Fundamental Forecast for Canadian Dollar: Neutral

USD/CAD trades near the monthly-high (1.2902) as the Federal Open Market Committee (FOMC) appears to be on course to further normalize monetary policy in 2018, but a marked pickup in Canada’s Consumer Price Index (CPI) may rattle the near-term resilience in the exchange rate as it puts pressure on the Bank of Canada (BoC) to follow a similar path to its U.S. counterpart.

Fresh forecasts from Fed officials suggest the central bank will stay on its current course of delivering three rate-hikes per year, and the hiking-cycle may prop up USD/CAD over the near-term especially as the BoC endorses a wait-and-see approach for monetary policy.

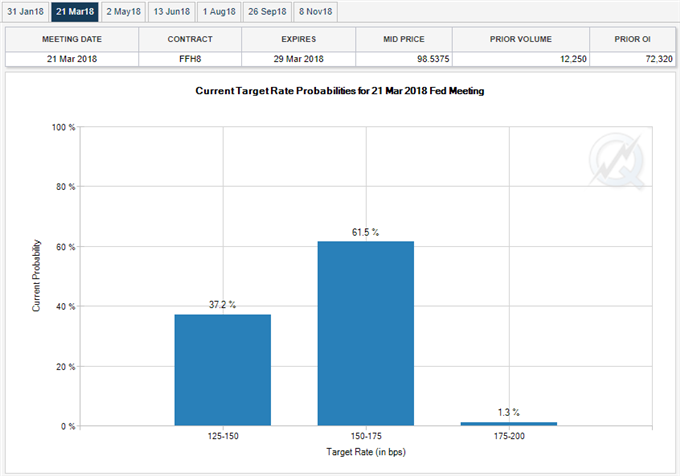

With Fed Fund Futures showing budding expectations for a March rate-hike, the pair stands at risk for a more meaningful recovery going into the end of 2017, but key data prints coming out of Canada may spark a bearish reaction in the dollar-loonie exchange rate as the headline reading for inflation is expected to climb to an annualized 2.0% from 1.4% in October.

The threat for above-target inflation may heighten the appeal of the Canadian dollar its raises the risk of seeing Governor Stephen Poloz and Co. adopt a more hawkish tone in 2018, and the central bank may increase its efforts to prepare Canadian households and businesses for higher borrowing-costs as officials note ‘higher interest rates will likely be required over time.’ On the other hand, a below-forecast CPI print may fuel the near-term resilience in USD/CAD as it raises the BoC’s scope to retain the current policy for the foreseeable future. Interested in having a broader discussion on current market themes? Sign up and join DailyFX Currency Analyst David Song LIVE for an opportunity to discuss potential trade setups!

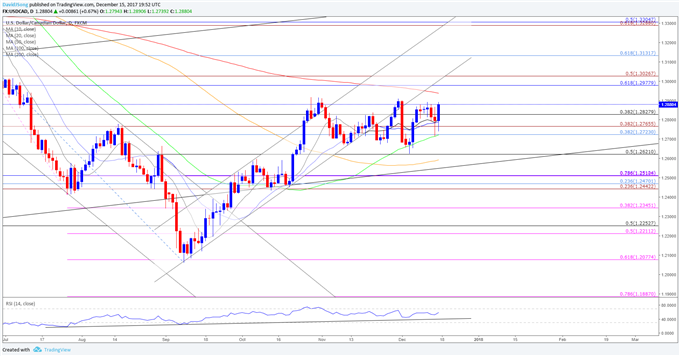

USD/CAD Daily Chart

Near-term outlook for USD/CAD remains clouded with mixed signals as the pair marks a failed attempt to test the monthly-high (1.2902), with the pair stuck in a narrow range as the 1.2620 (50% retracement) region offers support. Keep in mind, the Relative Strength Index (RSI) highlights a similar dynamic as it struggles to push back into overbought territory, but the broader outlook remains supportive as the oscillator preserves the bullish formation carried over from August.

With that said, topside targets remain on the radar for USD/CAD, with a break of the near-term range raising the risk for a move back towards the 1.2980 (61.8% retracement) to 1.3030 (50% expansion) region. Want to learn more about popular trading indicators and tools such as the RSI? Download and review the FREE DailyFX Advanced Trading Guides !

Sign up for David's e-mail distribution list