Fundamental Australian Dollar Forecast: Neutral

- There’s no first-tier Australian economic data this week, and nothing scheduled from the central bank

- The Australian Dollar looks likely to be stuck with global cues

- These have seen its rise slow in the last two weeks and this process may continue

The Australian Dollar must contend with a notable lack of domestic economic events in the coming week, which is likely to leave it in thrall to global risk appetite and so, inevitably, to coronavirus headlines.

With nothing major due from Australia’s official statisticians or its central bank, the Aussie’s fortunes will be tied to the fate of other growth correlated assets, such as major stock markets and other commodity currencies.

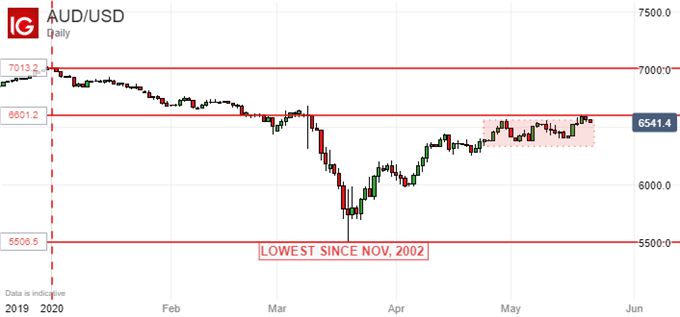

To be sure all such markets have risen considerably from their contagion-inspired March lows. The forthright remedial action taken against an immediate ‘credit event’ by the world’s monetary authorities was behind much of this rise, with trillions of dollars of stimulus pledged to ward off the sort of implosion which took global markets down in 2008.

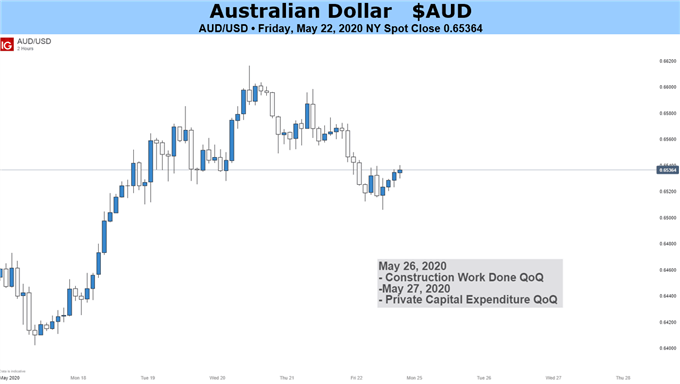

However, the certainty of world recession thanks to coronavirus lockdowns, and an ongoing procession of woeful employment data, has slowed this rise, with AUD/USD apparently stalled below key psychological resistance at A$0.66.

The next monetary policy decision from the RBA is not due until June 2. Current market pricing as to what might happen then is on a knife edge, with an historic, quarter-percentage-point reduction in the Official Cash Rate to zero favored, but only just.

However, such narrow pricing has been seen at the same distance from RBA meetings in the last couple of months, without a cut being delivered.

Still, the currency can hope for very little in the way of monetary support, but it’s hardly alone there. It’s more likely this week to be caught instead between the now familiar opposing forces of guarded optimism at economic emergency from lockdown and worries that the process will be far from swift. With this in mind, along with the sheer unpredictability of Covid news flow, it’s got to be a neutral fundamental call this week.

Australian Dollar Resources for Traders

Whether you are new to trading or an old hand DailyFX has plenty of resources to help you. There is our trading sentiment indicator which shows you live how IG clients are positioned right now. We also hold educational and analytical webinars and offer trading guides, with one specifically aimed at those new to foreign exchange markets. There is also a Bitcoin guide. Be sure to make the most of them all. They were written by our seasoned trading experts and they’ are all completely free.

--- Written by David Cottle, DailyFX Research

Follow David on Twitter @DavidCottleFX or use the Comments section below to get in touch!