CANADIAN DOLLAR OUTLOOK: BEARISH

- Canadian Dollar may fall as coronavirus wreaks havoc on global economy

- Weakening demand from the US is pressuring Canadian growth prospects

- CAD’s petroleum-linked nature makes it especially vulnerable to recession

US Economic Data in Focus as Recession Fears Mount With Rising Unemployment

The cycle-sensitive Canadian Dollar may fall in the week ahead if growth prospects from the US – the source of Canada’s economic vitality and primary destination for its exports – darken. Initial jobless claims data continues to register at historically-high levels and with such a magnitude that it makes the 2008 crisis – in comparison within this particular data set – look like a garden-variety downturn.

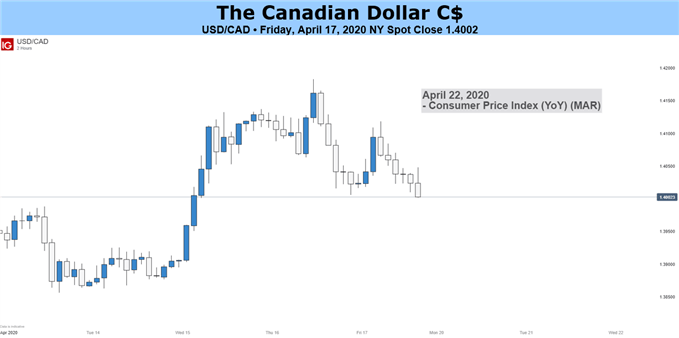

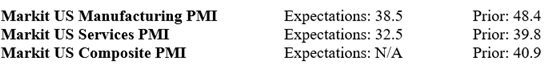

The Canadian Dollar will be paying particularly close attention to the publication of preliminary Markit PMI data for April out of the world’s largest economy. A worse-than-expected print could hurt CAD and cause it to retrace some of its recent gains. Even if the data registers in-line with forecasts or slightly better, the fundamental uncertainty posed by the coronavirus will likely continue haunting the Canadian Dollar.

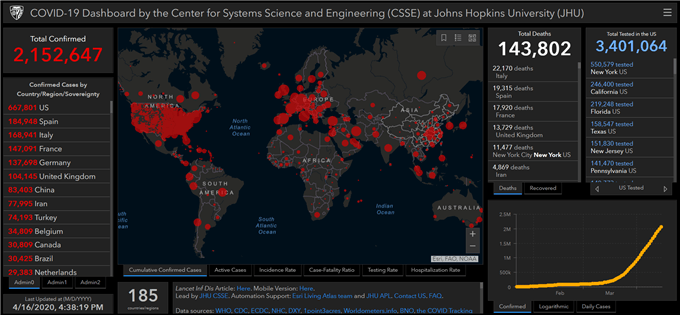

Last week, the IMF published its World Economic Outlook (WEO) and Global Financial Stability Report (GFSR) where officials forecasted a three percent contraction for global GDP in 2020. The lender of last resort’s Chief Economist also warned that the shelter-in-place orders – dubbed “The Great Lockdown” – could lead to the worst financial and economic crisis since the Great Depression.

While Canada itself has relatively few cases – totaling around 5245 – its Southern neighbor has become the new epicenter of the pandemic. Consequently, weaker demand there for goods outside of its borders will likely result in an economic chilling effect that reverberates back to Canada. CAD may therefore find itself at the mercy of the economic trajectory of the US, which, in the current circumstances is more alarming than comforting.

Weakening Oil Demand Could Hurt Petroleum-Linked Canadian Dollar

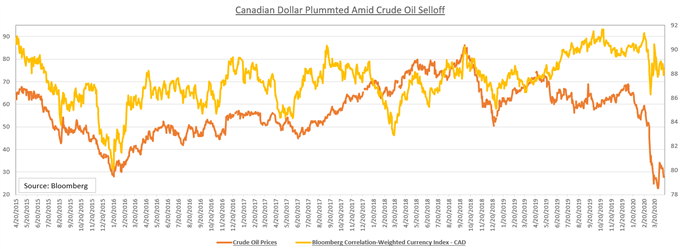

The Canadian Dollar may come under additional pressure if crude oil prices continue to be hammered by weak growth prospects. The sentimentally-fickle commodity is used as a key energy input in the growth framework for almost every economy. Consequently, when demand is anticipated to fall, so too does crude oil and petroleum-linked assets.

The petroleum sector accounts for roughly a little over 10 percent of Canadian GDP, which puts the economy in a tough position in the current environment. This does not include the precarious state of affairs in the Organization of Petroleum Exporting Countries that saw crude oil prices suffer from an inter-organizational dispute. Even with political stabilization in that arena, the outlook for future demand remains precarious.

CANADIAN DOLLAR TRADING RESOURCES

- Tune into Dimitri Zabelin’s webinar outlining geopolitical risks affecting markets in the week ahead !

- New to trading? See our free trading guides here !

- Get more trading resources by DailyFX !

--- Written by Dimitri Zabelin, Jr Currency Analyst for DailyFX.com

To contact Dimitri, use the comments section below or @ZabelinDimitri on Twitter