Fundamental Forecast for the Australian Dollar: Bearish

- Australian economic news-flow may add fuel to RBA rate cut speculation

- Fed rates outlook still a pivotal theme as critical data releases loom ahead

- “Brexit” referendum polls may influence risk appetite, Aussie price action

Having trouble trading the Australian Dollar? This might be why.

The Australian Dollar fell for a fifth consecutive week, making for the longest losing streak in 10 months. The currency succumbed to both external and domestic headwinds. US rate hike expectations continued to swell, undermining the Aussie’s relative yield appear. Meanwhile, RBA easing bets began to rebuild following suggestively dovish commentary from RBA Governor Glenn Stevens. More of the same seems likely ahead.

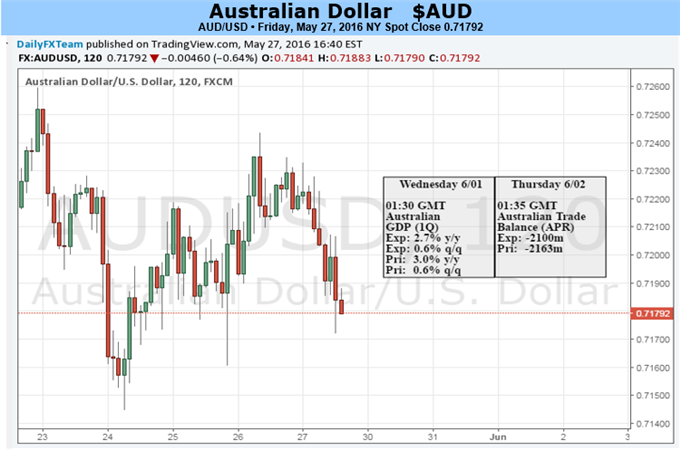

On the home front, a slew of activity indicators will help guide the evolving RBA outlook. GDP data is expected to show the year-on-year growth rate slowed from 3 to 2.5 percent, the weakest in three quarters, over the first three months of the year. April’s retail sales growth is also seen slowing while manufacturing- and service-sector activity surveys from AiG point to sluggish performance. Worse still, Australian economic news-flow has tended to underperformed relative to consensus forecasts since late January, opening the door for downside surprises.

Turning to broader macro themes, speculation surrounding the Fed policy trajectory continues to stand out. The central bank’s favored PCE gauge of inflation, the ISM suite of activity indicators, the Fed’s own Beige Book survey of regional economic conditions, and the always highly-anticipated official Employment report – complete with closely-watched measures of payrolls and wage growth as well as the baseline unemployment rate – are all due to cross the wires. Scheduled commentary from key central bank officials including Robert Kaplan and Bill Dudley are also on tap.

Fed officials’ tone in recent weeks, including that of comments from Chair Yellen late last week, has unambiguously steered markets toward contemplating a rate hike at the June or July FOMC meetings. Economic news-flow has helped in this regard: realized data outcomes bottomed and began to progressively improve relative to expectations, offering a foundation for policymakers’ saber-rattling. If this pattern holds into the week ahead, implied tightening probabilities will continue to be notched up and priced in accordingly across the financial markets.

On balance, the combination of an increasingly dovish policy outlook at home and an ever-more confidently hawkish one in the US seem likely to make for continued Aussie weakness. Jitters surrounding the “Brexit” referendum represent a wild card. As the June 23 vote approaches, polls have widened somewhat in favor of the “remain” campaign. More of the same may bolster risk appetite as worries about an unprecedented rupture within the EU core unravel. This may prove supportive for the sentiment-linked Australian unit.