Gold Price Forecast: Bullish

- Gold attracts investors as Bitcoin continues to deteriorate

- Money managers resume adding to their gold positions

- XAU/USD has Personal consumption expenditure data in focus

Gold prices moved higher for a third consecutive week as the yellow metal continued to attract institutional and retail traders’ attention. The bullish price action comes amid a painful drop in Bitcoin, with the cryptocurrency sinking over 20% as of Friday afternoon. Investors have speculated that Bitcoin may serve as an inflation hedge, although that narrative is being put to the test, and, so far, it appears to be failing.

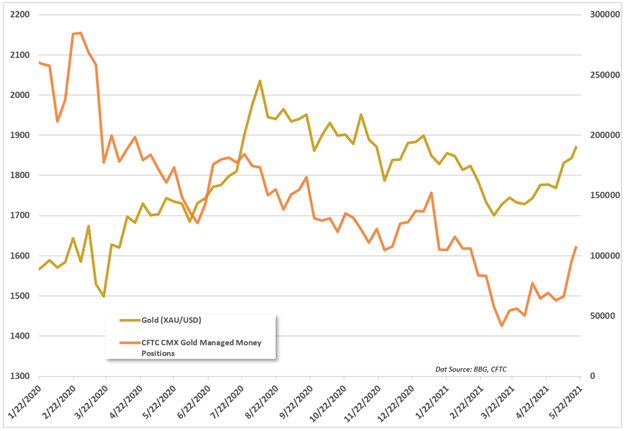

Gold, however, may be stepping back into that role, as outflows from Bitcoin appear to be at least in part flowing into gold. CFTC data shows money managers’ net-long positions in gold increasing alongside price action. The recent pick-up in prices across the economy as measured by the Consumer Price Index (CPI) is a double-edged sword of sorts. Gold will likely continue to perform well alongside higher inflation, but perhaps only if markets don’t believe those price pressures will force the Fed to tighten policy earlier than expected.

The question then becomes, how many months of above-target inflation will the Fed tolerate? Rate traders could put an end to the gold rally if they believe the Federal Reserve will ditch the transitory inflation narrative, but hedge fund managers appear to have taken a view more in line with the Fed’s outlook, evidenced by the COT figures. The main risks would be seen through a rise in Treasury yields, which would likely push the US Dollar higher and pressure gold prices in turn as markets price in a less dovish monetary policy stance. We saw the following last week’s CPI print, although the move reversed rather quickly.

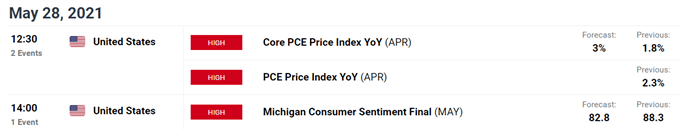

For now, at least, it appears gold is taking the view that prices are not so sticky. The upcoming personal consumption expenditure (PCE) data set to cross the wires on Friday is the next high-impact event for XAU’s price direction. According to the DailyFX Economic Calendar, core PCE – the Fed’s preferred inflation metric – is forecasted to print at 3.0% on a year-over-year basis, well above the Fed’s average inflation target. We may see another abrupt reaction on the figure’s release, but unless higher inflation carries out for several consecutive months, gold is likely in a position to trend higher.

DailyFX Economic Calendar

Source: DFX Economic Calendar

Gold TRADING RESOURCES

- Just getting started? See our beginners’ guide for FX traders

- What is your trading personality? Take our quiz to find out

- Join a free webinar and have your trading questions answered

- Subscribe to the DailyFX Newsletter for weekly market updates

--- Written by Thomas Westwater, Analyst for DailyFX.com

To contact Thomas, use the comments section below or @FxWestwater on Twitter