Gold Talking Points

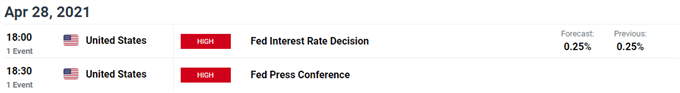

The price of gold pulls back from a fresh monthly high ($1798) as the 10-Year US Treasury yield defends the April low (1.53%), but the Federal Reserve interest rate decision may keep gold prices afloat as the central bank relies on its non-standard tools to achieve its policy targets.

Fundamental Forecast for Gold: Neutral

The price of gold may continue to benefit from the recent weakness in longer-dated US Treasury yields as the Federal Open Market Committee (FOMC) appears to be on a preset path after delivering the updated Summary of Economic Projections (SEP) at the March meeting.

It seems as though the FOMC will stay on track to “increase our holdings of Treasury securities by at least $80 billion per month and of agency mortgage-backed securities by at least $40 billion per month” as the central bank warns of a transitory rise in inflation, and the committee may continue to strike a dovish forward guidance as Vice Chair Richard Clarida insists that “policy will not tighten solely because the unemployment rate has fallen below any particular econometric estimate of its long-run natural level.”

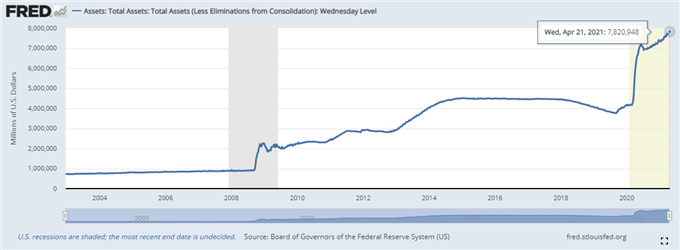

In turn, the more of the same from Chairman Jerome Powell and Co. may keep longer-dated Treasury yields under pressure as it curbs speculation for a ‘taper tantrum,’ and it remains to be seen if the 10-Year yield will continue to defend the monthly low (1.53%) as the Fed’s balance sheet climbs to a fresh record high of $7.821 trillion in the week of April 21.

With that said, the FOMC rate decision may keep the price of gold afloat as the central bank remains reluctant to scale back its emergency measures, and a further decline in longer-dated Treasury yields may coincide with higher gold prices as the break above the weekly opening range raises the scope for a resumption of the monthly uptrend towards the 100% extension at $1804.

--- Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong