Fundamental Forecast for CAD: Bullish

USDCAD Analysis and Talking Points:

- Bullish CAD as Canadian Data Outperforms US

- Bond Spreads Tighten in Favour of CAD

- Eyes on Canadian Jobs Report

See our Q3 CAD forecast to learn what will drive the CAD through the quarter.

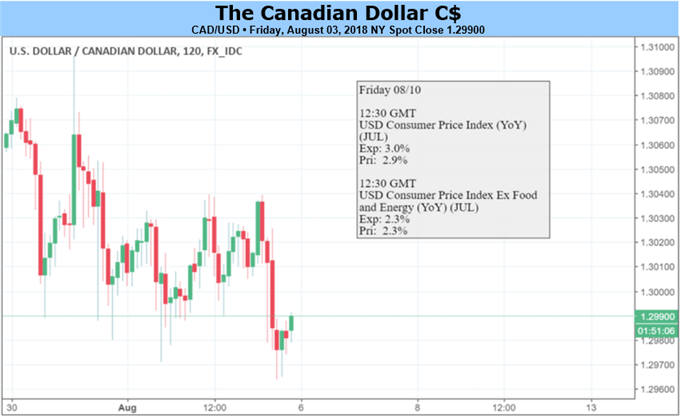

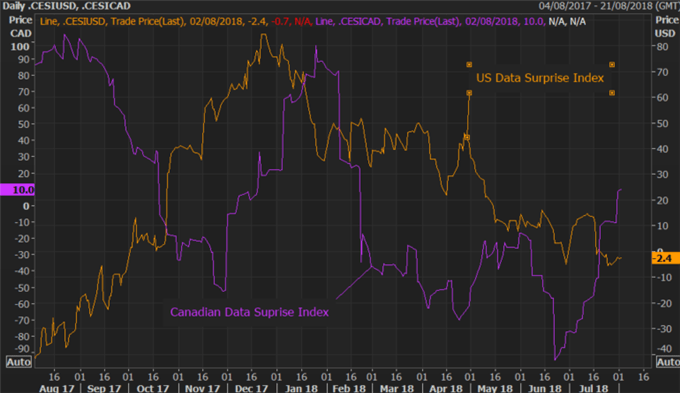

Last week, we were bullish on the Canadian Dollar and provided USDCAD remains below 1.30 we see no reason to change this view. The Loonie has continued to enjoy another flurry of strong data points this weeks. Firstly, the most recent GDP data rose above economic forecasts, showing the fastest growth spurt in a year, led by oil prices, while Friday’s trade deficit saw a significant narrowing, consequently supporting the case for another rate hike by the end of this year. Interestingly, recent data has outperformed relative to the US, as shown by the Citi Surprise Index, in which the US index has dipped into negative, relative to Canada which switched to positive, advocating the case for further USDCAD weakness.

US/Canadian Data Outperformance Index

Interest Rate Differentials Continue to Tighten

Rate hike expectations from the Bank of Canada has continued to firm with around 17bps worth of tightening priced in thus far for the policy meeting in October, while a 25bps rate hike is fully priced in by December. As such, US-CA 2yr yield bond spreads have continued to move in favour of CAD and has breached through the psychological 60bps mark, which has continued to keep USDCAD on the backfoot.

Focus Going Forward for CAD

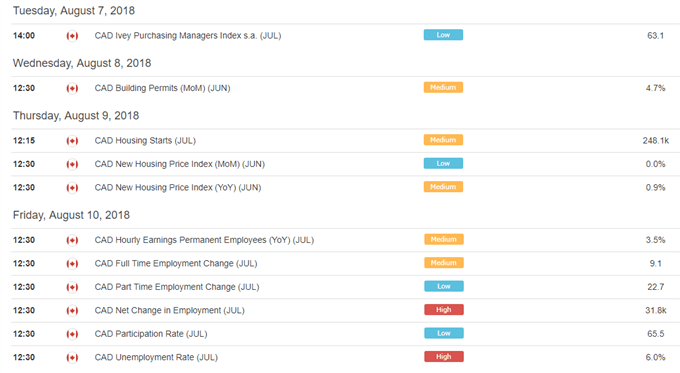

As we look to next week’s economic calendar, the vocal point for Canada will be the jobs report at the backend of the week, while eyes will also be on headlines regarding NAFTA which continues to present the biggest risk to the Canadian economy.

Source: DailyFX

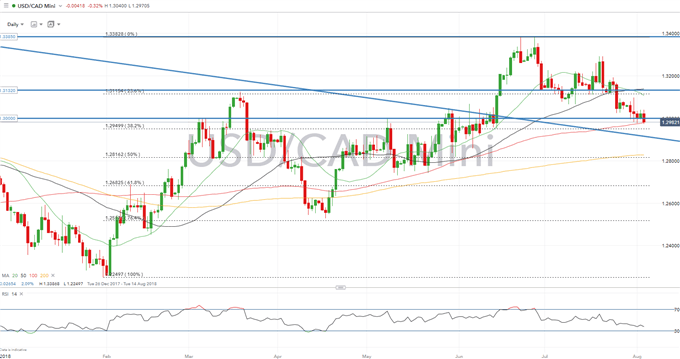

USDCAD PRICE CHART: DAILY TIMEFRAME (December 2017-August 2018)

USDCAD Technical Levels

Resistance 1: 1.3000 (Psychological Level)

Resistance 2: 1.3115 (23.6 Fibonacci Retracement)

Resistance 3: 1.3180-1.32 (Resistance Area)

Support 1: 1.2980 (100DMA)

Support 2: 1.2940-50 (Support Area)

CAD TRADING RESOURCES:

- See our quarterly CAD forecast to learn what will drive prices through mid-year!

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

--- Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX