Canadian Dollar Talking Points

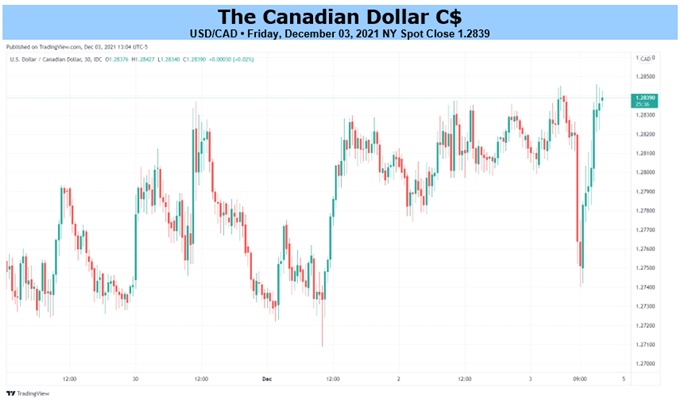

USD/CAD pulls back from a fresh monthly high (1.2845) following a larger-than-expected rise in Canada Employment, but the Bank of Canada’s (BoC) last interest rate decision for 2021 may keep the exchange rate afloat as the central bank is expected to retain the current policy.

Fundamental Forecast for Canadian Dollar: Neutral

The recent rally in USD/CAD appears to have stalled ahead of the September high (1.2896) as Canada Employment expands for the sixth consecutive month, with the economy adding 153.7K jobs in November versus forecasts for a 35K print.

It remains to be seen if the positive development will sway the BoC as the central bank insists that “the economy continues to require considerable monetary policy support” after concluding its quantitative easing (QE) program in October, and Governor Tiff Macklem and Co. may carry the wait-and-see approach into 2022 as the as the Omicron variant poses a new threat to the global economy.

In turn, more of the same from the BoC may keep USD/CAD afloat as the central bank is expected to hold the benchmark interest rate at the record-low of 0.25%, but the central bank may come under pressure to normalize monetary policy as officials acknowledge that “strong employment gains in recent months were concentrated in hard-to-distance sectors and among workers most affected by lockdowns.”

With that said, a shift in the BoC’s forward guidance may generate a bullish reaction in the Canadian Dollar as the central bank pledges to “ensure that the temporary forces pushing up prices do not become embedded in ongoing inflation,” and USD/CAD may face a larger pullback over the coming days as market participants brace for higher interest rates in Canada.

--- Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong