Fundamental Australian Dollar Forecast: Neutral

- The “USD” side of AUD did a lot of the driving last week

- Which is not to say there wasn’t some fascinating economic news out of Australia

- But there’s very little on the sked for next week, which may leave USD in charge again

Learn more about trading the Australian Dollar and all the Asia/Pacific Majors with the DailyFX guide

A bout of politically inspired US Dollar weakness came in handy for Aussie bulls last week, and put some green on AUD/USD trading screens which might otherwise have been a bit redder.

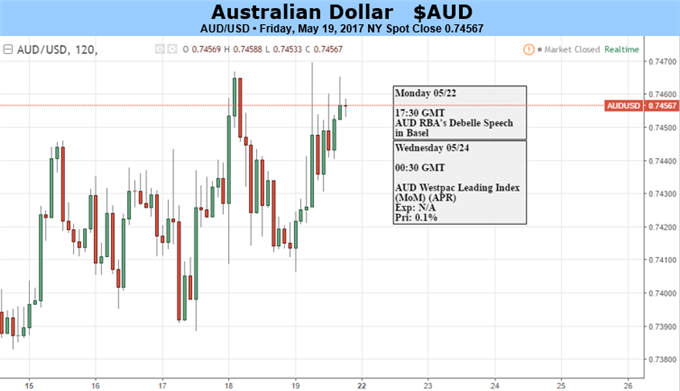

That said the pair didn’t really get a lot done for either bulls or bears, with this four-hourly chart of the week’s action showing the overall state of inertia quite nicely.

The Australian economic news flow was either as-expected or just plain weird. The Reserve Bank of Australia’s policy minutes fulfilled the first criteria. They added very little to central-bank watchers’ store of knowledge. Wage cost data behaved themselves, coming in exactly as forecasters expected.

But the weirdness? Well, that was evident in Australia’s official employment numbers for April. Yes, they blew expectations out of the water with a rise of 34,700. Markets had only been looking for 5,000. But those new jobs were all part time. Every one of them. 11,600 full-time roles were lost on the month.

That was a nasty sting in the tale of what looked at first glance to be a very strong reading. There was another knock for the Aussie in April’s Chinese industrial production data, which missed forecasts.

On the upside for the Aussie, iron ore prices appear to have found a floor, after months of declines, on modest hopes of increased demand from China into the year’s second half. However, it’s too early to call this a definite, enduring support for the currency even though Australia is the world’s largest exporter of that raw material.

And coming week is very short of first-tier economic numbers, from Australia or anywhere else. That is likely to leave the back end of AUD/USD still very much in the driving seat.

Assuming no intensification of news flow out of Washington DC a bearish call might have been tempting, if only because it would seem likely that AUD/USD simply continues the drift lower which has been this chart’s hallmark since February.

But as that can’t be guaranteed, and further greenback vulnerability can spring up at any point, I think a defensive, neutral call is the only way to go.

--- Written by David Cottle, DailyFX Research

Contact and follow David on Twitter: @DavidCottleFX