Offering Gold Support

The ongoing trade skirmish has kept a floor under gold prices and although equity markets have continued to press higher, seasonal tendencies for stocks turn heavy heading into September and ongoing geo-political concerns may further stoke demand for the perceived safety of the yellow metal. That said, the focus remains on the technical considerations we’ve been tracking over the past few weeks with expectations for limited downside in the days ahead.

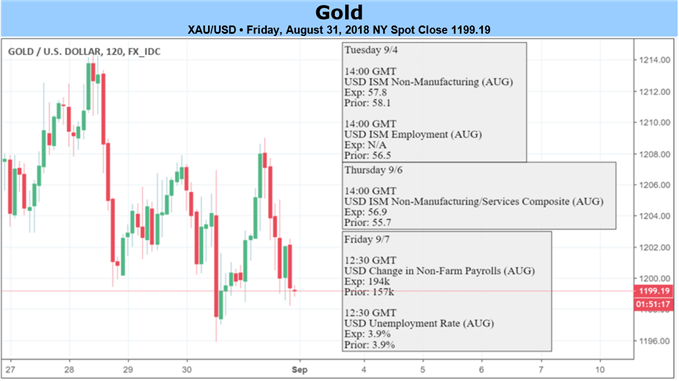

Highlighting the economic calendar into the start of the month will be central bank interest rate decisions from the RBA (Reserve Bank of Australia) and the BoC (Bank of Canada). US August NFPs (Non-Farm Payrolls) are released on Friday with consensus estimates calling for a print of 194K as unemployment holds near 18-year lows at 3.9%.

Learn more about how we Trade the News in our Free Guide !

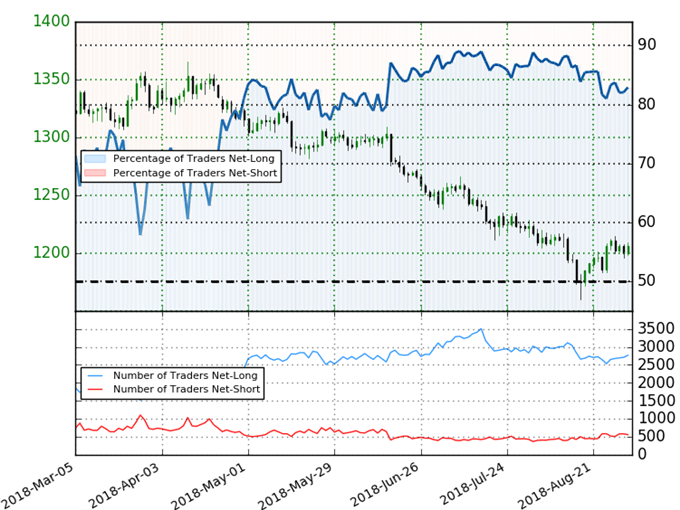

Spot Gold IG Trader Sentiment

- A summary of IG Client Sentiment shows traders are net-long Gold- the ratio stands at +4.85 (82.9% of traders are long) –bearish reading

- Long positions are 1.5% higher than yesterday and 2.8% higher from last week

- Short positions are 3.4% lower than yesterday and 4.4% lower from last week

- We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests Spot Gold prices may continue to fall. Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger Spot Gold-bearish contrarian trading bias.

Review Michael’s educational series on the Foundations of Technical Analysis: Building a Trading Strategy

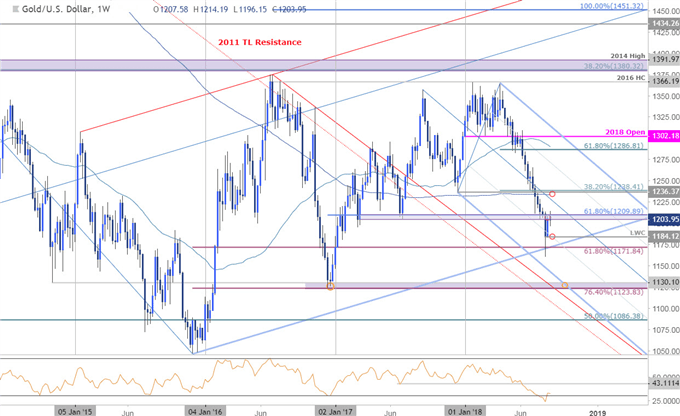

Gold Weekly Price Chart

In last week’s Gold forecast our ‘bottom line’ noted that, “Weekly momentum has recovered from oversold conditions as price responded to key long-term support. From a trading standpoint, I’ll favor fading weakness while above this confluence (1171/75) with a breach above 1209 needed to fuel the next leg higher targeting 1234/36.” September seasonal tendencies favor gold strength (typically best month for gold, worst for stocks) and with price coming off multi-year slope support, the risk remains for a move higher in the weeks ahead.

Bottom line:

The outlook for gold prices remains unchanged heading into the start of September trade and from a trading standpoint, we’re still looking for confirmation that a more significant low is place. Weekly bullish invalidation now raised to the yearly low-week close at 1184 – look for sideways to lower early next month to offer more favorable entries above this threshold. For a complete technical breakdown of the near-term gold trading levels (daily & intraday), review this week’s XAU/USD Scalp Report.

Why does the average trader lose? Avoid these Mistakes in your trading

---Written by Michael Boutros, Currency Strategist with DailyFX

Follow Michaelon Twitter @MBForex or contact him at mboutros@dailyfx.com

Other Weekly Fundamental Forecasts:

New Zealand Dollar Forecast - NZD/USD Vulnerable to US Tariffs & Trade War Fears, BoC Hike Bets

Japanese Yen Forecast - USD/JPY Initiates Bearish Sequence Amid Failed Run at August-High

Oil Forecast – Crude Oil Market Focuses On Supply Risk, Not Trump Threats As Oil Sees Monthly Gain

British Pound Forecast – Sterling Dips Look Attractive After Brexit Breakthrough

US Dollar Forecast – US Dollar Aims Higher on Haven Demand, Yield Appeal