Fundamental Forecast for Canadian Dollar: Bullish

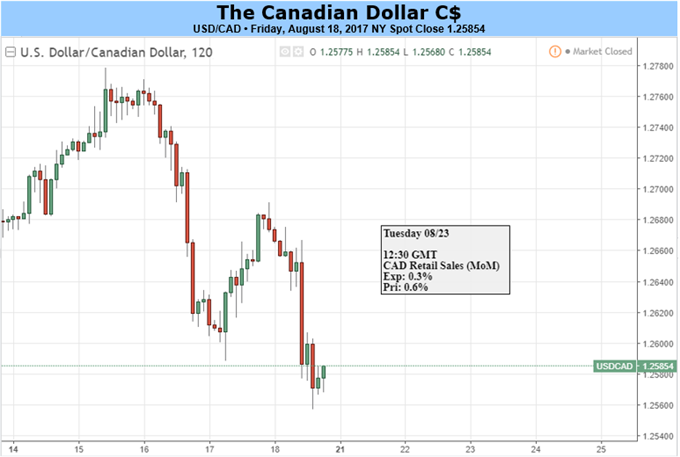

USD/CAD may continue to give back the rebound from the August-low (1.2413) as the Federal Reserve scales back its hawkish outlook for monetary policy, while the Bank of Canada (BoC) appears to be on course to deliver another rate-hike in 2017.

Sign Up and Join the DailyFX Team LIVE for an Opportunity to Discuss Potential Trade Setups

The Federal Open Market Committee (FOMC) Minutes seem to have rattled interest rate expectations as many officials ‘saw some likelihood that inflation might remain below 2 percent for longer than they currently expected, and several indicated that the risks to the inflation outlook could be tilted to the downside.’ In turn, Fed Fund Futures now highlight growing expectations for a hold in December, and the fresh headlines coming out of the Economic Symposium in Jackson Hole, Wyoming may continue to dampen the appeal of the greenback should an increased number of FOMC officials show a greater willingness to carry the current policy into 2018.

However, the U.S. dollar may face a more bullish fate as ‘the Committee expects to begin implementing its balance sheet normalization program relatively soon,’ and talks of unwinding the quantitative easing (QE) program at the September meeting may generate a near-term rebound in USD/CAD as the BoC is expected to retain the current policy during the same period.

Governor Stephen Poloz and Co. may stick to the current stance on September 6 after raising the benchmark interest rate for the first time since 2010, but the pickup in Canada’s Consumer Price Index (CPI) may encourage the central bank to prepare households and businesses for higher borrowing-costs as ‘the factors behind soft inflation appear to be mostly temporary.’ In turn, the BoC may continue to change its tune over the coming months, and the key developments coming out of the Canadian economy may fuel the shift in USD/CAD behavior as ‘the output gap is now projected to close around the end of 2017, earlier than the Bank anticipated in its April Monetary Policy Report (MPR).’

USD/CAD Daily Chart

Download the DailyFX 3Q Forecasts

Failure to push back above the former-support zone around 1.2770 (38.2% expansion) to 1.2780 (38.2% expansion) bring the downside targets back on the radar especially as USD/CAD fails to preserve the upward trend from July. With that said, a bear-flag formation appears to materializing, with the next downside hurdle coming in around 1.2510 (78.6% retracement) to 1.2540 (61.8% expansion) followed by the Fibonacci overlap around 1.2410 (100% expansion) to 1.2440 (23.6% expansion), which lines up with the 2017-low (1.2413).

Check out the new gauge developed by DailyFX based on trader positioning.

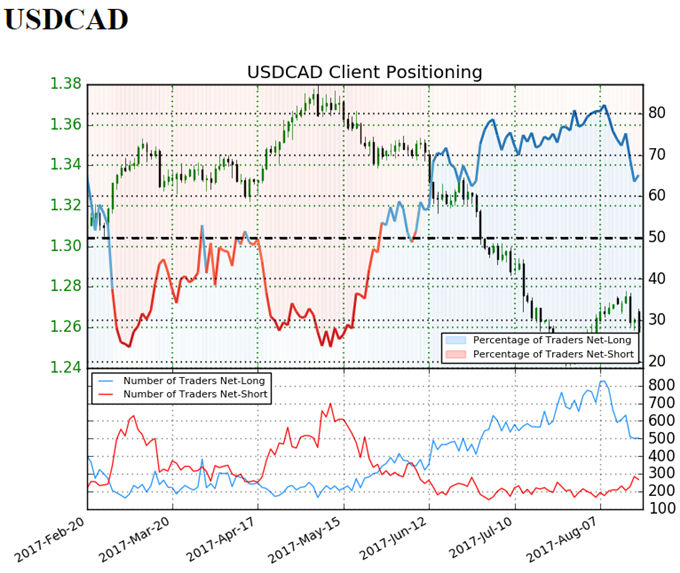

Retail trader data shows 65.2% of traders are net-long USD/CAD with the ratio of traders long to short at 1.87 to 1. In fact, traders have remained net-long since June 07 when USD/CAD traded near 1.34477; price has moved 6.5% lower since then. The number of traders net-long is 12.0% lower than yesterday and 16.4% lower from last week, while the number of traders net-short is 5.6% lower than yesterday and 31.9% higher from last week.

Sign up for David's e-mail distribution list