Gold Price Talking Points

Gold prices remain little changed even though the Trump administration boosts tariffs on Chinese goods, and the current environment may continue to drag on the price of bullion as the Federal Reserve remains in no rush to alter the outlook for monetary policy.

Fundamental Forecast for Gold: Bearish

Gold managed to clear the monthly opening range as President Donald Trump insists that the administration is ‘very happy with over $100 Billion a year in Tariffs filling U.S. coffers,’ and the lingering threat of a trade war may keep the precious metal afloat as China pledges to retaliate the new measures.

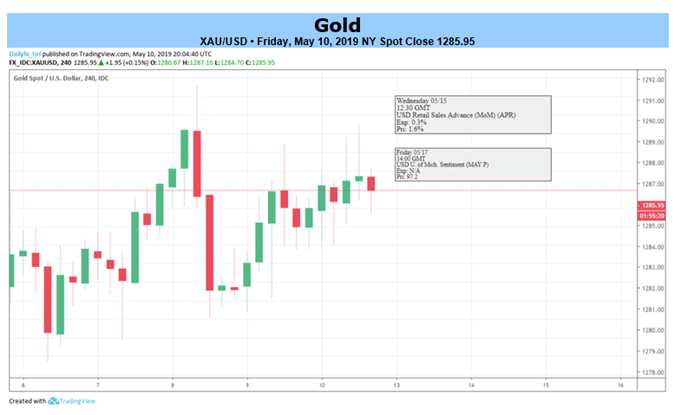

It remains to be seen if the Federal Reserve will respond to the change in U.S. trade policy as the economic docket is anticipated to show Retail Sales climbing 0.2% in April, with the U. of Michigan Confidence survey anticipated to increase to 97.9 in May from 97.2 the month prior.

Looking for a technical perspective on gold? Check out the Weekly Gold Technical Forecast.

Little to no evidence of a looming recession may push the Federal Reserve to further normalize monetary policy as ‘incoming data since our last meeting in March have been broadly in line with our expectations,’ and the central bank may sound more hawkish over the coming months as the 'baseline view remains that, with a strong job market and continued growth, inflation will return to 2 percent over time.’

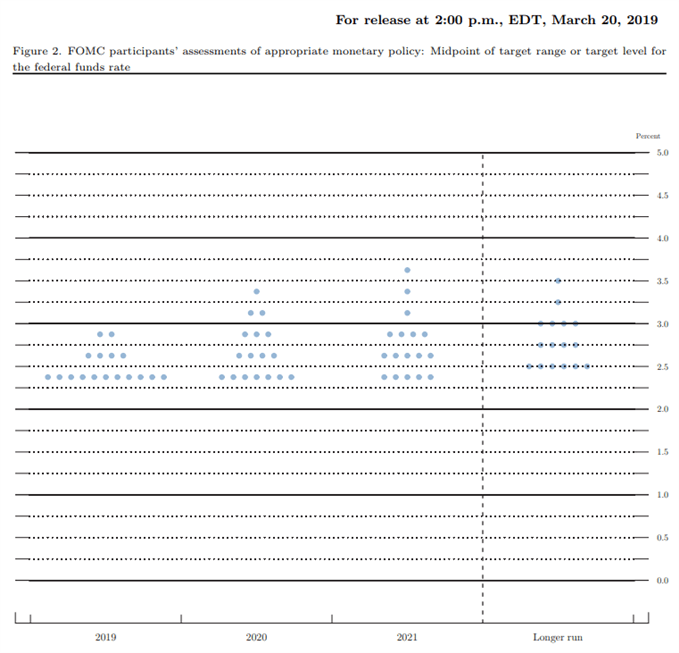

In turn, Chairman Jerome Powell & Co. may continue to project a longer-run interest rate of 2.50% to 2.75% as the central bank is slated to update the Summary of Economic Projections (SEP) at the next quarterly meeting in June, and the narrowing scope for a change in regime may dampen the appeal of gold especially as the central bank remains confident in achieving the dual mandate for monetary policy.

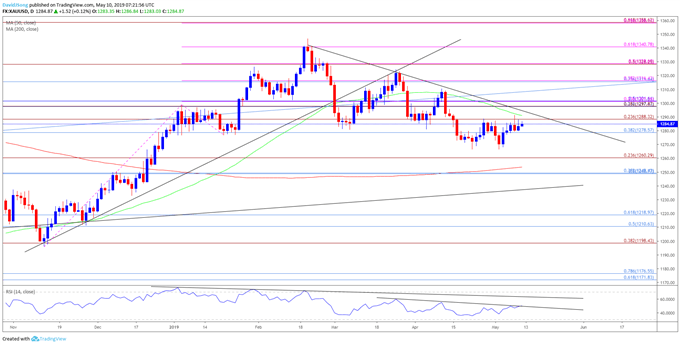

With that said, there appears to be a broader shift in market behavior as the price for bullion snaps the opening range for 2019, and the precious metal may continue to give back the advance from the 2018-low ($1160) as a head-and-shoulders formation remains in play.

Gold Price Daily Chart

The broader outlook for gold remains mired by the head-and-shoulders formation amid the break of neckline support, with the Relative Strength Index (RSI) highlighting a similar dynamic as it tracks the bearish trends from earlier this year.

However, the lack of momentum to clear the April-low ($1266) along with the failure to retain the monthly opening range may generate a larger rebound in gold, with a break/close above $1288 (23.6% expansion) opening up the Fibonacci overlap around $1298 (23.6% retracement) to $1302 (50% retracement).

As a result, need a break of the April-low ($1266) to bring the downside targets on the radar, with the first area of interest coming in around $1260 (23.6% expansion) followed by the overlap around $1249 (50% retracement) to $1250 (38.2% retracement).

Additional Trading Resources

For more in-depth analysis, check out the 2Q 2019 Forecast for Gold

Are you looking to improve your trading approach? Review the ‘Traits of a Successful Trader’ series on how to effectively use leverage along with other best practices that any trader can follow.

Want to know what other currency pairs the DailyFX team is watching? Download and review the Top Trading Opportunities for 2019

--- Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong.

Other Weekly Fundamental Forecast:

AUD Forecast: Australian Dollar Could Get Some Respite If Employment Keeps Revving

Crude Oil Forecast: Prices Under Pressure From Souring Global Sentiment

USD Forecast: Torn Between S&P 500 Outlook, Dovish Fed as US Dollar Ranges