Fundamental Forecast for Gold: Bullish

- Gold pulls into support on strong NFP / USD- Broader outlook remains constructive

- What’s driving gold prices? Review DailyFX’s New 3Q Gold Projections

- Join Michael for Live Weekly Strategy Webinars on Mondays at 12:30GMT

Gold prices snapped a three week winning streak with the precious metal down 0.93% to trade at 1257 ahead of the New York close on Friday. The reversal off seven-week highs comes on the back of a strong U.S. employment report with the greenback rallying sharply into the close of the week.

Non-Farm Payrolls topped expectations with a print of 209K for the month of July as the unemployment rate down-ticked to 4.3%. The gains were accompanied by an increase in the labor force participation rate- a welcomed development for the Federal Reserve. While the data does little to shift interest rate expectations (markets still pricing 50/50 chance of a December rate-hike), the release was just the catalyst needed to fuel a rebound in the greenback which has been under tremendous pressure over the past few weeks.

Looking ahead to next week, traders will be eyeing U.S. inflation data with the release of the July Consumer Price Index (CPI) slated for Friday. With employment more-or-less at the Fed’s ‘natural rate’ the focus has been on the inflation outlook and if the data tops estimates, interest rate expectations could further fuel the late-week USD rally. For gold, the dollar advance has been enough to cap the rally near-term with prices pulling back into support ahead of the weekly close. While the broader outlook remains constructive, we’ll be looking for a break of the monthly opening range to offer further guidance of our near-term bias.

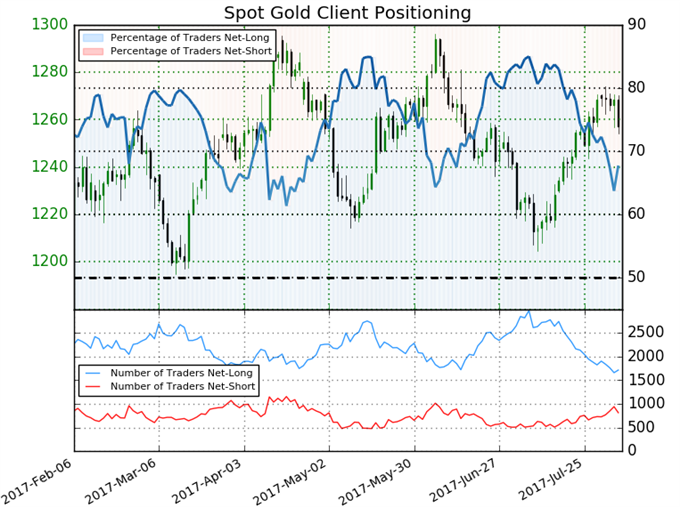

- A summary of IG Client Sentiment shows traders are net-long Gold - the ratio stands at +2.1 (67.8% of traders are long)- bearish reading

- Long positions are 1.1% lower than yesterday and 13.3% lower from last week

- Short positions are 6.2% lower than yesterday but 14.4% higher from last week

- We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests Spot Gold prices may continue to fall. That said, retail is more net-long than yesterday but less net-long from last week and the combination of current positioning and recent changes gives us a further mixed Spot Gold trading bias from a sentiment standpoint.

Learn how to use Gold sentiment in your trading. Get more information on Sentiment here Free !

Gold Daily

Gold prices tested former slope resistance, now support extending off the 2016 highs into the close of the week. IF this advance has further upside to go, losses should be limited to the 100-day moving average with our bullish invalidation level now raised to 1244. Interim resistance still 1274 with a breach targeting the yearly high-day close at 1293.

Join Michael for his bi-weekly Live Webinar on the Foundations of Technical Analysis- Register for Free Here!

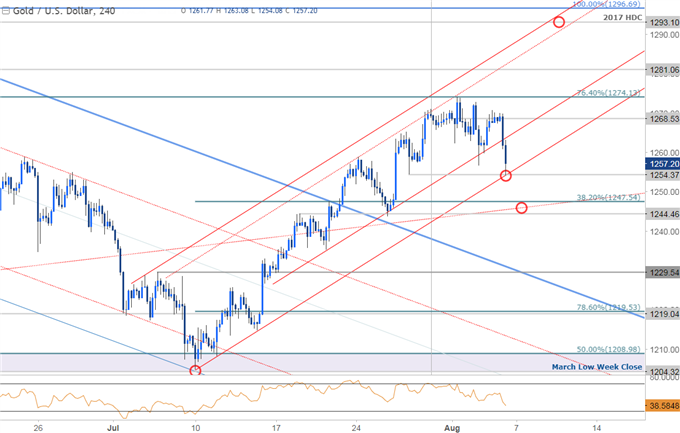

Gold 240min

Last week we noted that a, “near-term channel resistance is just higher and a rally into this region could see some profit-taking before continuing higher. Interim support rests at 1254 backed by the weekly low / lower parallel at 1243. Bottom line: could get an interruption next week but the trade remains constructive while within this formation.”

The pullback has now tested support at 1254 and heading into next week the focus will be on this support zone with a break below 1244/47 needed to suggest a larger correction is underway- such a scenario would target a decline into 1229. That said, look for interim resistance at the monthly open (1268) with a breach above this week’s high at 1274 needed to mark resumption of the near-term uptrend targeting 1281 & 1293/96. Bottom line: look for a reaction early next week at one of these two support targets early next week as prices continue to carve out the August opening-range.

---Written by Michael Boutros, Currency Strategist with DailyFX

Follow Michaelon Twitter @MBForex contact him at mboutros@dailyfx.com or Click Here to be added to his email distribution list.