Talking Points:

- AUD/USD has been climbing steadily since early May but has begun to lose its upward momentum.

- Still, it is too early to say that the trend has changed and it is now about to head lower.

- One to watch out for: the RBA Governor's appearance before the House of Representatives' Standing Committee on Economics in Melbourne.

Fundamental Forecast for AUD Neutral

Looking for a longer-term view on currencies? Check out our new Trading Guides: they’re free and have been updated for the third quarter of 2017

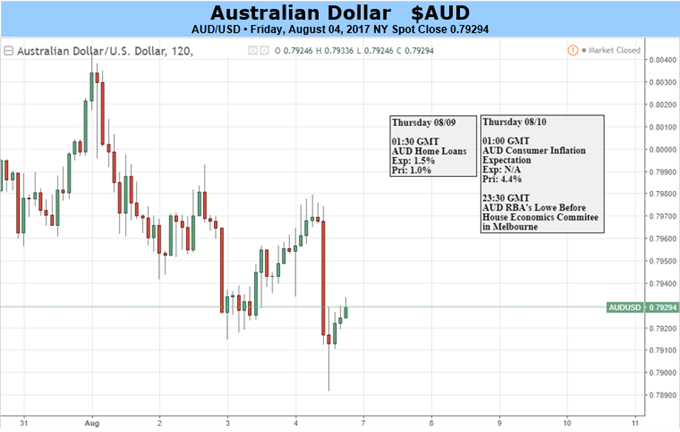

The Australian Dollar has been on a roll since early May, with AUD/USD climbing from a low around 0.7330 to a high of 0.8063 in late July. Since then it has eased back, trading at 0.7920 in late European business Friday.

However, it is far too early to say the trend is over, as the economy remains in good shape. Retail sales data Friday showed a month/month increase of 0.3% in June, rather than the 0.2% expected, and retail sales ex-inflation rose by 1.5% quarter/quarter in Q2, rather than the predicted 1.2%.

Moreover, the Reserve Bank of Australia’s statement on monetary policy was more upbeat than it appeared at first sight. While the economic growth forecasts were lowered, the projected increases of 2.0%-3.0% year/year in 2017 and 2.5%-3.5% in the first half of 2018 are still robust.

The only major concerns are the impact of the strong currency on the economy, a possible slowdown in China, which buys plenty of Australia’s exports, and slow wage growth that could weigh on consumption. Neither the data nor the statement had much impact on AUD/USD, with its late fall Friday due to the US employment report rather than anything specifically Australian.

Chart: AUD/USD One-Hour Timeframe (July 27 to August 4, 2017)

As for the week ahead, there are few major economic releases on the calendar so the main scheduled event will be Friday’s appearance by RBA Governor Philip Lowe before the House of Representatives' Standing Committee on Economics in Melbourne. Unless he is unexpectedly dovish, there is reason to believe that the uptrend will resume, though perhaps not until after a further period of consolidation.

--- Written by Martin Essex, Analyst and Editor

To contact Martin, email him at martin.essex@ig.com

Follow Martin on Twitter @MartinSEssex

For help to trade profitably, check out the IG Client Sentiment data

And you can learn more by listening to our regular trading webinars; here’s a list of what’s coming up