AUSTRALIAN DOLLAR FUNDAMENTAL FORECAST: BEARISH

- AUD/USD firmed as USD softened with commodities drifting higher

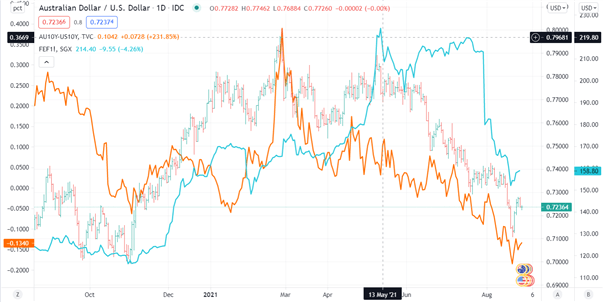

- Australian/US yield differentials continue to play a role for Aussie

- Delta variant cases provide challenges for risk assets going forward

The Australian Dollar found some support this week with risk assets firming as the US Dollar pulled back from recent highs across the board. Domestic data was mixed with private capex beating expectations (4.4% Q2) while retail sales disappointed (-2.7% July). Iron ore prices helped to steady the ship for AUD as its freefall was halted when China its re-opened its ports.

Iron ore, by far Australia’s largest export, has a clear relationship with AUD - seen in the chart below. In the last fortnight, we have seen the impact of China closing and re-opening its ports. Any changes in circumstances and policy out of the country will likely drive iron ore prices. As such, the market will likely remain alert for any further developments.

Commodities are mostly priced in the US Dollar and it’s no surprise that commodity prices impact AUD movements. With that in mind, the focus on more moves in the Greenback is likely to play into commodities and the Aussie. The fallout from the Fed saw an immediate weakening of the US Dollar across the board. For now, this has put a bid for commodities.

The 10-year yield differential between Australia and the United States has consistently played a critical role in AUD/USD direction. The outcome of Jackson Hole saw more bond-buying and yields moving lower together. A break in yields on one side of the equation may impact AUD direction.

Looking ahead, the inter-relationship between markets is likely to determine AUD direction unless domestic issues deliver some surprises. The ongoing pandemic continues to disrupt economies and risk assets are responding to news accordingly.

Australian trade data is due out this week, but the market will likely be more focused on monthly building approvals and the second quarter GDP numbers. In the aftermath of Jackson Hole, the RBA meeting on September 7th will come into view, particularly for yield markets.

AUD/USD Against Iron Ore and Australia/US 10 Year Yield Spread

--- Written by Daniel McCarthy, Strategist for DailyFX.com

To contact Daniel, use the comments section below or @DanMcCathyFX on Twitter