Fundamental Forecast for Gold: Neutral

- Gold prices hold key support – All eyes on Fed testimony next week

- What’s driving gold prices? Review DailyFX’s 2018 Gold Projections

- Join Michael for Live Weekly Strategy Webinars on Monday’s at 12:30GMT to discuss this setup and more!

Gold prices moved lower this week with the precious metal down 1.3% to trade at 1239 ahead of the New York close on Friday. The decline comes amid renewed strength in the greenback with the US Dollar Index (DXY) rallying more than 1% on the week. Concerns over the looming global trade war seem to have abated in the near-term with headlines out of the UK regarding the ongoing Brexit negotiations and Presidents Trump’s European tour taking center stage. Broader risk appetite has remained positive with all three major US equity indices closing higher on the week.

All Eyes on Powell

Traders will be lending a keen ear to comments made by Federal Reserve Chairman Jerome Powell next week at the semi-annual Humphrey Hawkins testimony before congress. This week’s release of the U.S. Consumer Price Index (CPI) showed an up-tick in the core rate of inflation to 2.3% y/y. With the labor markets more-or-less at the central bank’s ‘natural rate’ of unemployment, the inflationary picture has remained the committee’s primary focus in determining when to raise rates. Investors will be looking for clues from Chairman Powell as it pertains to the timing of future hikes – keep in mind that markets are currently pricing in an 85% likelihood for a 25bps hike in September and 59% for another hike in December (in line with the FOMC dot plot expectations for four hikes).

That said, there may be limited upside for the USD next week based on shifts in rate-hike expectations- a development that could help alleviate some of the downside pressure on gold. Note that expectations for higher interest rates will tend to weigh on demand for the yellow metal and with the rate outlook largely priced at the Fed’s projected path, this headwind should abate in the coming weeks. For gold, the focus remains on a key technical support confluence with the broader short-bias at risk while above 1235.

New to Trading? Get started with this Free Beginners Guide

Gold Trader Positioning

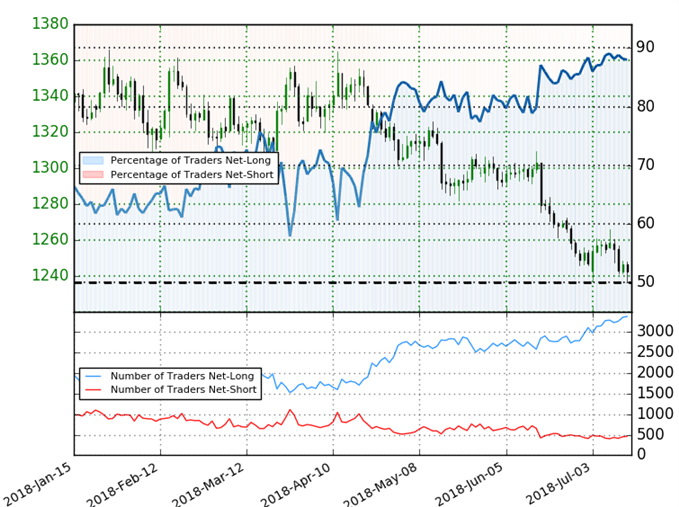

- A summary of IG Client Sentiment shows traders are net-long Gold- the ratio stands at +7.34 (88.0% of traders are long) –bearishreading

- Long positions are 0.4% lower than yesterday and 3.3% higher from last week

- Short positions are 1.8% higher than yesterday and 3.4% higher from last week

- We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests Spot Gold prices may continue to fall. Yet traders are less net-long than yesterday and compared with last week. Recent changes in sentiment warn that the current Spot Gold price trend may soon reverse higher despite the fact traders remain net-long.

Review Michael’s educational series on the Foundations of Technical Analysis: Building a Trading Strategy

Gold Weekly Price Chart

The technical picture has remain unchanged for the last three weeks with the focus still on critical support confluence at, “the 50% retracement of the late 2016 advance at 1245 backed closely by the 200-week moving average / trendline support at ~1235.” Price has continued to defend this threshold on a weekly close basis keeps the medium-term outlook neutral for now until we get further clarity on a near-term construct in price.

This is a big support zone and although the broader outlook does remain weighted to the downside, the risk is mounting for a larger recovery while above these lows. Weekly resistance stands up at 1285 where the 61.8% retracement converges on the 50-line with broader bearish invalidation at the yearly open at 1302. A break below this key support zone risks accelerated losses for bullion with such a scenario targeting the 61.8% retracement of the late 2016-advance at 1215 and 1204.

Bottom line: We’re looking for a low - gold has responded to key weekly support and the immediate focus is on the June opening range with the broader downtrend at risk while above 1235. For a complete technical breakdown of the near-term Gold price levels (daily & intraday), review this week’s XAU/USD Technical Outlook.

What are the traits of a Successful Trader? Find out with our Free eBook !

---Written by Michael Boutros, Currency Strategist with DailyFX

Follow Michaelon Twitter @MBForex or contact him at mboutros@dailyfx.com