AUD FUNDAMENTAL FORECAST: BEARISH

- AUD nervously twitches on global growth prospects

- The US-China trade war continues to sap confidence

- China CPI and Australia employment data in focus

See our free guide to learn how to use economic news in your trading strategy !

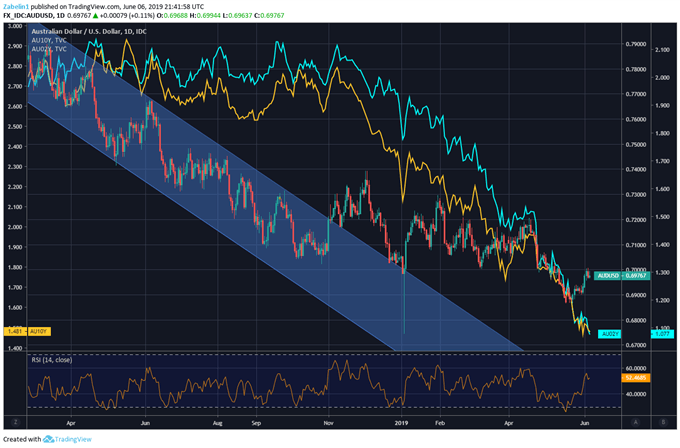

The Australian Dollar will continue to feel the pressure of mounting tensions between the US and China as the global economy slows and most central banks all over the world are pivoting away from their rate hike cycles. The G20 Summit this weekend in Fukuoyka, Japan will include finance ministers and central bank chiefs convening to discuss global growth prospects and the US-China trade war.

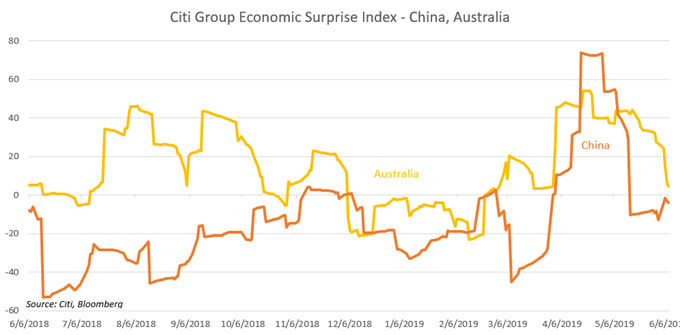

As an export-oriented economy with China as its largest trading partner, Australia is sensitive to changes in global demand with particularly sharp reactions to Chinese growth. After a fairly significant recovery in economic performance, both economies are now sharply beginning to underperform relative to economists’ expectations. Chinese CPI this week may shed more light on China’s economic activity.

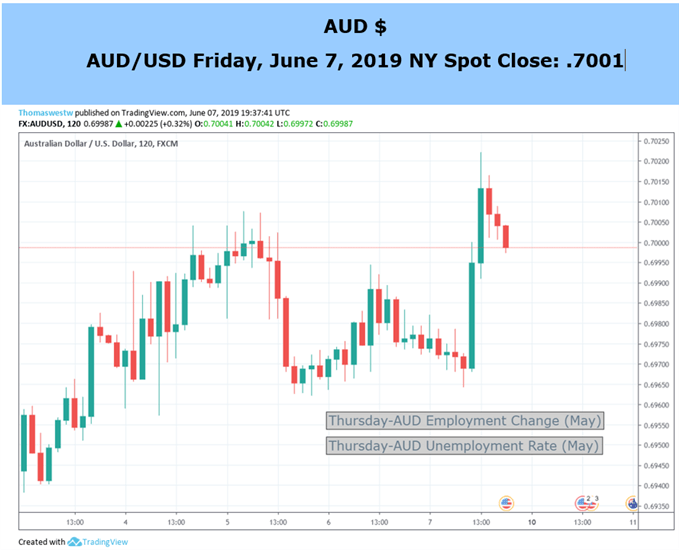

The following day, Australian employment data will be released. For those trading the Australian Dollar, this will be a high-level event risk to monitor because it will almost certainly stoke a fair amount of volatility. After the RBA cut the OCR to 1.25 percent from 1.50 percent, officials stated that such a measure was taken to support employment growth and boost inflation. Monitoring this data is therefore crucial because of the significant impact it may have on monetary policy.

AUD, Australian 10, 2-Year Bond Yields Continue to Tumble on Trade War, Growth Prospects

On June 14, Chinese industrial production and retail sales data will likely occupy the spotlight in Asia trading hours, barring any unexpected market-disrupting developments. Following the G20 Summit, US President Donald Trump is expected to make an announcement by the end of the month on whether he will be imposing a $325 billion tariff against Chinese goods. Developments related to this policy measure will warrant the attention of all traders.

FX TRADING RESOURCES

- Join a free Q&A webinar and have your trading questions answered

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

--- Written by Dimitri Zabelin, Jr Currency Analyst for DailyFX.com

To contact Dimitri, use the comments section below or @ZabelinDimitri on Twitter